BYD remains upbeat on new energy vehicles, after reporting interim profit declined 24pc

The maker of vehicles, mobile handsets and rechargeable batteries reported profit of 1.72 billion yuan in the first half, a fall of 23.8 per cent as state subsidy reductions weighed on electric car sales

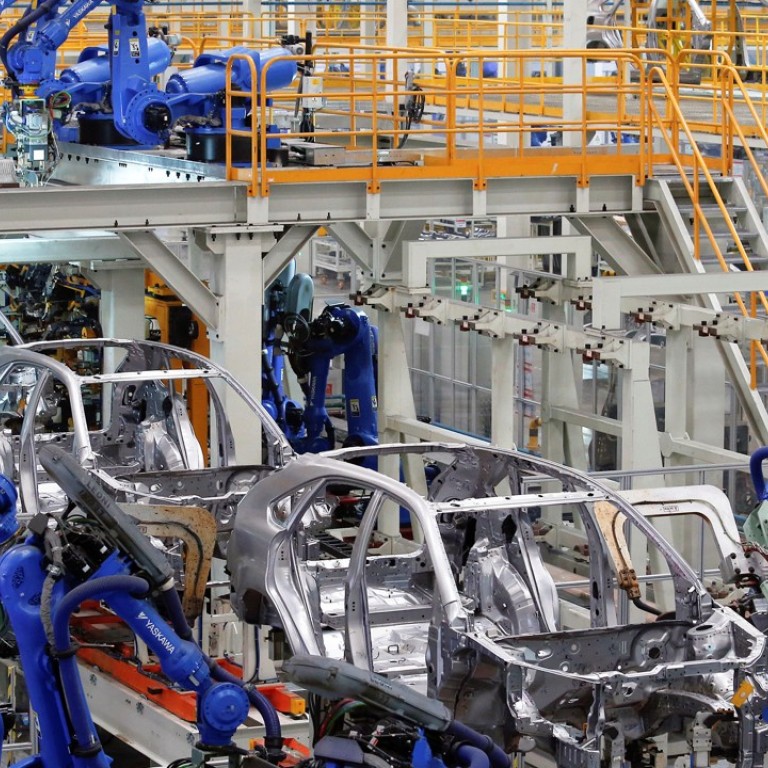

Chinese car manufacturer BYD, which is 8 per cent owned by Warren Buffett’s Berkshire Hathaway, remain upbeat on the country’s new energy vehicle sector, especially those priced under 100,000 yuan, after reduced state subsidies dampened sales and profit in the first half.

“We will roll out new models of new energy vehicles to try to boost the sales,” said Wang Chuanfu, chairman of BYD on Tuesday. “In general, there is no concern for us to further develop in this area.”

He said the sales of the company’s new energy vehicles saw declines in the first three months of this year, but the situation was improving in the second quarter as customers grew accustomed to new prices.

BYD had sold 7,000 commercial electrical vehicles and 40,000 passenger electrical vehicles in the period, with those priced under 140,000 yuan (US$21,217) taking up the major share of the total sales.

Wang also expected its ambitious “Sky rail” project, a monorail system costing 5 billion yuan in research and development, to begin bringing in revenue in three years.

The company announced on Monday that its net profit fell 23.8 per cent to 1.72 billion yuan in the first half of the year, missing analysts’ expectations as reduced government subsidies weighed on its sales of new energy vehicles, while fierce competition had hurt its photovoltaic business, the company said in a statement.

BYD’s interim results were announced late on Monday. In Tuesday’s trading in Hong Kong the company’s shares dropped by 3.18 per cent to close at HK$47.25 a share.

BYD’s business operations include automobiles, mobile handsets, and rechargeable batteries and photovoltaics. For the first half of the year, the automobile segment reported revenue fell 4.1 per cent to 22.4 billion yuan, the mobile handset segment reported revenue rose 10.3 per cent to 18 billion yuan and the rechargeable battery segment reported revenue of 3.42 billion yuan, representing a drop of 15.75 per cent.

BYD said it expected the divergent performance of its three business lines to continue into the latter half of the year.

“During the third quarter of 2017, it is expected that...sales of the group’s new energy automobiles will grow rapidly, while our profitability may decrease, influenced by the reduction of subsidies and market competition,” it said.

A number of different Chinese official bodies have embarked on campaigns to drive the development of environmentally friendly industries including renewable energy generation and new energy vehicles.

These have resulted in some notable successes, but also some market inefficiencies, and in its statement BYD referred to oversupply in the photovoltaic industry in the second half of the year.

BYD Electronic, which was spun off from BYD and listed in Hong Kong in 2007, earlier announced a net profit of 1.32 billion yuan for the first half, 119 per cent higher than the same period last year.