‘Beijing is finally on the right course to clean up the mess in the property sector,’ Nomura analysts said on Friday.

Developer puts another noncore asset on the chopping block to bolster its liquidity and appease creditors, part of its three-pronged strategy to overcome a financial crisis.

Temu, Shein, AliExpress and TikTok Shop boost the logistics-related property sector as they scramble to secure space to fuel their growth.

A new wave of property stimulus measures is brewing that should fuel a recovery in market sentiment across China as the country’s top decision-makers pledged to tackle housing inventories, according to analysts.

The capital city has relaxed rules on multiple home purchases after 13 years as part of the country’s effort to stimulate a stubbornly stagnant property market.

Prices weakened in March, extending sequential erosion since May 2023. China’s efforts to stem declines in home prices have not produced the desired results, prompting Goldman Sachs to predict a more aggressive policy response.

China needs more than 15 trillion yuan (US$2.1 trillion) to overturn a three-year housing crisis, Goldman says. Rescue efforts have not been good enough and the market downturn could still get worse.

Embattled China Vanke said it was well-prepared to resolve its liquidity problems and operational difficulties, while denying that travel restrictions were imposed on its key managerial staff.

China is encouraging more property owners to swap their old homes for new ones as a way to rejuvenate the market. Zhengzhou, home to the largest iPhone factory, is among at least 30 other mainland cities to introduce the trade-in scheme.

Shanghai-based developer, facing 61.86 billion yuan (US$8.5 billion) in debts, says it needs more time to consider restructuring plan amid slumping sales and slow asset disposal as the property market crisis grinds on.

A wholly-owned unit of Lai Sun Development Company, a Hong Kong property firm, has sold its equity stake in the AIA Central skyscraper for HK$1.42 billion (US$180 million) in a bid to boost its liquidity.

The CEO of Neom – a US$500 billion futuristic, zero-carbon megacity under construction on the country’s northwest coast – is scheduled to host a half-day event on April 19 inviting investors to back the ambitious development.

An influx of non-local higher-education students is creating opportunities for property investors and hotel owners as a shortfall of accommodation widens, according to industry insiders.

Swiss agrichemicals and seeds giant Syngenta Group has withdrawn its application for a listing in Shanghai amid China’s slowing equities market.

The embattled property developer posted a 46.4 per cent slump in net profit for 2023, alarming investors just weeks after markets were roiled by rumours of liquidity problems at the firm.

Monetary authority announces a nine-point plan that offers reassurance about access to credit relief amid market rumours of loans being called early.

The Shanghai-based firm is seeking approval from offshore creditors for a restructuring plan, according to a filing made to the Hong Kong stock exchange late on Monday, as part of its latest efforts to avoid liquidation.

