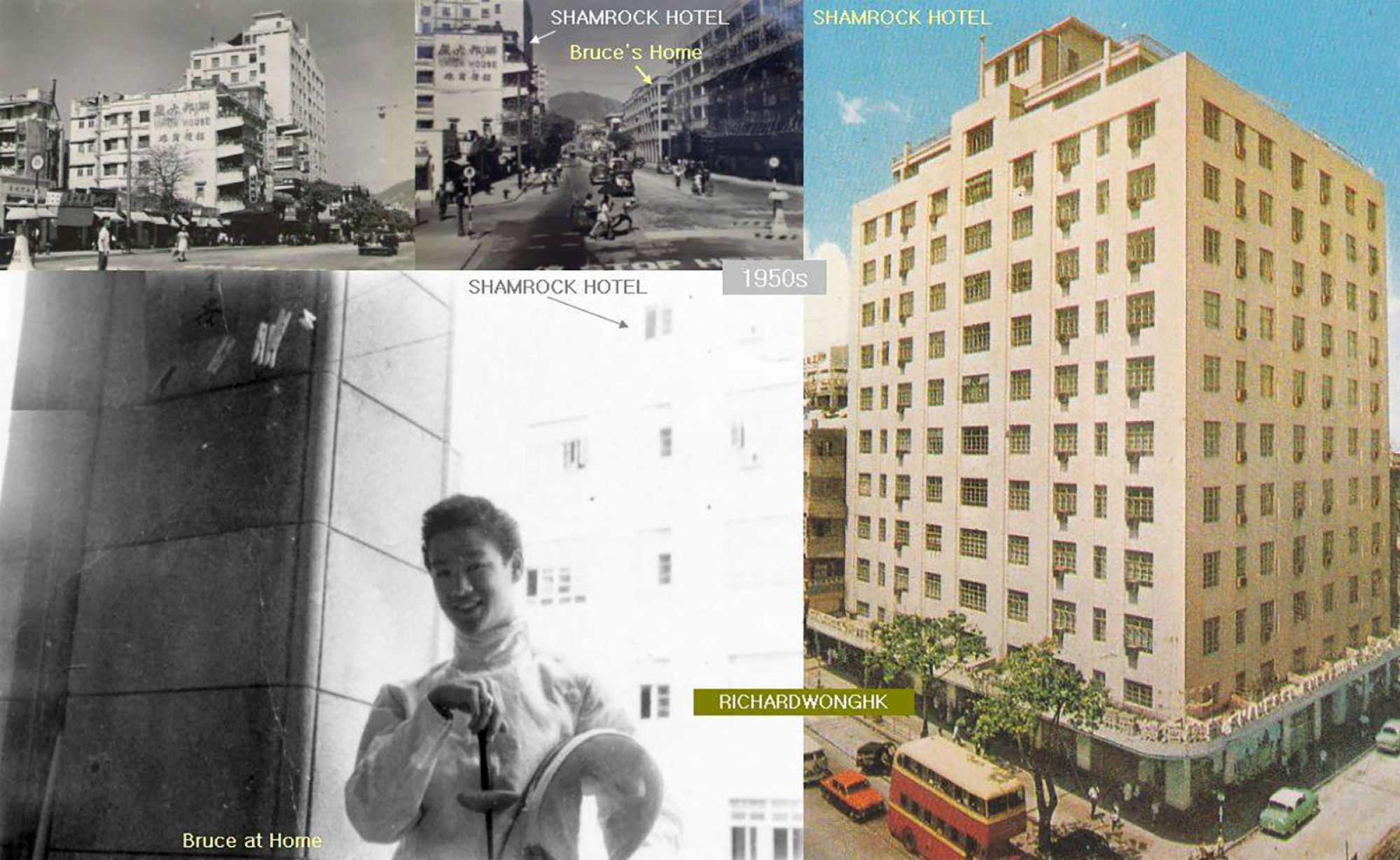

Coronavirus Hong Kong: will the Omicron surge turn half-empty hotels into quarantine centres?

- Hong Kong has 12,500 rooms across 44 quarantine hotels until July 31, a mere 14 per cent of the 89,403 hotel rooms in the city, compared with a quarter in Singapore

- Ten hotels with 3,013 rooms in total ceased operating in the three years since 2019, according to the Hong Kong Tourism Board’s data

As Stacie Yang drew up plans to celebrate her 30th birthday due at the end of February, her options were quickly vanishing with Hong Kong’s explosive growth in Covid-19 cases.

Spa sessions, a karaoke rendezvous, and manicures were out, as city authorities shut close-contact services to contain the spread of the Omicron variant of the Covid-19 virus. Even dinners were out of the question as indoor dining was banned after 6pm.

Exasperated, Yang booked a deluxe room at the Rosewood Hotel in Tsim Sha Tsui, with a view of the Victoria Harbour and Hong Kong island, where she invited four of her closest friends to spend an entire weekend in a staycation.

Two weeks before checking in however, Hong Kong authorities slapped a two-person limit on public gatherings, and banned members of more than two households from congregating in confined space. Luckily for Yang, she received a refund on her HK$5,000 (US$641) booking fee.

