It’s a ‘merger’, says CEO as New York start-up WeWork makes play for China co-working crown with Naked Hub deal

Acquisition could be worth US$400 million and adds co-working spaces in Shanghai, Beijing, Hong Kong, Vietnam, Australia and London to WeWork’s portfolio

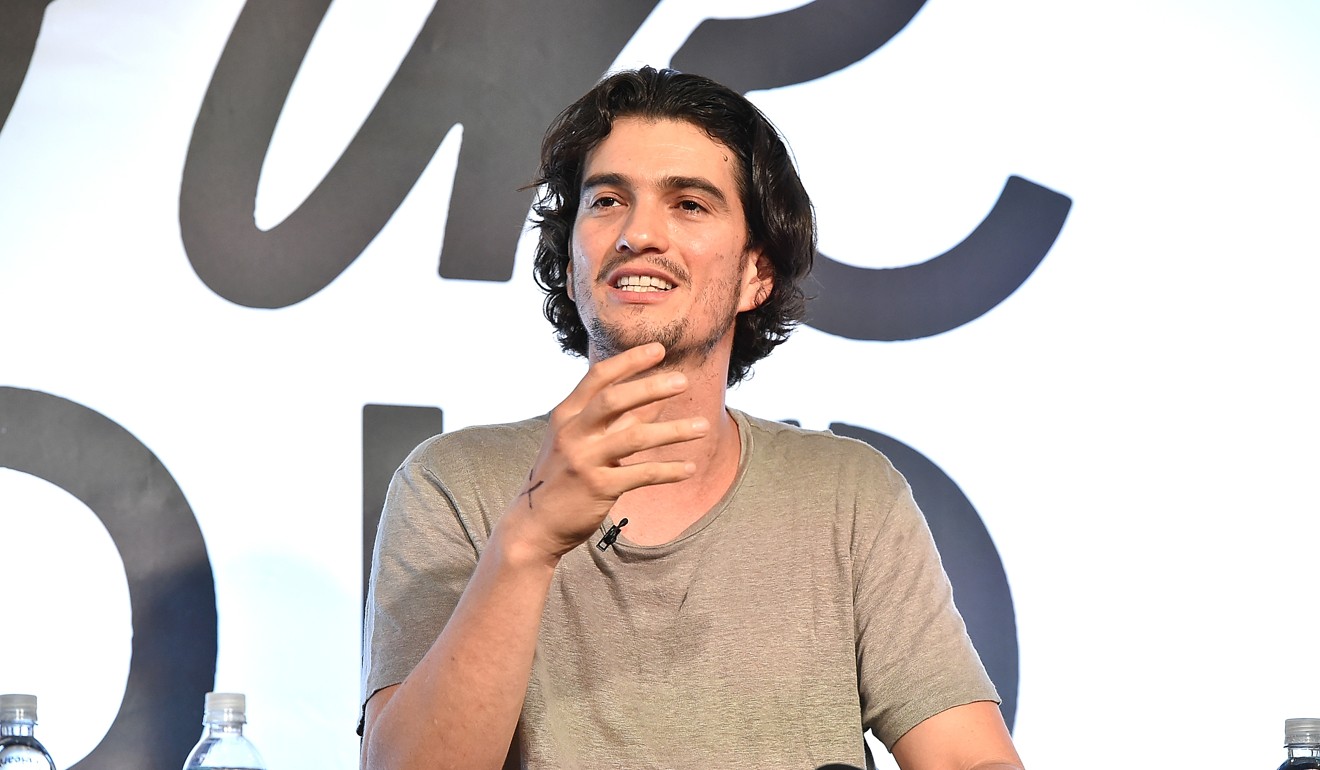

New York-based co-working start-up WeWork “merged” with Chinese rival Naked Hub for its local knowledge and technological strength, Adam Neumann, its co-founder and chief executive, said in Shanghai on Thursday.

“One plus one equals 11,” said Neumann, stressing that the “merger” would make WeWork “substantially larger and stronger”, as Naked Hub had a larger local technology team and more experience in local market.

