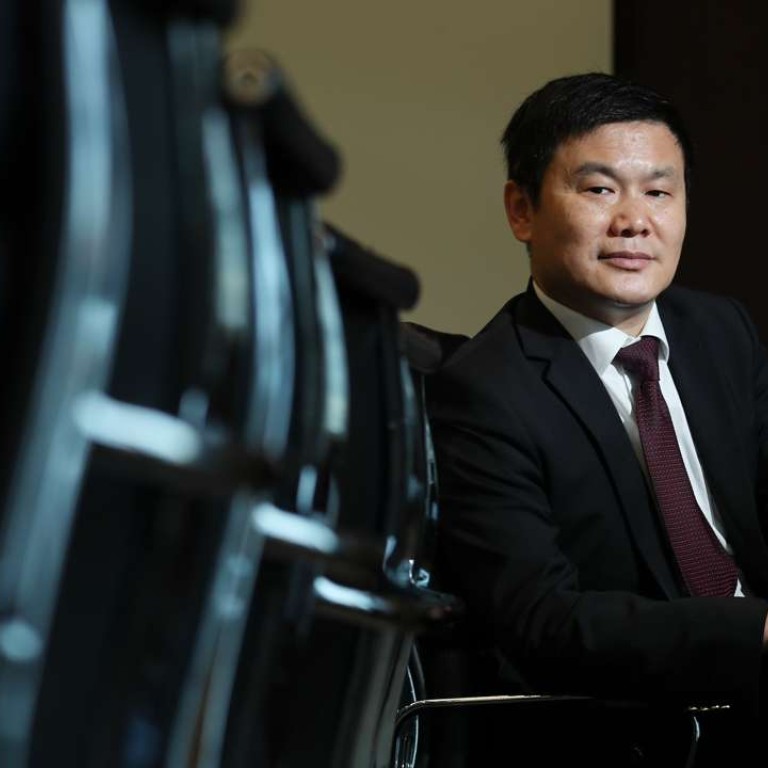

Chinese investors’ offshore appetite still ‘huge’ despite curbs on outflows, says Guotai chairman

Guotai Junan International’s chairman Yim Fung says new growth engine taking shape as company serves the demand for overseas investment

The appetite of mainland investors for US dollar-denominated assets is “huge” and offshore funds available for investment are growing despite curbs by Chinese authorities to stem capital outflows, Yim Fung, chairman of Guotai Junan International Holdings, told the South China Morning Post in an interview on Wednesday.

“The competition among mainland based brokerage firms is becoming more fierce, particularly for the securities brokerage business, as more players are consolidating or expanding their operation in Hong Kong,” Yim said.

On the other hand, the sentiment for trading equities has become more rational, particularly among mainland based investors, after the Chinese stock rout in the summer of 2015.

“Although the Shenzhen-Hong Kong stock connect kicked off last December, the inflows to small and mid-chips in Hong Kong from mainland investors is not as large as expected,” he said.

However, Yim said his company has found new growth engines and is working on developing services including financial products and debt securities.

“The demand to move some wealth offshore, to maintain and increase the value of it is very strong among clients, regardless of whether it is a state-owned company or a privately owned one, or if he or she is a high net worth individual,” he said.

Yim said his team was able to offer a tailor-made investment portfolio of products based on equities, debt and derivatives, which provided a competitive edge to attract these customers “as long as they could move their wealth to the offshore market”.

The company’s 2016 results showed that gains on structured financial products surged 237.9 per cent year on year to HK$116.1 million.

Guotai Junan’s results also showed that commission income from placement, underwriting and sub-writing for debt securities services tripled year on year to HK$250.2 million.

Since late 2016 Chinese authorities have stepped up measures to stem capital outflows, including tighter scrutiny of overseas investment purposes, after outflows intensified as the yuan devalued 6.6 per cent against the dollar last year, its worst annual drop since 1994.

Another competitive factor helping Guotai outperform its peers, said Yim, is the risk control ability of the company.

Last August the firm was rated “BBB/A-2” by Standard & Poor’s, and one month later it earned for the first time a Baa2 long-term issuer rating and a Prime-2 short-term issuer rating from Moody’s.

Yim said the upgrades reflected the company’s leading position in the niche market of facilitating mainland individuals in making offshore securities investments.

“When we finally got ratings from these international agencies, we saw our liability costs going down, while the customer base was expanding,” he said.

Still, the company is facing the most competitive market ever seen in China.

The number of stock brokers in the Hong Kong market has risen to the highest level in 20 years, with more than 600 brokers licensed to trade on the city’s bourse, according to Securities and Futures Commission data from October.

Meanwhile, the stock market’s level of activity is declining, as the average daily turnover has dropped to HK$66.9 billion, a decrease of 36.6 per cent compared with the HK$105.6 billion daily average in 2015.

In granting the new rating to Guotai Junan International, Moody’s said in a report that offsetting the company’s credit strengths were risks arising from the rapid increase in total assets, driven by margin loans, structured products and proprietary investments.