A theory for every expert: These two China market gurus can’t agree on where stocks are headed

HSBC Jintrust’s Qiu Dongrong is switching out of the year’s best-performing blue-chips, while Haitong Securities says it’s too early to bail on the bull market

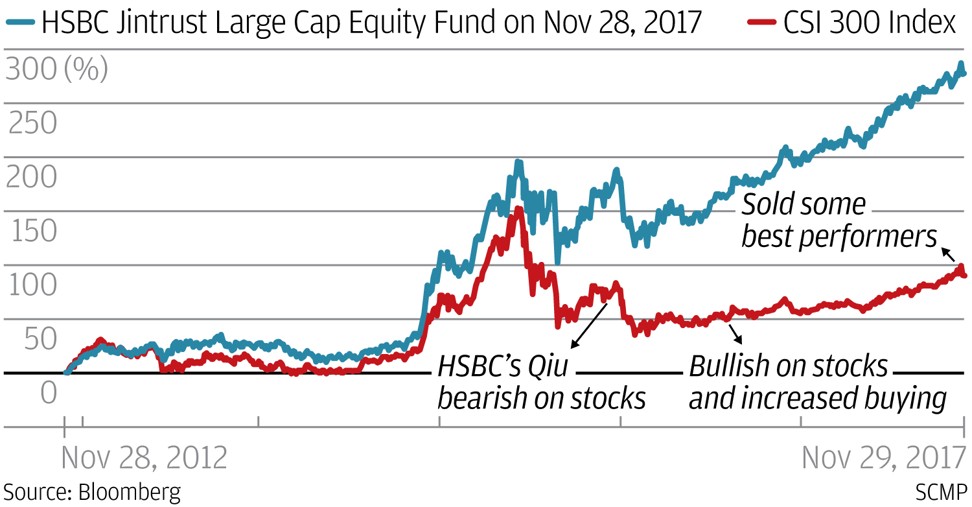

One of China’s top-performing fund managers has reduced holdings of the year’s top equities and rotated into companies that trade at cheaper valuations, in the expectation of a looming correction in share prices.

Qiu Dongrong, the Shanghai-based money manager at HSBC Jintrust Fund Management, said he recently began selling down his positions in some financial companies as well as cyclical companies – sectors that are among the best performers this year – in the belief that valuations fully reflect future earnings growth.

Instead, Qiu has been seeking better value among banks and car makers, in addition to smaller companies that look more appealing in terms of their growth prospects.

“Market expectations about earnings growth have already been fully priced in,” he said. “The correction is within our expectations.”

The HSBC Jintrust Large Cap Equity Fund, managed by Qiu, has beaten 94 per cent of rival funds over the past three years, according to data compiled by Bloomberg.

While Qiu’s selling seems prescient, with best-performing equity benchmarks of large companies down at least 4 per cent from this year’s highs, his general bearishness is at odds with analysts from China’s top market forecaster. Haitong Securities and Citic Securities said the recent declines in share prices are a temporary pullback as traders take profit in the approach to the year end. The upward momentum in big companies remains intact, they said, underpinned by continuing earnings growth.

“We are still optimistic about the medium-term trend on the market,” said Xun Yugen, a strategist at Haitong Securities in Shanghai. “Earnings growth will continue to boost market valuation and domestic and overseas institutional investors will keep moving in. The correction is halfway through now.”

Xun and his team were ranked No 1 for China equity strategy research by New Fortune magazine for a second straight year in 2017.

Selling pressure ripped across mainland equity markets last week, weighing negatively on popular stocks such as Ping An Insurance Group and Gree Electric Appliances on mounting concern policymakers will rein in runaway gains in blue-chip stocks and step up stricter oversight of financial products.

Among other triggers for the decline, the state-run Xinhua News Agency slammed Kweichow Moutai for its overly rapid share price gain this year. Just a day later, financial regulators rolled out new rules designed to put the nation’s asset-management products valued at US$15 trillion under more scrutiny. The products will be banned from issuing promised returns and be required to observe ceilings for leveraged investments.

The turmoil deepened last Thursday with a 3 per cent slump on the CSI 300 Index of bigger blue chips. A decline of this scale has rarely been seen since the frequent intervention in the market by the state-backed funds after the 2015 stock crash. The year’s best performers have borne the brunt of the sell-off, with Kweichow Moutai tumbling 11 per cent from its record high and Ping An dropping 7.7 per cent from the peak.

State authorities have refrained from intervening as they want to impart the lesson that “even blue-chips cannot be speculated on and valuations need to be reasonable,” said Wang Zheng, chief investment officer at Jingxi Investment Management in Shanghai. “An annual gain of between 20 per cent and 30 per cent is acceptable but a 100 per cent gain is definitely not.”

Kweichow Moutai’s shares had risen 115 per cent for the year to an all-time high in November before trending lower in November. Similar outsize moves were seen in Ping An and Gree Electric, which were up 121 per cent and 94 per cent respectively before their shares made a U-turn. About 20 stocks on the CSI 300 have doubled this year and more than 30 have gained between 50 per cent and 100 per cent.

The CSI 300 and SSE 50 Index of blue-chip companies now trade at the most expensive levels relative to the benchmark Shanghai Composite Index in almost three years on a valuation basis, according to data compiled by Bloomberg.

The recent turbulence was triggered by a short-term fluctuation of investment sentiment rather than the reversal of the market trend, said Qin Peijing and Yang Lingxiu, analysts at Citic Securities, the nation’s biggest listed brokerage.

“The frequent introduction of new rules adds to uncertainty in the near term,” Citic analysts said. “But in the long run, that will boost the value of A-share allocations as the asset-management rules are expected to squeeze the yield for those financial products competing for funds with A shares.”

For HSBC Jintrust’s Qiu, he is already buying companies in the pharmaceutical, electronic and media industries.

“The best stocks now could be growth ones, namely those with high return-on-equity ratios, strong profitability and not-too-high valuations,” he said. “That’s the type of companies we like most.”