“We had a plan for the entire birthday weekend: watching films, singing, dancing, and playing games, but now all the planning is in vain,” said Yang. “I can never have my 30th birthday ever again. Such a pity.”

All across Hong Kong, Yang’s exasperation is being replayed multiple times in a myriad of versions, often with more dire – occasionally fatal – circumstances, as the city’s 7.5 million residents grapple with a disease that has infected about 40,000 people at the latest count after setting daily records for two straight weeks.

For the 320 licensed hotels in one of Asia’s busiest hubs for business travel and tourism, Hong Kong’s zero-Covid approach may sound the death knell for an industry that hired as many as 34,606 people last September.

Ten hotels with 3,013 rooms in total ceased operating in the three years since 2019, according to the Hong Kong Tourism Board’s data, arguably the industry’s worst rout in recent history, as a combination of street protests and the coronavirus pandemic reduced inbound travels to almost zero.

As few as 91,398 visitors arrived in Hong Kong last year, down 97.4 per cent from 3.56 million in 2020, and compared with 55.91 million in 2019, according to the Tourism Board.

The hotels that are hanging on have to put up with empty rooms, and since, empty restaurants after 6pm. Average occupancy climbed to 63 per cent last year across the industry, from 46 per cent in 2020, but still some ways from the 79 per cent in 2019 and 91 per cent in 2018 before street protests began to deter tourists from mainland China.

Mid-tier hotels can typically break even with occupancy of as low as 30 per cent because of their cheaper overheads, but luxury hotels need at least 50 to 60 per cent of their rooms filled to stay afloat, operators said.

Occupancy at Yulan Group’s 187-room Arca hotel in Wong Chuk Hang plunged from last year’s 98 per cent during its opening to 25 per cent, as the fifth wave of Omicron-led Covid-19 infections swept Hong Kong.

“Due to the tightened social-distancing policy, people tend to stay home instead of staycation, which affected our occupancy,” a spokeswoman said in an email.

The average room rate fell across the city to HK$860 per night last year, the cheapest in a decade, according to available data.

Room rates have another 10 to 20 per cent to fall, exacerbating the downbeat mood for the city’s hoteliers, according to Colliers the property consultant.

“Staycations are likely to be cut back, as people opt to stay home, thereby reducing occupancy rates and causing further stress to an already challenging environment,” said Colliers Asia’s senior director Shaman Chellaram.

To survive, many hotels have transformed themselves in various ways to attract guests for staycations, gig workers seeking shared offices, or retrain employees to work in their restaurants and bars.

“We have to survive by shifting to the non-tourist markets as there are no travellers visiting Hong Kong at all,” said William Cheng Kai-ming, chairman of Magnificent Hotel Investments, which owns seven hotels in Hong Kong.

As the exploding caseload tightened the noose around indoor dining and social distancing, a new option has opened up: quarantine facilities.

Singapore pips Hong Kong in usable hotel rooms for Covid-19 quarantine

Cheng turned six of his hotels, with 2,000 rooms in total, into quarantine facilities two years ago, contributing to 17 per cent of Hong Kong’s quarantine rooms. The six, under the Best Western and Ramada brands, averaged 80 per cent occupancy rate each, while the seventh of Magnificent’s hotels offers short leases at HK$8,000 per month.

“Our business has recovered, but the Omicron outbreak that started last month is hitting us hard,” Cheng said. “Still, we will certainly support and will offer our hotels for isolation as we have been used as quarantine hotels.”

Volunteering is easier said than done. Hoteliers must get the consent, support and buy-in of their frontline service staff, who must bear the risks of coming into daily contact with potential carriers, said an owner who declined to be named.

The hotels themselves must also withstand the potential stigma from infections, which would deter staycationers and other guests even after the pandemic subsides.

To encourage hotels to step up, the government has pledged to take up 50 per cent of the occupancy of participating hotels at 70 per cent of their room rates, ensuring a stable stream of income to keep them going. Licensed hotels with at least 101 rooms that have not taken part in the quarantine programme received a one-time subsidy of HK$400,000 each.

Within two days of the president’s edict, Hong Kong’s government announced it secured more than 20,000 rooms, double the number of additional rooms it sought out to secure for quarantine purposes.

Still, the explosion in Omicron cases had pushed local authorities to tighten inbound travelling. Last week, the government extended flight suspensions from eight countries – Australia, Canada, France, India, Pakistan, the Philippines, the UK and the US – by 14 days until March 4.

That means fewer requirements for quarantine rooms, which is bad news for hotels that are already offering their premises for isolation in return for the guaranteed occupancy.

“Sales in our quarantine hotels have dropped to 20 per cent as demand fell sharply,” said Magnificent’s Cheng. “We have not asked for any financial subsidies in the past two years as our occupancy rate exceeded 50 per cent, but we may need it from next month.”

Are tycoons’ tangled ties to blame for Hong Kong’s anger?

Some hotels are transforming themselves altogether to get out of the industry, as they see no immediate recovery in the industry.

H Development converted its former hotel building in Causeway Bay into a commercial property named Biz Aura, whose leasing business is doing well.

The Silveri Hong Kong – M Gallery in Tung Chung deferred its opening from mid-2020 to the end of this month. A spokeswoman attributed its delay to “the change of plan due to the Covid-19 situation.”