Chinese plastics makers are switching to biodegradable materials as Beijing stresses on pollution-free economic progress

- The prospect of impending government regulations against single-use plastic packaging is causing companies to ramp up biodegradable plastic production

- Biodegradable plastics made from agricultural sources such as corn and sugar cane are emerging as an alternative to traditional petroleum based products

Lou Zhongping, dubbed the “king of plastic straws”, is changing his strategy.

The founder and chairman of Saton Daily Necessities is spending US$15 million to double the size of his factory in Yiwu, Zhejiang province to produce biodegradable straws, Plastic News reported earlier this month.

Lou has good reason for the switch. Orders for biodegradable straws made from polylactide acid (PLA) – a type of biodegradable plastic raw material – have exploded in the past few months from 4 per cent of total orders, amid rising concerns from consumers over the detrimental effect of plastic products on the environment.

Chinese President Xi Jinping stressed the importance of ecologically sound development in his address to delegates at the “two sessions” gathering in Beijing earlier this month. He has made pollution control and environmental governance top priorities.

Trashed: China is forcing small-town America to stop recycling, by refusing to buy mountains of contaminated waste

Chinese plastics makers, responsible for 29 per cent of the global plastic production, are increasing the use of corn, sugar and other crops to develop biodegradable plastics, as concerns about pollution has spurred directives from Beijing and the prospect of a ban on single-use, non-biodegradable plastics such as cutlery, plastic bags and packaging.

China’s production of polylactide acid (PLA), a type of biodegradable plastic raw material, is expected to rise quickly from a very small base.

Market research firm IHS Markit estimates that in 2017, production of biodegradable plastics in mainland China was just over 31,000 tonnes – a fraction of the 335 million tonnes of plastic produced worldwide. But production of the biodegradable material is expected to climb over 15 per cent per year until at least 2022, according to IHS Markit.

“We see great potential for PLA [plastics] in China, mainly in textiles, packaging and automotive,” said Frederic van Gansberghe, chief executive of Galactic, a subsidiary of French sugar company Finsucre. Galactic is building a PLA plant in China with its partner BBCA, a Chinese corn processing company, with a capacity to produce 100,000 metric tonnes per year by 2020.

The switch to PLA plastic is growing visibly in China.

Zhejiang Hisun Biomaterials’ annual output has risen to 15,000 tonnes a year in 2018 from 5,000 tonnes per year in 2006. A company spokesman said that Hisun is likely to increase production to 65,000 tonnes by next year.

China XD, a maker of plastic-based car parts that holds dozens of product patents, including for parts made from PLA plastic resins, said that bioplastics would be one of three main product lines.

A spokesman for the Nasdaq-listed China XD, which had installed production capacity of over 600,000 tonnes in 2017, will focus on promoting bioplastics in packaging. China XD’s latest annual report showed that it planned to build an additional production capacity of 300,000 tonnes of “biological composite materials” in 2019.

Dr Wolfgang Baltus, a researcher with nova-Institut, a German research institute focused on the bioplastics industry, estimated that China’s current production of PLA plastic is about 70,000 tonnes per year, with another 400,000 tonnes made from petrochemical-polymers blended with starch.

