Danger signals as China's state sector leverage reaches new heights

China's state companies are more highly leveraged than sub-investment grade 'high yield' companies in either the US or the European Union

If there is one lesson everyone learned from the 2008 crisis, it is that a rapid rise in leverage can signal the risk of an approaching financial crash.

So it should be no surprise today that hordes of market-watchers are poring over the data from the mainland and wondering just how dangerous the recent build-up of debt really is.

According to estimates from the US investment bank Morgan Stanley, the mainland's total debt has now reached 232 per cent of gross domestic product, with corporate debt hitting 106 per cent of GDP.

That puts the corporate debt to GDP level higher than that of the United States and on a par with crisis-hit Europe.

But as Viktor Hjort, a fixed income analyst at Morgan Stanley, pointed out in a research report last week, GDP is a blunt instrument when it comes to gauging credit risks.

That is partly because the data is unreliable, but also because GDP tell us little about corporations' ability to service their debts.

So instead of looking at GDP, Hjort and his team have assessed leverage levels at the mainland's non-financial companies by scouring through corporate reports to come up with a measure of debt relative to cashflow (measured here as earnings before interest, tax, depreciation and amortisation or ebitda). With credit continuing to expand over the past two years as economic growth has slowed, debt levels have grown faster than cashflow. As a result, corporate leverage has risen to a record high, with the median level of gross corporate debt at mainland companies climbing to 3.1 times ebitda.

"The credit quality of corporate China is deteriorating and is now at a point where we think it's going to become a headwind," Hjort and his team concluded.

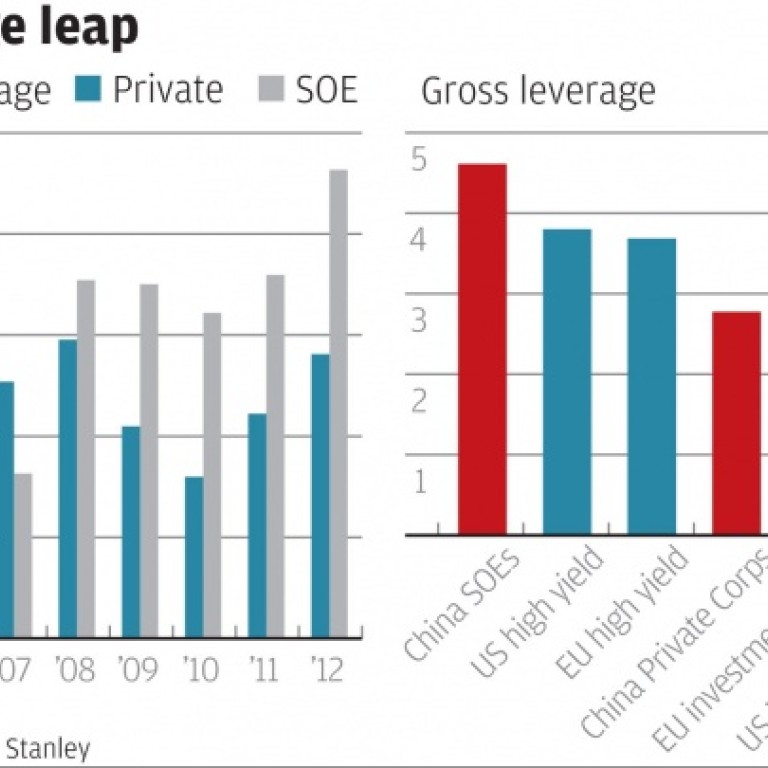

Even more troubling, the increase in leverage has been concentrated in the state sector. While leverage ratios in the private sector were much the same last year as in 2007, as the first chart shows, debts at China's state enterprises have shot up to 4.5 times cashflow - three times pre-crisis levels.

As the second chart shows, at that level, China's state companies are more highly leveraged than sub-investment grade "high yield" companies in either the US or the European Union.

According to Hjort, in the US such high leverage would usually only be seen among sub-investment grade credits in the middle of a recession, and would typically be associated with a corporate default rate of between 10 and 12 per cent.

That does not mean there is going to be a rash of corporate defaults. If necessary the government will order mainland banks to support indebted state-owned companies.

But the trend of rising state sector leverage is still disturbing. According to the Morgan Stanley team, rising leverage has done nothing to boost returns, with returns on assets dropping last year to their lowest level since before the crisis.

Again, the deterioration is concentrated in the state sector, where returns on assets are a third below those at private companies. As a result state-owned companies face a widening funding gap, which they are currently filling by borrowing even more; a worrying sign that capital is being channelled preferentially into less productive sectors of the mainland economy.

To reverse the deteriorating trend in credit quality, capital must be allocated more efficiently, Hjort and his colleagues argue. In a nutshell, that means cutting investment spending in the state sector, where the ratio of capital expenditure to sales is some 50 per cent higher than among private companies.

Clearly a reduction in state sector investment would be good for the mainland's long-term economic health.

Whether it would be acceptable to officials in Beijing in the short term, is another matter entirely.