Simple-minded to expect Hong Kong home prices to fall? Not at all

With the yields on US Treasury notes rising sharply, the city's property market will come under pressure as it loses investor attraction

I suppose I should be offended.

Three weeks ago, warned that Hong Kong property prices are likely to fall following the US Federal Reserve's decision to wind down its programme of quantitative easing.

"Since the Fed began its first round of quantitative easing in 2008, local home prices have shot up 100 per cent," the column noted. "Now, with tapering, they are likely to come under pressure."

It seems some people disagree - vehemently.

A report on the front page of this paper's business section yesterday quoted Cheung Kong executive director Justin Chiu declaring "the worst is over for the city's housing market".

Prices have found plenty of support, and demand is picking up, he said. Anyone who cites the Fed's tapering as a reason to expect the market to fall is being "too simple-minded".

Chiu, of course, has form when it comes to talking up Hong Kong's property prices. Back in 2009, when the International Monetary Fund first warned that a bubble was developing, Chiu famously welcomed the prospect.

"I don't really mind a bubble as long as it doesn't burst," he said at the time. "If I drink champagne, I don't like to drink flat champagne."

But even though as a property developer Chiu has a clear interest in promoting higher prices, it's still worth examining his reasoning - and 's - to see who is really being too simple-minded here.

In a nutshell, Chiu argued that the Fed's tapering will be a gradual process. He correctly pointed out that US interest rates will remain effectively at zero well into 2015.

Because of Hong Kong's currency peg to the US dollar, that means local mortgage rates will remain at their current levels between 2 and 3 per cent for at least another year.

And when the Fed does finally begin to raise its rates again, the increases will be small and carefully paced. As a result, Chiu believes low mortgage rates will continue to support Hong Kong's property market for the foreseeable future.

He's right that mortgage rates will remain low, but 's argument was that property prices will come under pressure " ".

Chiu's belief that low mortgage rates will boost demand would make sense if all buyers were taking out mortgages and if they were all buying flats to live in.

But if we look at the data on mortgage lending compiled by the Hong Kong Monetary Authority, strip out the mortgages taken out to refinance existing home loans, and compare the resulting numbers with the figures on home sales from the Rating and Valuation Department, we find that over the past five years roughly a quarter of all home sales have been to cash buyers.

Some of those buyers will have been unleveraged owner-occupiers looking to trade up. But many were investors looking for potential capital gains, and a decent yield from renting out their properties.

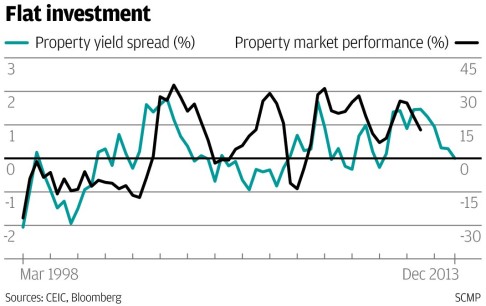

From the beginning of 2009 to early last year, the Hong Kong market delivered on both fronts. Not only did prices double, but the rental yield on a typical 700 square foot flat exceeded the "risk free" yield on 10-year US Treasury notes by as much as 1.5 percentage points. In other words, buying Hong Kong property as an investment was a no-brainer.

Now the situation has changed. Since hitting a record high in March last year, secondary market prices have slipped back by 4 per cent. What's more, since the middle of last year when the bond market began to price in the prospect of tapering, the yield on US Treasury notes has doubled and now exceeds the yield on Hong Kong property by a whisker.

That means Hong Kong flats are no longer such an enticing option for cash investors. With more attractive assets out there, many potential buyers will decide to put their money elsewhere.

That's bad news for Chiu. The chart is a bit messy, but the relationship is clear enough: when Hong Kong property yields are above the yield on US Treasury notes, as they have been for the past five years, local prices tend to rise (with a slight time lag). When property yields fall below the "risk free" rate, as they did between 1998 and 2002, prices drop.

It might sound like an obscure argument, but it's hardly a simple-minded one.