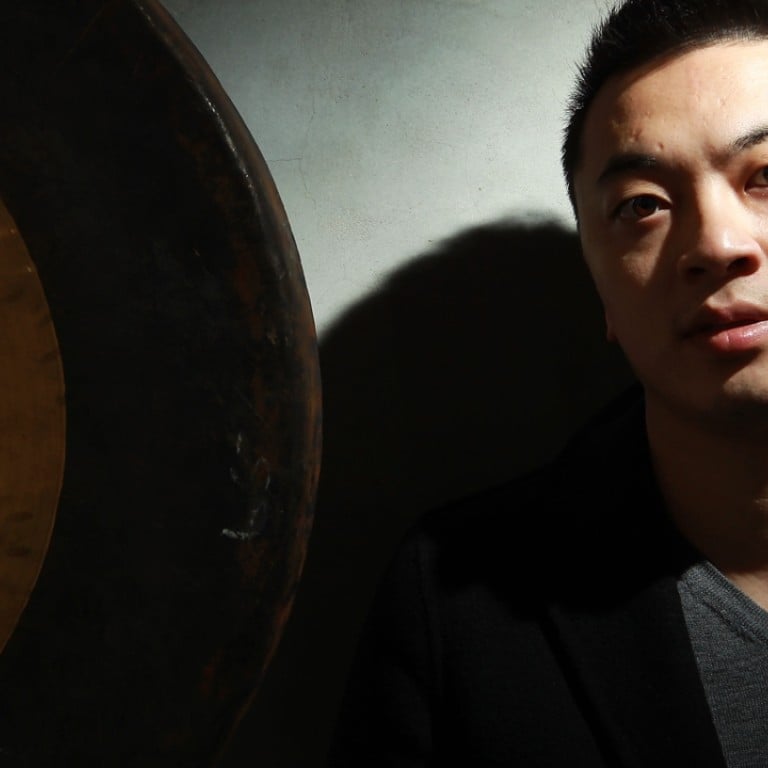

Hong Kong investor Danny Yeung dives into biotech after trying out mango shakes and retail shop bought out by Groupon

Danny Yeung has been called a serial entrepreneur, having dabbled in everything from mango shakes to furniture to a Hong Kong-based internet retailer that was bought out by Groupon, who then put him in charge of its East Asian operations.

The San Francisco native is now an investor in and chief executive officer of a local biotech firm. So one can’t help but to ask him jokingly if he is the Martin Shkreli of Hong Kong.

“I’m the opposite,” he says of the controversial American hedge fund manager. “Shkreli bought into a pharmaceutical company, then raised the price of its medicine, hurting people. I want to do good.”

His company, Prenetics, is part of the growing personalised medicine trend that evolved from the mapping of the human genome.

The information that can be derived from individual genomes is broad; the actress Angelina Jolie was able to identify the same genes that triggered her mother’s fatal breast cancer, and as a result Jolie took radical preventative measures, including undergoing a double mastectomy.

Prenetics’ focus is limited to pharmacology: it tests DNA to give doctors more tailored information on drug treatments for a range of ailments, including depression and heart conditions. I took the test, which involves a cotton swab inside the cheek, and found that I have a specific genetic variant of a protein coding gene in the liver, called SLCO1B1. As a result, there are certain types of cholesterol-lowering drugs that I would not metabolise well.

Personalised medicine is new and fairly limited in Asia, but is taking off in the United States. Some are enthusiastic about this evolving technology, others say it is just another expense without commensurate benefits.

Yeung argues that Prenetics’ services are cost-savers that will create sector-wide efficiencies. He points to US data that show adverse drug reactions inflate health care costs by billions of dollars each year. As such, DNA pharmacological testing is accepted by a number of hospitals, and US insurance firms including the federal government’s Medicare.

Preneticds plans to focus initially on private-sector health care in the region – including China and Southeast Asia - by partnering with insurers to offer the service on some of their insurance packages. A Prenetics test will cost less than US$500, roughly a third of the cost in the US, says Yeung.

It is cheaper than in the US because the core technology was developed by three professors from the Chinese University of Hong Kong and City University Hong Kong. “We don’t have to pay any licence fees [because] the test is done in-house at our own laboratory,” says Yeung. “[There is] no outsourcing of anything.”

“We work on very low margins as we believe if we can help more people with our test, ultimately we can make up for the low margins with volume,” he adds.. “It’s a one-time test good, for a lifetime… to get your own personalised profile of more than 200 drugs. We feel everyone will be wowed by the great value.”

Healthcare is an obvious growth sector in ageing Asia. Many governments have offered guidance or support to develop the related biotech industry, which has a global market capitalisation exceeding US$1 trillion.

Little of that is market cap is in Asia, however. Which raises the question of whether Hong Kong can provide a good exit – i.e., eventual public listing - for venture capital investments in biotech?

“There has been a lot of talk, but so far there has not been a big exit,” says Yeung. He thinks Prenetics is the company that can change that story, and forge a path for other biotech start-ups in Hong Kong. “You need exits to feed the ecosystem…so capital goes back to feed smaller companies.”

That said, there are a lot of VC funds currently sloshing around Asia in search of tech opportunities. Yeung says he has turned down VC investors, preferring to sell equity stakes to corporate investors who can offer strategic partnerships. A health insurance arm of Indonesia’s Lippo Group is one such investor, and Prenetics will soon announce another strategic partner.

But the end game is the same as with any other start-up. “This company is from Hong Kong, and that is where we would like to exit,” says Yeung.

Cathy Holcombe is a Hong Kong-based financial writer