Facing an inconvenient truth, Hong Kong’s monetary authority chooses to stay mum

Hong Kong’s ATM network has been hit with a surge in withdrawals by customers using Chinese UnionPay bank cards in the wake of facial recognition technology being introduced at cash dispensing machines in Macau. -- SCMP, August 21

The most interesting thing about this story is that the Hong Kong Monetary Authority (HKMA) is running scared of telling us anything about it.

Our reporter quoted a spokeswoman for the HKMA as saying that the regulator is “not in a position to comment on any dialogues of a supervisory nature.”

What dialogues? It’s a simple matter of confirming whether this surge in ATM withdrawals is actually happening as, wonder of wonders, Macau goes tighter on cash withdrawals than Hong Kong. Don’t tell me that the HKMA does not know whether it is happening.

I gather from this mention of “dialogues”, however, that the HKMA has already been telling our commercial banks to put a stop to it, and the banks have replied that they cannot do so without shutting down the entire ATM network, which would bring chaos to our payments system.

The HKMA’s difficulty, of course, is that it dare not admit publicly that our banks are subverting Beijing’s restrictions on capital outflows, although it has been happening for the last 150 years.

So they just play dumb. They are otherwise positively garrulous on matters of a “supervisory nature.”

But I also understood that the authorities in Beijing have been congratulating each other at having stopped the outflow. The benchmark they use to measure it, the total holding of foreign reserves, has gone up slightly in recent months.

This is mostly a valuation anomaly. Beijing reports its foreign reserves in US dollar terms and the US dollar has been down this year against most of the world’s currencies. Those holdings of the reserves not denominated in US dollars have therefore risen in US dollar terms. Call it smoke and mirrors.

But it is not true anyway that the outflow has been stemmed. It’s simply covered by a merchandise trade surplus still running at US$460 billion a year.

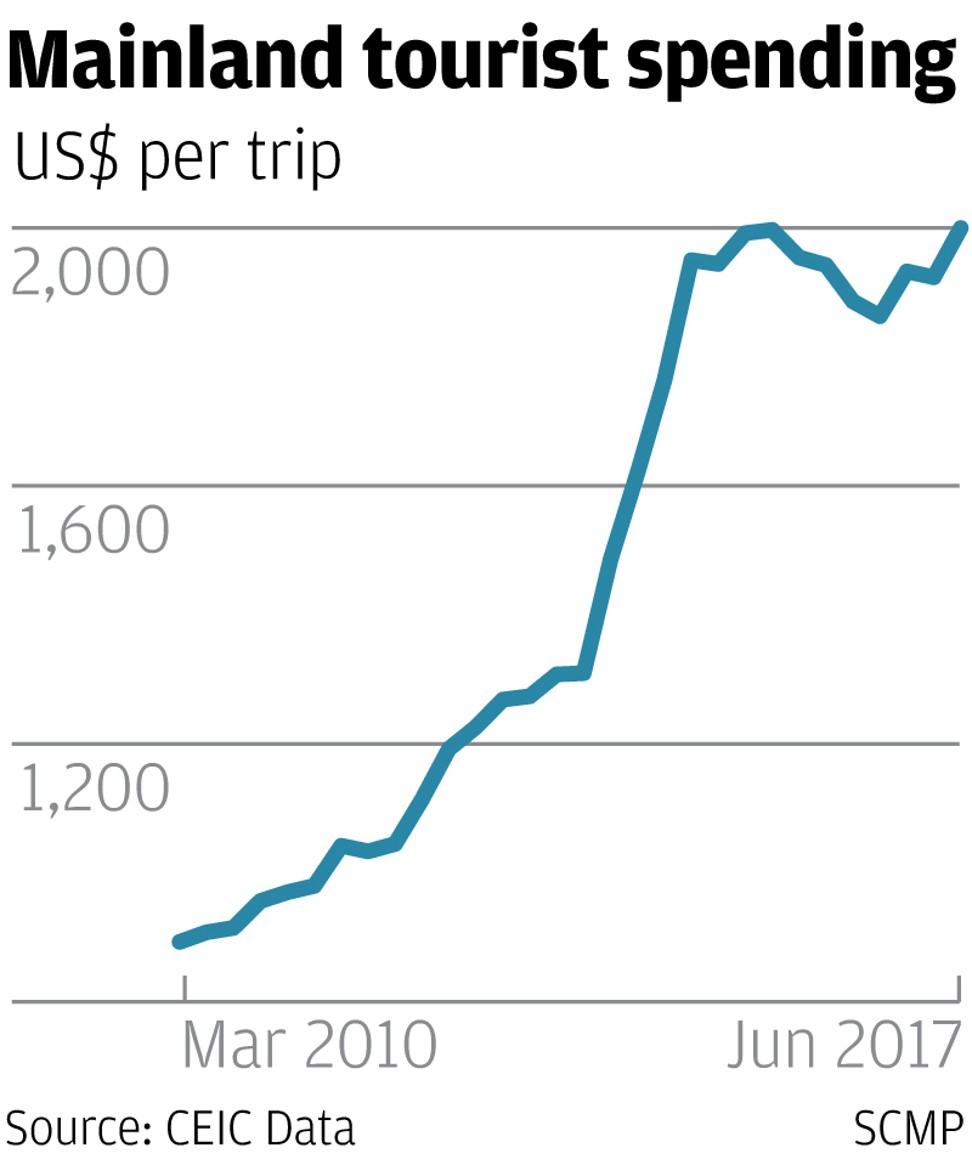

One particular anomaly worth noting here is the drain on the tourism account, now showing a net outflow of US$235 billion a year. They like to pretend in Beijing that this is just a matter of many more mainland tourists wanting to see the world, but there is more to it than that.

The anomaly is that spending per outbound tourist is now running at US$2,000 per trip, more than double what it was seven years ago and, no, it is not because inflation has been particularly unkind to tourist knick-knacks, or that mainland tourists have suddenly begun to scatter money wildly as never before.

My guess is that at least US$90 billion a year of it right now is just money squirrelled abroad. It is ordinary individuals taking cash out of Macau ATMs, and now coming to Hong Kong to do it because Macau has convinced them that it can identify them through facial recognition technology.

I wonder whether the technology really works that well, or works at all, when faced with a hat, sunglasses and a medical mouth mask. I think it’s a bluff.

But this doesn’t matter. It has scared the visitors and we in Hong Kong cannot scare them the same way, as our ATM network does not have this miracle technology.

So now they come here, which means that the next time Beijing develops a capital outflow scare, which it will do again as certainly as the tide rises and falls, the HKMA will have to explain why it is acting for two systems when it should now be acting for one country.

Not in a position to comment, you know.