Chinese brokers face rising regulatory risks in 2017 as Beijing clamps down on leverage

Securities firms are expected to be less reliant on the brokerage business while asset management will become an important revenue contributor

Chinese brokers face rising regulatory risks in 2017 with tighter scrutiny on financial leverage,

but this should lead to structural changes and business reforms for the industry, analysts said.

“We expect the crackdown on leverage to be the main theme of 2017, which will hit brokers’ financial performance on many levels,” said Tang Zipei, an analyst for Orient Securities.

Morgan Stanley recently reduced its average earnings estimates for brokers by 12 per cent this year and 10 per cent in 2018.

China Galaxy International also lowered its forecasts for the 2017 earnings per share of the three top brokers – Citic Securities, Haitong Securities and GF Securities – by 7.1 per cent, 6 per cent and 4.7 per cent respectively.

Chinese authorities have stepped up their campaign against financial leverage on all fronts, including the banking industry, the insurance sector and the securities market.

Consequently, brokers have taken a hit in both the brokerage and investment banking businesses as trading volumes in stock markets dropped sharply and underwriting of bonds remained sluggish due to higher bond yield rates.

“We expect [brokers to have] less reliance on the brokerage business as the velocity in the A-share market has decreased,” a group of Morgan Stanley analysts led by Lu Lu and Richard Xu said in a recent report.

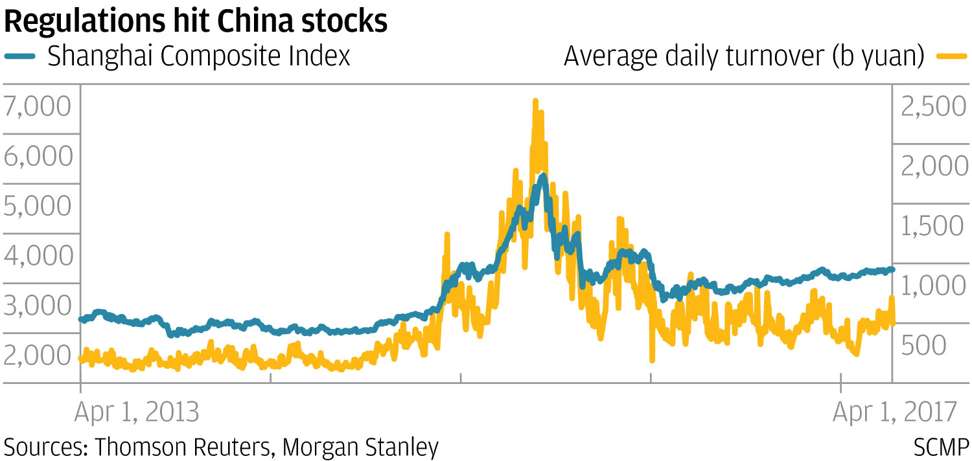

Although the Shanghai Composite Index has gained about 10 per cent since July 2016, the A-share trading volume remains subdued.

“This is the first time in the past decade that a notable and sustained divergence between [the Shanghai Composite] performance and [average daily turnover] has been observed,” the Morgan Stanley analysts said.

They believe the regulators will continue to tighten their grip during the rest of 2017, which should put pressure on A-share trading volumes.

Morgan Stanley lowered the 2017 estimate for the average daily turnover to 500 billion yuan from 650 billion yuan.

“We believe the likely lower [turnover] in 2017 and further pressure on the commission rate will lead to a decline in commission income across all brokers under our coverage in the near term,” the analysts said.