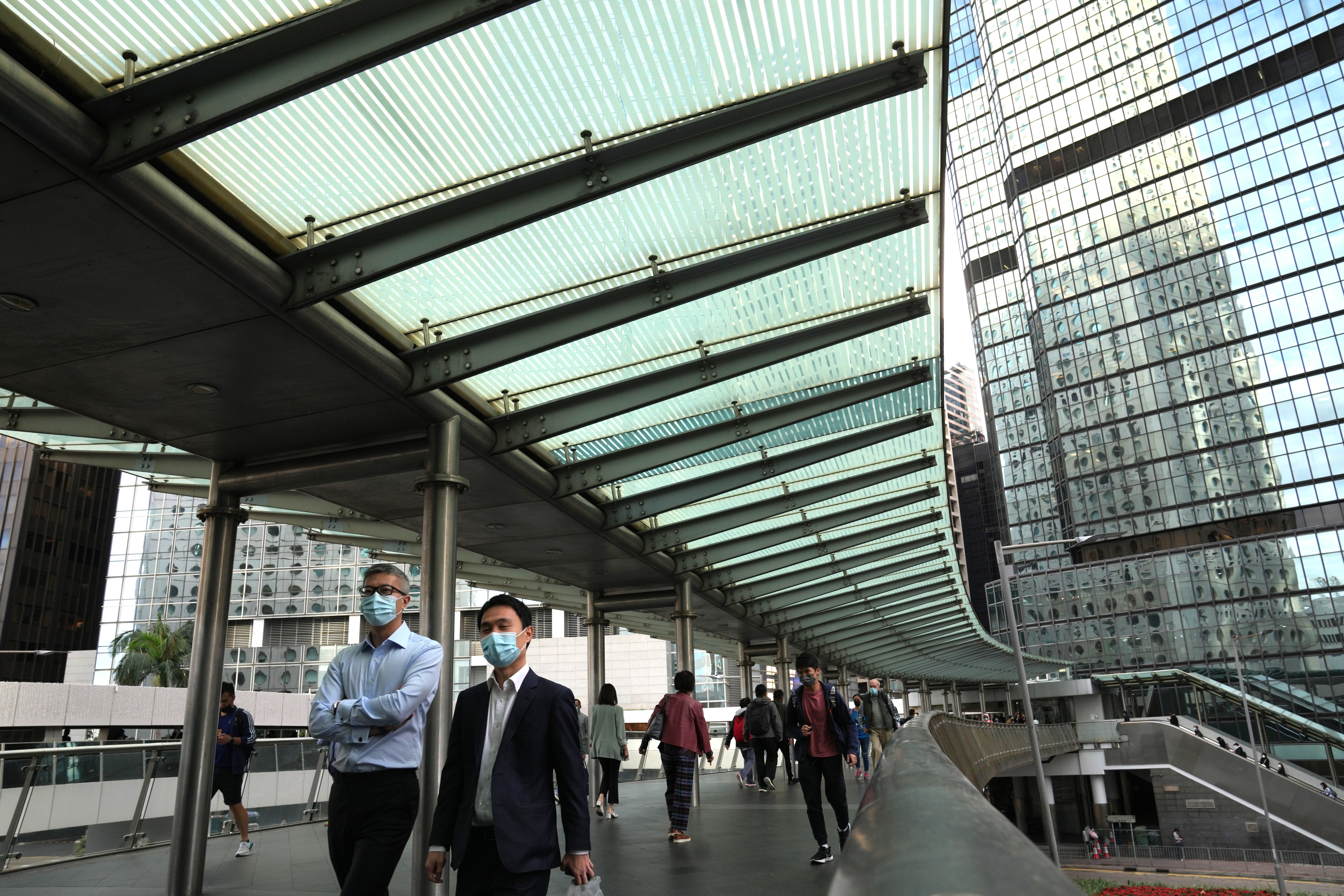

Mainland Chinese buyers are aggressively snapping up new luxury homes worth HK$30 million or more since the removal of all of Hong Kong’s property curbs last month, JLL says.

Beijing-based developer’s net profit fell to 12.85 billion yuan (US$1.8 billion) in 2023, from 24.36 billion yuan in 2022. Revenue from property development declined 31.3 per cent year on year to 155.86 billion yuan.

