Cash crunch lifts lid on squabble between state and banks

After Li Keqiang's initial tough stance on injecting liquidity, the central bank eventually consented but not without opening some raw wounds

Never have we seen a more eye-opening public fight between the leadership and vested interest groups than the cash crunch in the past two weeks.

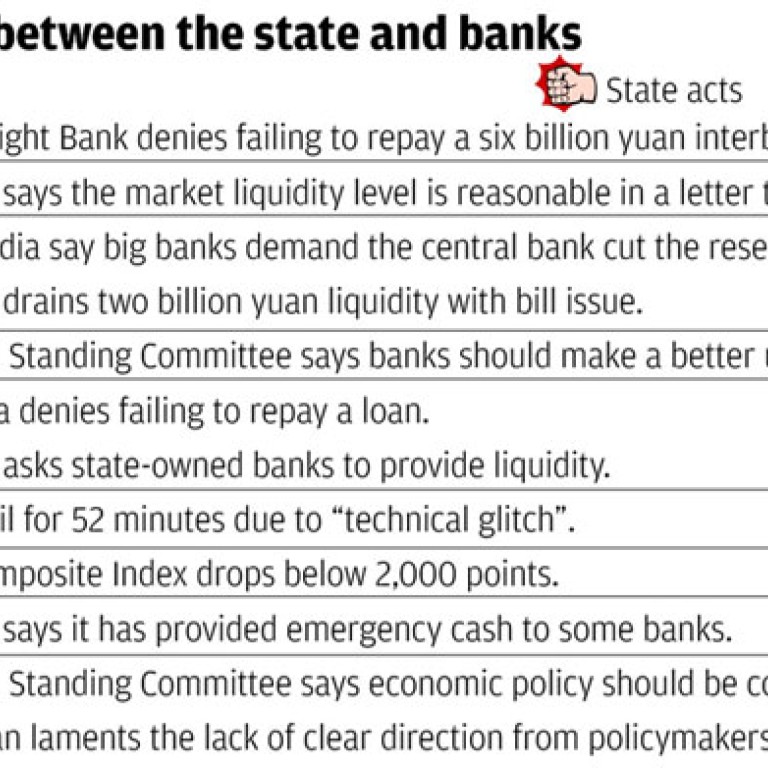

There was a dated ultimatum for liquidity injection leaked to foreign press. When the People's Bank of China said no, rumours of major bank defaults and the failure of ATMs followed (see table).

Now the central bank has provided the emergency funds. Has the towel been thrown in? Far from it.

First, the central bank is only the fists and kicks. In the past week, there has been two State Council Standing Committee meetings in support of the central bank. The fighter is Premier Li Keqiang.

Li refused to boost the economy with more money. On more than three occasions, he called for a better use of existing liquidity. He wants to squeeze the liquidity out from the interbank market, and carry trade and other speculative activities into the real economy.

Second, the message has been sent home. Banks have taken liquidity for granted for years. Every spring, banks loan out 99.9 per cent or more of their target. Every June, the interbank rate climbs while bankers scramble for savings to satisfy mid-year regulatory checks. Every time, the central bank chips in. Not anymore.

Third, the cash crunch has largely exposed the problem of individual banks. Just think about the bank that funds a property loan with money from a three-month wealth management product. Don't be surprised that following stringent mid-year checks there will be hefty penalties on some. Fear paves the way for reform.

Why now? Well, if you can't set the rule when you are newly in power and have the most chips to hedge, when can you?

There is urgency, too. It is only a matter of time before the Americans will raise interest rates, draining liquidity from developing countries like China. It's better to act when you can wait than when you cannot.

However, it won't be easy. It is hard to imagine the banks playing sitting ducks to Li's reform. The resistance was clearly spelled out by Jiang Jianqing, chairman of the Industrial and Commerce Bank of China via two dramatically different interviews in the press on the day the central bank said liquidity has been injected.

The interview with Xinhua is a kowtow. He said liquidity was sufficient and the cash crunch was caused by seasonal factors like the Dragon Boat festival.

He said banks should better match liquidity, security and return. "We can't stretch ourselves too thin for profit," said Jiang. In short, the banks, not the central bank or state, is to be blamed for the fiasco.

However, to Reuters, Jiang complained of a lack of clear direction from policymakers.

"We too needed a few days to … understand the underlying reasons for the market movements," he said. "During that process we too were a bit nervous. If we are going to be of help, we also need policy expectation to be even clearer and more stable."

This public contradiction of the state is rare. The cheese Li is trying to move is simply too big. How this will play out? One thing for sure, deleveraging will happen. That is not good news for investors.