Opinion: The identity of TVB’s true controller lays bare for all to see

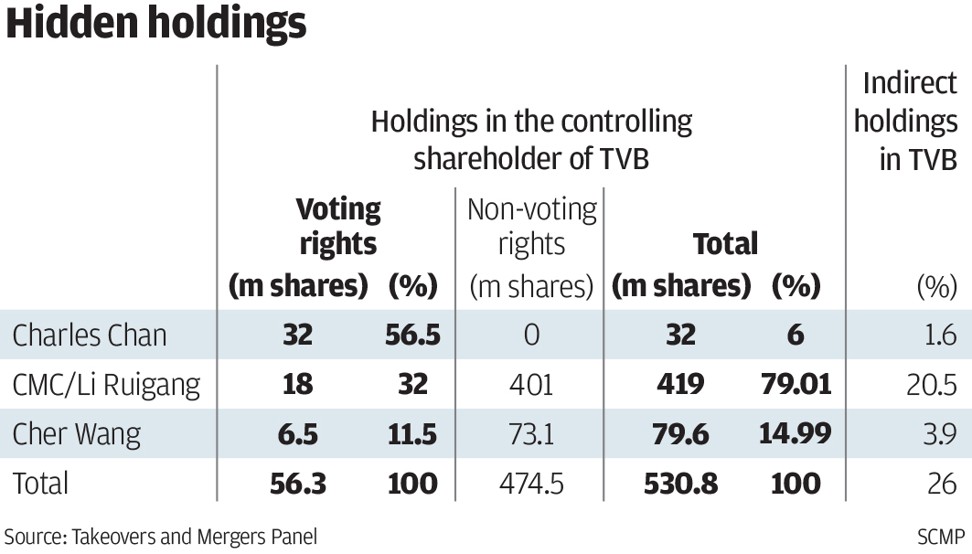

According to agreements seen by Money Matters, Chinese media mogul Li Ruigang owns 79 per cent of the non-voting shares -- which should be counted the same as voting shares -- giving him 20 per cent of TVB.

Very few people in Hong Kong’s media industry take Charles Chan Kwok-keung as the genuine controlling shareholder of TVB, given his reputation as the “King of Shell Companies,” and the political importance of the city’s dominant free TV to Beijing.

Yet, it was still shocking to see his role spelt out in a contract as the frontman for the Chinese media mogul Li Ruigang, an agreement that’s signed by a venerable list of Who’s Who of mainland China, Hong Kong and Taiwan.

It’s shocking for the contract’s blatant contradiction to our laws; the fact that it was left unchallenged for years, and the silence by the authorities following its accidental revelation.

Ever since the late Sir Run Run Shaw sold 26 per cent of TVB in 2011 to a holding company called Young Lion Holdings Ltd., Chan had been presented as the man in charge.

This is because Hong Kong’s Broadcasting Ordinance stipulates that only a permanent resident of the city can be a “qualified voting controller” of a domestic free TV license.

A shareholding agreement of Young Lion, which was obtained by Money Matters via the Hong Kong Stock Exchange, however, reveals a very different picture.

The reality is that Young Lion has two kinds of shares: the voting and non-voting kind.

It is “structured to constitute qualified voting controllers under the Broadcasting Ordinance, including that a majority of the Voting Shares shall be held by Hong Kong residents,” according to the agreement.

All the official announcements made by TVB referred to the voting shares, including Chan’s 56 per cent “control” of Young Lion.

What matters, however, is the non-voting shares, which account for 90 per cent of Young Lion’s total share capital, much to the surprise of Hong Kong’s Takeover & Mergers Panel in the process of its vetting of TVB’s HK$4.2 billion share buyback plan.

To be fair, Li is not the sole non-resident in Young Lion. Cher Wang, the chairwoman of Taiwan’s HTC Corp is also a shareholder of Young Lion. And Li has been, for all intents and purposes, a private entrepreneur ever since stepping down in 2012 from his Communist Party post in Shanghai.

But the dominance of his China Media Capital (CMC) is visible everywhere in TVB.

CMC can order Chan to sell his shares anytime. It’s the sole party with the first right of refusal to any stock sale by Young Lion’s shareholders. While Chan only nominates one director of TVB, CMC has the biggest say in the appointment of directors. Li is the only non-Hong Kong resident among Young Lion’s shareholders and directors.

The shareholding agreement does nothing to hide CMC’s ambitions. As soon as Hong Kong’s relaxes the restrictions against non-residents, the shareholders will “take all necessary steps to convert the non-voting shares into voting shares, or vice versa,” in the process making CMC the official controller.

Before this can happen, everyone will make sure no non-resident is seen to be in control, at least on the books.

This is despite the law disallowing outright any holding, or acquisition structured with a purpose to avoid restriction against non-residents.

More than a week has passed since the embarrassing revelation by the Takeover Panel. Important questions remained unanswered.

To the Communication Authority: Have you read the shareholding agreement, as well as the relationship agreement mentioned in the former?

If not, on what basis do you assess Young Lion’s qualification?

If yes, how did you assess Young Lion as a qualified controller of TVB, despite its control by a non-resident, mainland person? How will it rectify the situation? Will anyone be punished?

To the TVB board of directors: Why didn’t it inform shareholders of the significant fact revealed? Has the board sought any verification with the controlling shareholders? What has it been doing to assess the impact of its license and business?

So far, TVB has made no comment on its shareholding, while its lawyers argued to the Takeover Panel to treat non-voting shares differently as voting shares.

To the Securities & Futures Commission, and the Hong Kong Exchanges & Clearing Ltd.: Have the regulators and TVB shareholders been provided with misleading information, which is an offence under the law? Will anyone be punished for that?

These are not questions to be brushed aside.

Any wishy washy handling will invite not only copycats, but more importantly, confirm the impression that Hong Kong will bend any law to please Beijing.

That’s the last thing our city needs.