Danger budget working group is attempt to impose new taxes

Financial secretary John Tsang's budget suggests that the Hong Kong government's long history of making poor decisions will continue

In his budget speech on Wednesday, Financial Secretary John Tsang Chun-wah said he would set up a working group to formulate "more comprehensive planning for our public finances".

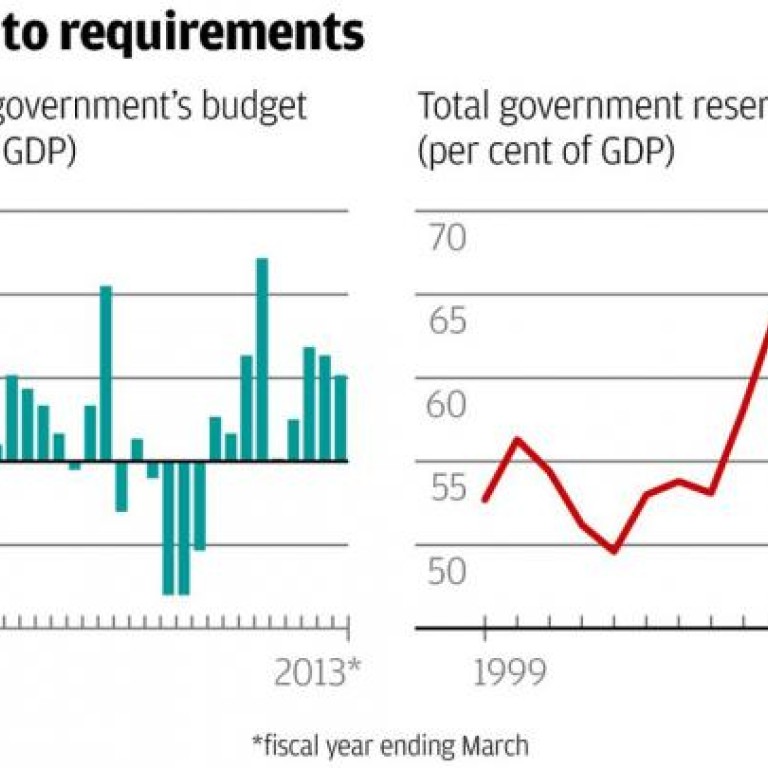

This sounds like excellent news. In recent years the government's fiscal policymaking has looked distinctly slapdash. The financial secretary has consistently forecast budget deficits while actually collecting far more revenues than he needs. As a result, the government has run nine successive years of budget surpluses, which have boosted its total reserves, including the Exchange Fund's accumulated surpluses, to some 66 per cent of Hong Kong's gross domestic product (see the charts below).

Meanwhile, there has been no serious attempt to make any long-term plans for the future of Hong Kong's public finances.

So news of Tsang's working group is encouraging. Or rather, it would be encouraging if it weren't for the Hong Kong government's long history of diligently examining all aspects of a problem, consulting widely among experts in the field and carefully weighing the experience of countries elsewhere, before throwing common sense out of the window and making a truly lousy decision.

Unfortunately, judging by Tsang's speech, this may well be another of those occasions.

Tsang is worried because Hong Kong's population is ageing. As he noted, the government expects the percentage of retirees among Hong Kong's people almost to double over the next 20 years from 14 per cent last year to 27 per cent in 2032.

As people retire, they become less productive, which means economic growth will tend to slow. And in Hong Kong, they will drop out of the tax base, which will put pressure on government revenues.

At the same time, more elderly will mean greater demand for health care. With the public purse currently paying half Hong Kong's HK$100 billion a year health care costs, officials are afraid that the government's health spending will soar even as its revenues decline.

So far, so uncontroversial. Where things get worrying is that Tsang appears already to have rejected some of the more obvious solutions in favour of another terrible idea. He ruled out deploying the government's reserves to solve the problem, for example by using some of its accumulated surpluses to seed a public health insurance fund.

The government needed its reserves, he said, to provide a cushion against cyclical economic downturns. In addition, he said, the reserves were necessary to meet unfunded liabilities like HK$300 billion of infrastructure spending and HK$600 billion in civil service pension payments.

He's wrong on both counts. Combating even the most vicious and protracted slump would hardly require reserves worth more than 20 per cent of GDP. That still leaves us with HK$1 trillion to play with.

Spending this money on infrastructure projects seems ludicrous. If the projects are economically viable, they can be funded through the bond market.

In any case, the government's infrastructure plans assume Hong Kong's population is set to grow by 2 million over the next three decades. If our productive workforce is actually set to decline, as Tsang warns, it isn't clear we need all this new infrastructure in the first place.

As for civil service pensions, Tsang was disingenuous to suggest he needs the reserves to cover them. The Pensions Ordinance and the Pension Benefits Ordinance are explicit: the government's pension liabilities must be met from its general revenue account.

As a result, it looks very much as if Tsang's working group may be just another attempt to impose a regressive and unnecessary goods and services tax on Hong Kong's long-suffering population.

We shall be watching.