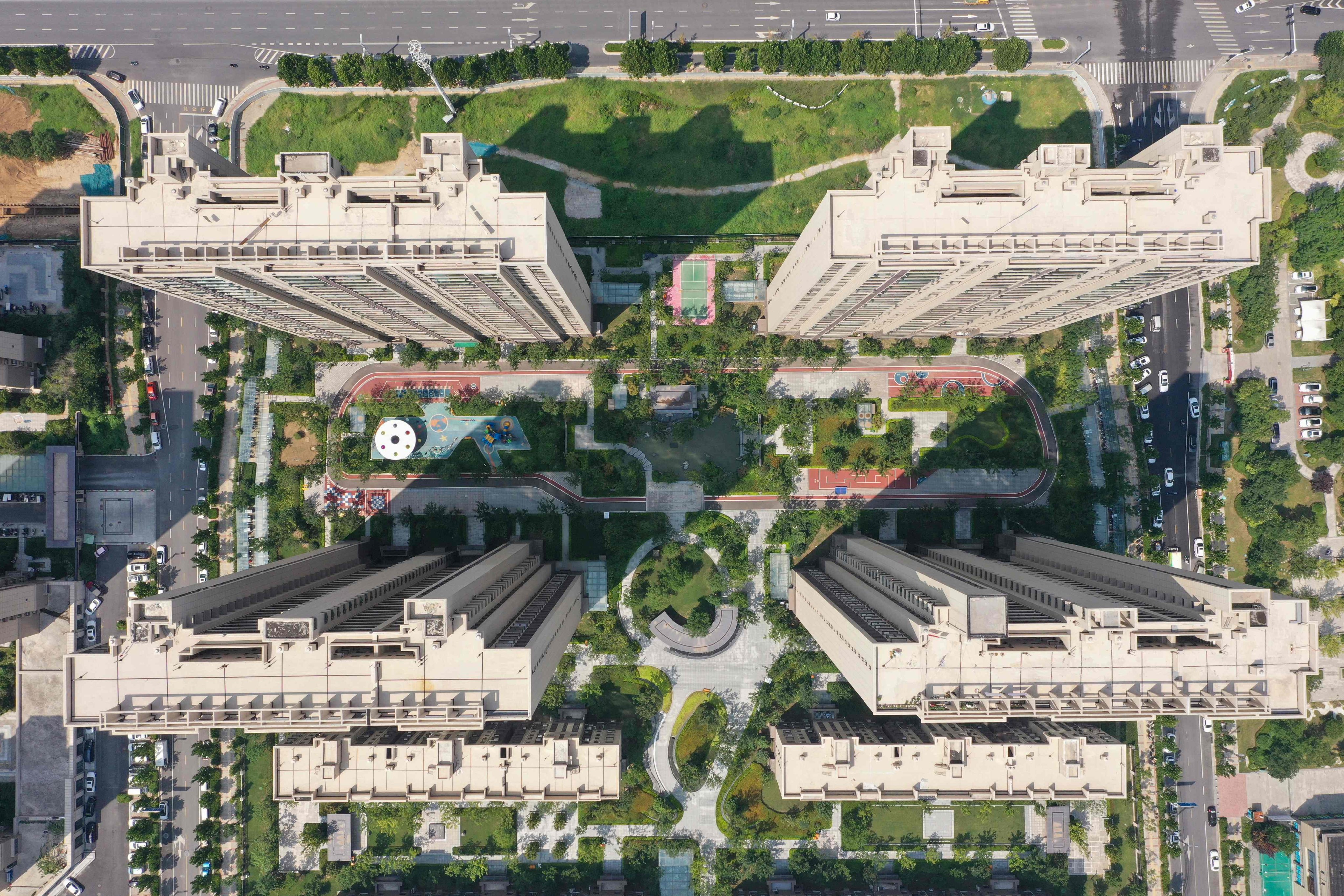

China’s state-backed developers are generating more profits from residential sales at the expense of weak rivals, indicating buyers continue to place greater emphasis on safety in capital and home delivery

Debt-stricken Sino-Ocean warns losses in 2023 could widen by as much as 21 per cent to 23 billion yuan (US$3.2 billion) as home sales plunged, margins narrowed and provision for asset impairment increased.

Evergrande, which has the dubious honour of being the world’s most indebted developer with US$332 billion of liabilities, stands accused of inflating its revenue by 564 billion yuan (US$78 billion) preceding its collapse.

New home prices fell again in February, despite a slew of measures to prop up the market. While more easing measures can be expected, an ‘L-shaped’ recovery is likely in the coming years given weak fundamentals, Goldman says.

The local government in Hangzhou has taken another drastic move to ease home-purchase restrictions, after an effort last year failed to sustain a rebound in the housing market.

Country Garden is trying its best to pay a 96 million yuan (US$13.3 million) bond coupon within a 30-day grace period, the Chinese developer says in a reply to the Post.

The impact of Monday’s downgrade is ‘controllable’, the second-largest Chinese developer says. Its shares rose more than 10 per cent to HK$6.30 on Tuesday on belief commercial banks will raise up to US$11.1 billion to repay its debts.

China’s housing market is still plagued by excess supply of used homes as desperate owners look to cash out amid an economic gloom. Prices may need to drop further, with buyers waiting for bigger discounts, analysts say.

Fosun Tourism Group, the leisure and tourism unit of Fosun International, said on Wednesday that it is “financially sound”, amid reports that its parent firm is mulling the sale of a stake in the luxury resort to cope with debt.

The country’s second-largest developer has assured investors it has the funds in place to repay its outstanding offshore debts coming due soon, as its shares and bonds tumbled amid rumours about liquidity distress.

A plunge in contracted sales last month underscores why some creditors are running out of patience to recover their debts.