“We do not consider it an acquisition, we consider it a merger … they are now going to be our partners for a very long time,” he said at the China launch of “Powered by We”, a programme that will deliver tailor-made design and operational services to big corporate clients in their own office space. The programme is already available globally.

WeWork, counted among the world’s most valuable start-ups at about US$20 billion, will pay about US$400 million for the three-year-old Chinese business, according to Bloomberg. The deal adds co-working spaces in Shanghai, Beijing, Hong Kong, Vietnam, Australia and London to its portfolio, and puts it on a collision course with the China market leader, Ucommune.

Neumann said the deal with Naked Hub would allow WeWork to deploy Powered by We “twice as fast”. He declined to answer questions about the value of the deal and if whether Naked Hub would keep running independently.

“When it comes to brand names, I think names are good but that is not what is most important,” he said, stressing that it was more important that the two companies had shared culture and values.

“In Naked Hub, we have found an equal who shares our thinking about the importance of space, community, design, culture, and technology. Together, I believe we will have a profound impact in helping businesses across China grow, scale and succeed,” said Neumann.

WeWork also announced partnerships with Hong Kong retailing giant Fung Group and mainland private equity company Hony Capital for the Powered by We programme on Thursday.

WeWork will revamp Fung Group’s offices in Shanghai’s Hongqiao area. “It’s a milestone for us,” said Victor Fung Kwok-king, the company’s chairman, who added that Fung Group will also look at WeWork spaces overseas, in territories where it does not have a foothold.

The group will also supply furniture to WeWork globally from its furniture line, in which Hony Capital has invested, said John Zhao, the private equity company’s chairman.

Hony Capital is also a key investor in WeWork. A consortium led by the private equity company that includes its parent company, Legend Holdings, Shanghai’s Jin Jiang International Hotels Group and property companies Oceanwide Group and Greenland Holdings, invested US$690 million in WeWork in March last year, securing a boardroom seat in the deal.

Hony Capital also helped WeWork seal its partnership with Fung Group.

Companies such as WeWork are flourishing because a rising number of young workers are opting for flexible working hours and a more relaxed working environment.

The rising number of technology start-ups bolstered by Beijing’s ambitious goal of turning the mainland into a global innovation powerhouse has created a strong demand for flexible offices.

Together, I believe we will have a profound impact in helping businesses across China grow, scale and succeed

A survey by global property services company JLL found that 81 per cent of white-collar respondents in Shanghai now accept working in flexible offices, compared with 24 per cent at the end of 2013.

“An explosive growth of co-working offices can be expected as the authorities ramp up support for start-ups by offering them fast track listing approvals, and more young entrepreneurs set up their own shops,” said Daniel Yao, research director with JLL. “Co-working operators will see an increasing demand for their office space and the market will soon grapple with a short supply.”

A new supply of 180,000 square meters of flexible offices is expected in Shanghai this year, accounting for 15 per cent of the total new office space to be delivered in 2018, according to JLL.

But China’s booming sharing economy might be about to have its own day of reckoning, amid growing evidence that financing activities have reached their high water mark. The industry raised a record 216 billion yuan (US$34.28 billion) last year, an increase of more than a quarter compared with a year earlier, according to a report by the State Information Centre, which predicted that competition among platform companies would intensify and drive mergers and acquisitions.

Bicycle-sharing has been among the most prominent sectors that have seen weaker players drop out as funding dried up. And the consolidation in bike-sharing followed that in ride-hailing, which saw fierce competition between rival platforms before Didi merged with rival Kuaidi to take on and eventually beat back Uber.

Co-working spaces might be the next sharing sector to see a wave of consolidation.

WeWork’s acquisition of Naked Hub is rivalled by main competitor Ucommune, which acquired New Space and Woo Space in the first quarter of this year. Ucommune also completed a strategic investment in Wedo last July and announced a strategic partnership with Vanke, the Chinese property developer.

“I think it’s reasonable that companies sharing similar cultural genes and development strategies merge together for further growth,” Mao Daqing, Ucommune’s founder and chairman, said in a statement.

“Ucommune will remain committed to our globalisation strategy, and we foresee major moves on the M&A front from our side in the near future.”