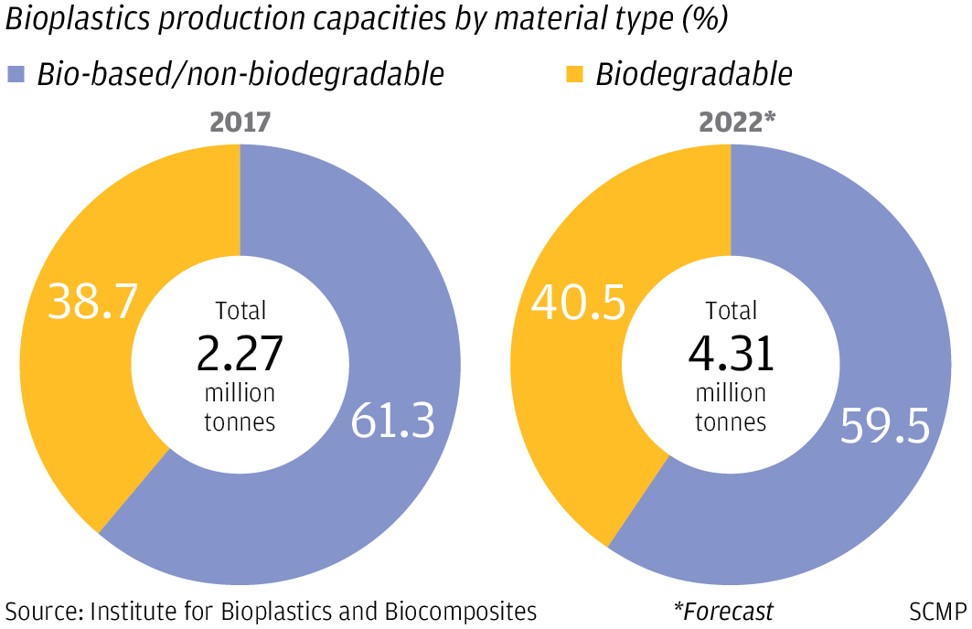

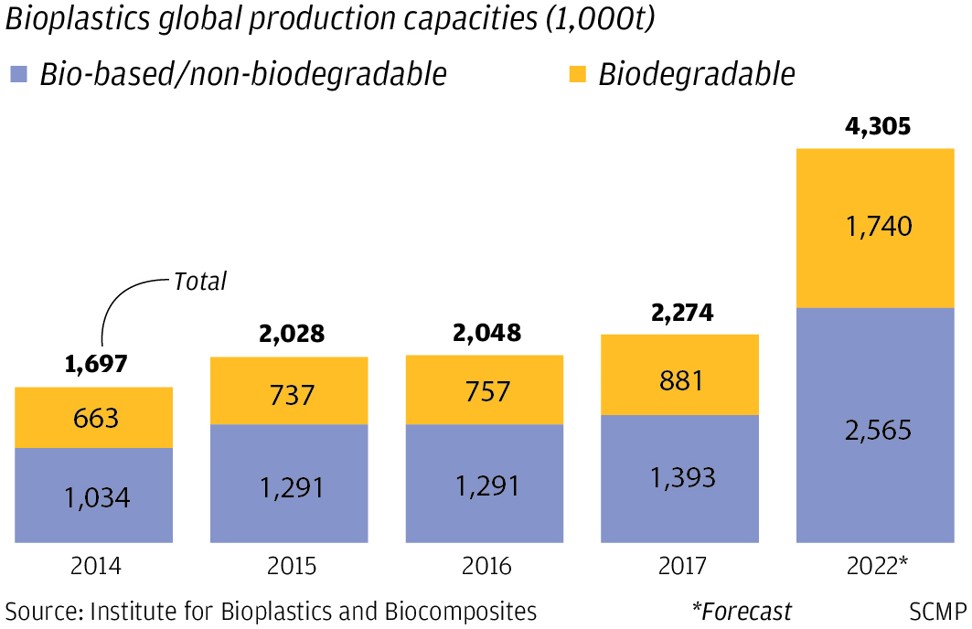

Despite the rising production of biodegradable bioplastic in China and globally, worldwide output is minuscule – it totalled 2.27 million tonnes in 2017 compared to overall global plastic production of 335 million tonnes, according to Germany’s Institute for Bioplastics and Biocomposites (IfBB).

IfBB sees global bioplastics production growing to 4.3 million tonnes per year by 2022, with biodegradables accounting for 40 per cent.

China’s waste ban has rocked the recycling world and revealed Hong Kong’s dire record. What next for the city’s rising mountains of trash?

Analysts and researchers are predicting rapid growth for this niche business, thanks to concerns over mounting plastics waste.

Plastic packaging, often quickly discarded, is estimated by Credit Suisse to account for as much as 40 per cent of the plastics industry, while another study from consultants McKinsey showed that just 16 per cent of plastic waste is recycled.

