China disrupting world’s diamond sector, tapping sophisticated technology to produce cheap synthetic alternatives

- Synthetic diamonds to become a bigger share of fine jewellery market

- China already makes the lion’s share of ‘lab grown’ diamonds

China is taking on the world’s diamond miners, using sophisticated technology to offer increasingly cheap alternatives that threaten to upend the lucrative fine jewellery market.

The technological disruption seen in medicine, autos, banking and countless other sectors is spilling over into diamonds, where an oligopoly of just four miners controls more than 60 per cent of production, according to consultancy Bain & Company.

It is happening as China taps the know-how it developed in becoming the world’s biggest maker of synthetic diamonds used primarily in the industrial cutting tools market.

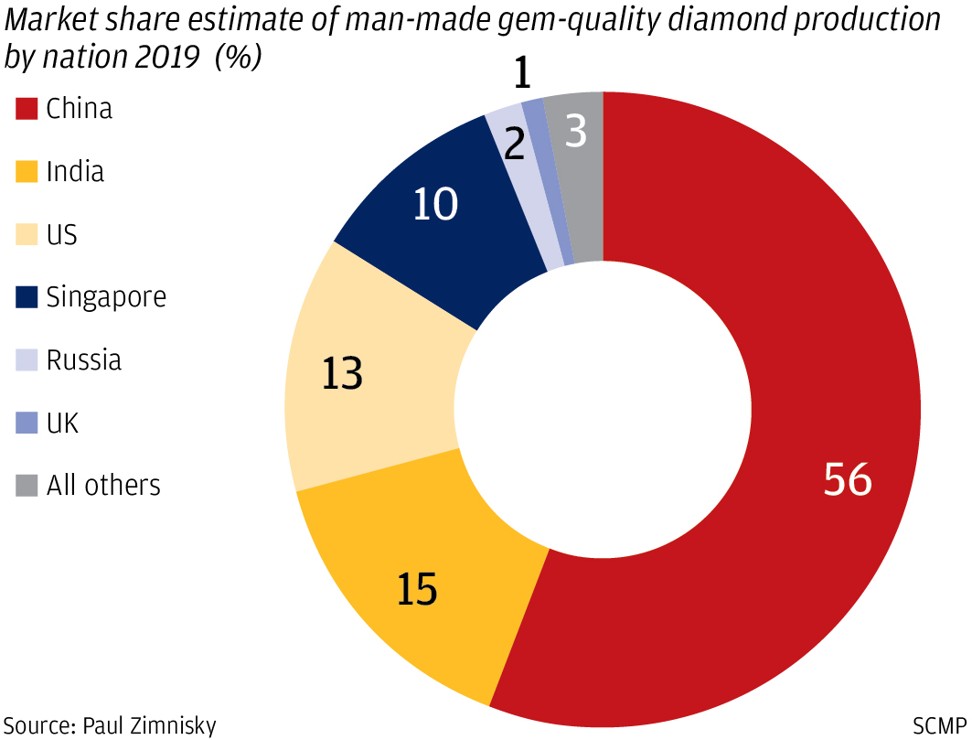

By doing so, China now makes 56 per cent of the world’s gem-quality synthetic diamonds, far outpacing second-placed India.

While synthetic diamonds right now only account for 3.5 per cent of the world’s diamond jewellery, the share could grow to six per cent in four years, and even more later, says Paul Zimnisky, a New York-based independent diamond sector analyst.

“In the last few years some Chinese producers have been upgrading existing equipment to produce larger, better-quality synthetic diamonds for use as jewellery,” Zimnisky said.

“China already has the infrastructure in place which allows for high production scalability of higher-quality synthetic diamonds, as existing high-pressure high-temperature equipment is upgraded.”

This poses a serious threat to the world’s diamond miners.

Five years ago, a “fake” diamond cost about 10 per cent less than the real thing. Now the discount is about 50 per cent. And within five years, Zimnisky, it could be 90 per cent.

“Technology has progressed rapidly, not only are the lab-grown diamond producers able to produce bigger stones … but also better clarity and colour,” Georgette Boele, senior precious metals and diamonds analyst at Holland-based bank ABN AMRO, wrote in a report in January.

“There seems to be a higher acceptance … probably driven by perception that lab-grown diamonds are more sustainable and the price more attractive.”

The “sustainability” issue is becoming a bigger selling point for lab-grown diamonds.

The diamond industry has been subject to much criticism over its impact on the environment and workers’ health. In addition, so-called “conflict” or “blood” diamonds have been used pay for wars and terrorist activities, according to a number of investigative reports.

Huanghe Whirlwind International, a Henan province-based synthetic diamond maker, uses sustainability as part of its sales pitch, saying its cultured diamonds are “perfect for those seeking to minimise the environmental impact of a jewellery purchase” since they do not require mining and are “conflict free”.

Diamond producers have been pushing back.

The Diamond Producers Association commissioned research by a third party known for assessing environmental and other risks, Trucost ESG Analysis.

The research found that its seven rough diamond miners members emitted on average 160 kilograms (353 lbs) of carbon dioxide for each polished carat produced in 2016. That is one-third of what lab-grown ones emit, according to Mabel Wong McCormick, managing director of the association’s Greater China region.

Trucost said its research was hindered by the limited amount of publicly available information on the use of energy and materials by lab-grown diamond producers.

The lab-grown average figure was based on four highly variable data points from media reports and company disclosures, which Rick Lord, an environment, social and governance analyst at Trucost said “may be less reliable sources of technical information”.

The threat posed by synthetic diamond makers is expected to grow. That, analysts say, is leading to concern that prices of natural diamonds may be threatened, and that distributors will keep smaller inventories to protect themselves.