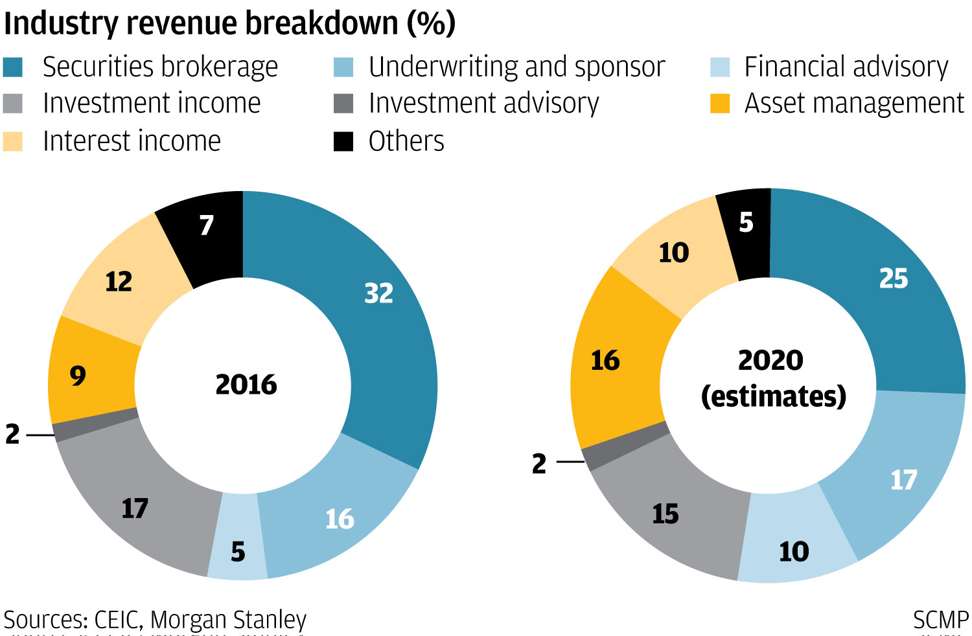

The percentage of revenue contribution by the brokerage business to the securities industry has already fallen.

In 2016, revenue from the brokerage business accounted for 32 per cent of the industry total in 2016, down from 47 per cent in 2015. Lu and Xu anticipate the share to decline further by 2020.

Investment banking, the second largest revenue contributor that includes underwriting and financial advisory services, had also been affected by tight regulatory scrutiny, analysts said.

“The investment banking business has been dragged down by sluggish bond underwriting,” said Wang Zhiwen, an analyst for China Galaxy Securities.

More and more bond issuers were “sitting on the sidelines” due to rising bond yield rates, he said.

So far this year, the volume of corporate and enterprise bond issuances has declined 73 per cent and 87 per cent respectively, resulting in lower bond underwriting income for brokers.

“Although the market might recover later this year, the chance is low for corporate and enterprise bond issuances to record a year-on-year increase in 2017,” Wang said.

The equity issuance volume might also fall in 2017 compared with 2016, the Morgan Stanley analysts said.

“Equity placement volume has increased significantly since 2015 and part of the funds went to financial leverage rather than supporting the real economy,” Lu and Xu said.

Nevertheless, tighter restrictions on private placements are expected to lead to a drop in equity issuance volume despite the potential acceleration in initial public offerings.

“Assuming [listing] issuances double year on year in 2017 and placements drop by 40 per cent, the equity issuance volume in 2017 would decline by 30 per cent,” Lu and Xu said.

On the bright side, “faster [listing] approvals and stricter rules on equity placements will likely curb speculation in the primary market and the misuse of financing proceeds”, they added.

The analysts also expected brokers to derive more underwriting fee income from mergers and acquisitions and non-main-board listings rather than relying on equity underwriting fees from listings.

“Listings on the [National Equities Exchange and Quotations] and M&A activity will play more important roles in corporate financing,” they said.

The NEEQ, also known as the “New Third Board”, is an over-the-counter system for trading shares of public limited companies that are not listed on the Shanghai and Shenzhen stock exchanges.

Aside from underwriting and market-making fees, brokers could generate revenue with private equity investments in listing candidates for the third board or invest in their placements, Lu and Xu said.

Last but not least, brokers are expected to pivot towards active asset management as tightened regulatory rules have increased the costs for channel business, which guides client funds into off-balance-sheet investments.

“We expect much slower growth in channel business, which now represents about 70 per cent of brokers’ assets under management,” the Morgan Stanley analysts said.

In contrast, brokers may increase focus on active asset management to tap into rising household wealth.

“Considering the increasingly strict controls on capital outflows, high-net-worth customers may also have growing demand for asset allocation within China, particularly in asset management products,” the analysts said.

“We also expect demand for financial advisory services to rise as investment options for retail investors continue to expand and become more complicated, given slower growth in principal-guaranteed products. This should also benefit China’s securities firms over the longer term.”

In the longer term, brokers with stronger technology integration and client bases will be able to build up better active asset management capabilities.

Morgan Stanley estimated the asset management segment would see faster growth than other business lines in the next couple of years and contribute 16 per cent of the industry revenue by 2020, compared with 9 per cent in 2016.