However, market insight indicates a bright future for biodegradable plastics as this could alleviate some of the environmental problems.

IHS Markit sees worldwide sales of biodegradable plastics growing from US$1.1 billion in 2018 to US$1.7 billion by 2023, thanks to a ban on single-use plastics, particularly in western Europe.

Thomas Luedi, a partner at Bain & Company based in Shanghai who oversees the chemicals sector, said that part of the reason PLA plastic remains more expensive than traditional plastic is that economies of scale do not exist yet and that Chinese regulations need to catch up.

He warned that China’s regulations were hard to predict, but the world’s regulations on plastic were “all headed in one direction”.

For the chemicals industry, particularly in western Europe, the key is making sure that government restrictions on traditional plastic products still allow the use of biodegradable plastic replacements.

Even though a plastic straw made with PLA may biodegrade, it still has to be composted in industrial facilities. This means that waste management infrastructure still needs to be built to cope with biodegradable plastic waste.

We see great potential for PLA [plastics] in China, mainly in textiles, packaging and automotive

German chemicals giant BASF markets a biodegradable plastic product under the trade name Ecovio. It constitutes a small fraction of BASF’s total plastics production, but Lydia Lau, business development manager for Ecovio, expects to grow production and sales from 200,000 tonnes currently to 700,000 tonnes annually by 2025.

Lau said that Europe accounts for nearly 50 per cent of Ecovio sales, but she expects business will pick up in China as Beijing adopts a harder regulatory line on plastics and waste.

She also sees potential demand for Ecovio in Chinese agriculture.

For years, Chinese farmers have used thin, polythene plastic sheets to protect crops from cold or arid conditions and increase yields.

A 2014 report said that farmers’ use of plastic sheeting had risen 200-fold from 1982 to 2011, to 1.2 million tonnes per year. Researchers found that farmlands in Xinjiang had as much as 500kg of polythene per hectare, contaminating soil and reducing yields.

In January, the Law on the Prevention and Control of Soil Pollution went into effect. Among other things, it regulates the plastic sheets farmers may use on their crops. Lau said that BASF was “involved” in discussions on drafting the legislation, and that Ecovio plastic sheets can still be used by farmers under the law.

She also noted that during the recent two sessions in Beijing, a policy to subsidise the use of biodegradable agricultural mulch films was also discussed.

Lau said she maintains contact with Chinese government officials about standards on biodegradable plastics.

In 2017, BASF announced plans to invest US$10 billion – the largest single foreign investment in China – in a new integrated chemicals plant in the Greater Bay Area.

Lau would not say whether the factory would produce Ecovio, though Bain’s Luedi said that it would make a lot of sense for BASF to include Ecovio in the production mix.

He added that bioplastics are now a “top three concern” for any global chemicals chief executive.

Atanu Baruah, a researcher with BCC Research, said that developing biodegradable plastics is capital intensive, making it hard for small businesses to get involved. “Big, agricultural commodity companies who are willing to invest financial and human capital can … expect to succeed in this rapidly developing market.”

In October 2018, Jilin Cofco Biomaterial, a subsidiary of Cofco, China’s largest food company and one of its most powerful state-owned enterprises, began production of PLA plastic using technology supplied by ThyssenKrupp, a German engineering conglomerate.

ThyssenKrupp officials refused to comment on the production volume of the new plant and Cofco officials could not be reached for comment.

Chinese scientists hope to fight ocean pollution by making plastic that breaks down when exposed to seawater

Galactic’s PLA plant in China will have a capacity to produce 100,000 metric tonnes per year by 2020, making it the largest in China.

Located in Anhui Province, the plant will have access to plenty of corn, said Van Gansberghe, who estimates the overall investment at about US$100 million.

Van Gansberghe said that the success of plastics companies of the future will depend on easy access to agricultural feedstocks, rather than petrochemical feedstocks. “It [the bioplastics market] is a real opportunity for new companies to enter in this business because the majority of the traditional, fossil-based polymers companies are still stuck with their old products.”

.