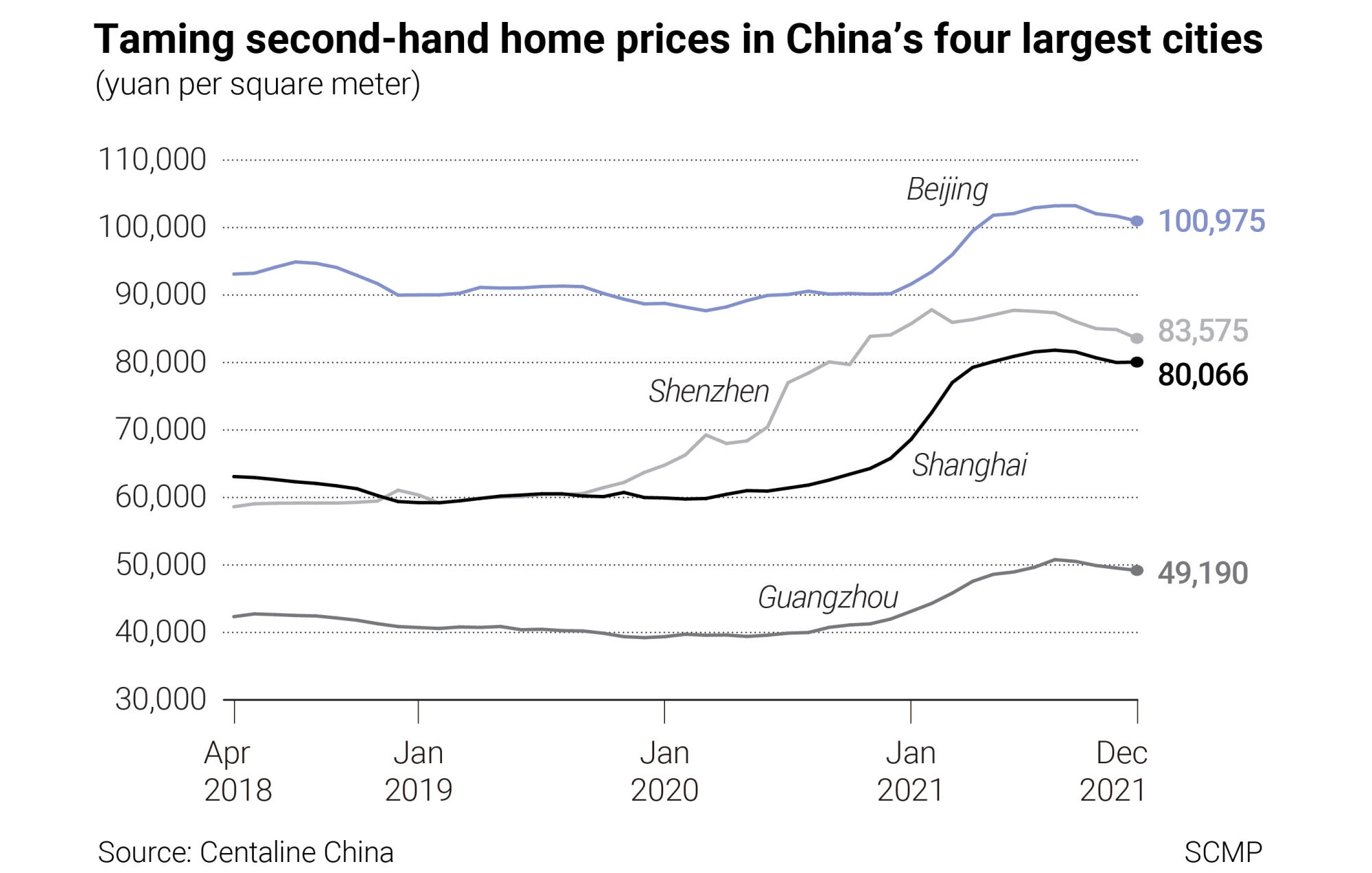

Housing deals to resume in 2022 in China’s first-tier cities as buyers re-enter the fray with pent-up demand after four years of draconian controls

- Median home prices in Beijing, Shanghai, Guangzhou and Shenzhen may rise by no more than 5 per cent in the new year

- Easier financing pledged by monetary authorities is helping leveraged developers to get their projects back on track, while genuine homebuyers get their mortgage loans

Transactions may return to China’s housing market in 2022, most noticeably in the country’s four first-tier tentpole cities, as relaxations in both monetary policy and market-dampening measures attract genuine buyers to re-enter the fray.

Median home prices in Beijing, Shanghai, Guangzhou and Shenzhen may rise by no more than 5 per cent – the level that triggers alarms about property bubbles, which sends policymakers into overdrive – in the new year, as financing pledged by monetary authorities help leveraged developers get their projects back on track, while genuine homebuyers get their mortgage loans.

“All eyes are on mortgage loans because it was the major stumbling block to home purchases by most buyers with genuine demand,” said Yin Ran, a Shanghai-based angel and property investor. “Many of them are seeing a ray of hope after the leadership decided to give economic stability their top priority in 2022.”

The prognosis is a welcomed breather from the relentless attempt to rein in runaway home prices that began in the autumn of 2017. Authorities introduced a raft of draconian measures that seeped into every aspect of the economy, from bank loans to capital-gains tax and even the divorce procedures of property-owing couples, to tamp down on speculation and tame prices.

That is a relief for Xiao Yue, a 35-year-old Shanghai clerk who failed to close her purchase in June because her bank was reluctant to lend her enough to afford her dream home.

“We are keeping our fingers crossed that the monetary policy would be eased soon,” she said. “In Shanghai, where homes are extremely expensive, middle-income wage earners cannot own a home without bank loans.”

China property: how the world’s biggest housing market emerged

“Banks’ restrictions on mortgage credit [forced] numerous deals to be cancelled over the past six months,” said Song Yulin, a senior manager at the Baonuo property agency in Shanghai. “It makes no sense to curtail homebuying by people who do not own homes.”

Xiao, a first-time buyer, signed a preliminary contract in March to buy a 4-million yuan (US$627,000) flat in the secondary market. Under Shanghai’s lending rules, she had to put down 30 per cent of the home’s value up front, or 1.2 million yuan, before paying for the remainder in mortgage loans.

However, her bank valued her property at only 3 million yuan, and was only willing to lend her 2.1 million yuan, leaving her with a shortfall of 700,000 yuan and few options but to renege on her purchase.

“Many of the measures aimed at curbing over-speculation have ended up hurting buyers like us, who have genuine demand for homes,” she said. “Officials making housing policies should make sure that the policies are well founded before promulgating them.”

To curtail housing demand, banks have been dragging their feet in approving loans, taking as long as 50 days to sign off on mortgages, according to a study by the Beike Research Institute that took a sampling of the average waiting time across 72 major cities in June.

“A healthy property market is still desirable in China because of its significance to the national economy and fiscal income,” said Wang Zhen, vice-president of the Shanghai Academy of Social Sciences. “The real estate sector will not stop growing.”