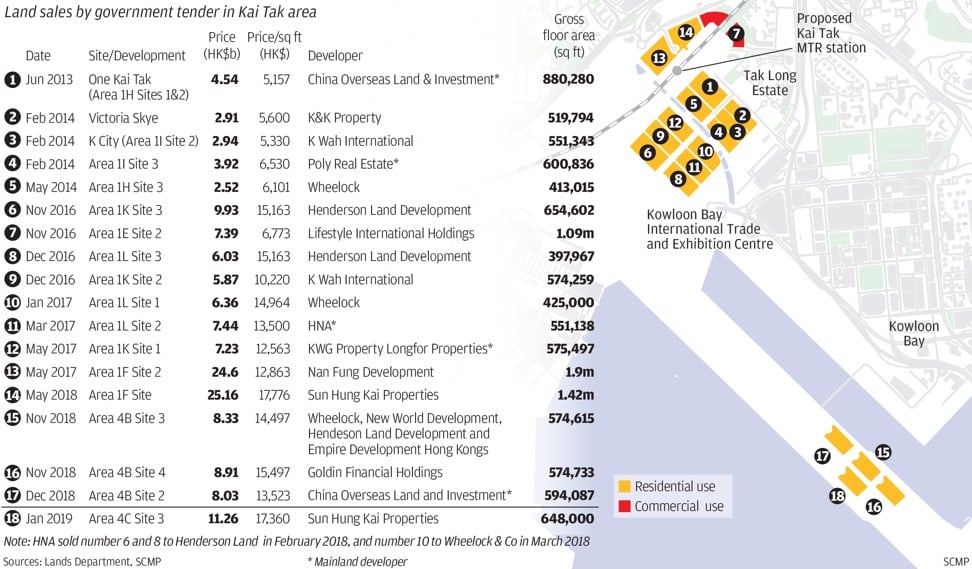

Sun Hung Kai pays US$1.43 billion for Kai Tak residential plot in subdued tender that underscores downbeat market

- Sun Hung Kai’s winning bid works out to HK$17,360 per square foot, within the price range expected by valuers

- The developer will spend HK$20 billion on the project, and agents expect the completed homes to sell for around HK$30,000 per square foot

Sun Hung Kai Properties, Hong Kong’s biggest developer, has won a government tender for the fourth plot of residential land on the old runway at Kai Tak, paying HK$11.26 billion (US$1.43 billion) for the parcel at the city’s former airport.

At HK$17,360 per square foot, the winning price for Kai Tak Area 4C Site 3 was the highest paid for a purely residential plot in the area, and within the price range expected by valuers of between HK$10.4 billion and HK$13 billion, or HK$16,000 to HK$20,000 per sq ft.

“The price reflected developers’ confidence in the market’s prospect and the need for land with full view of Victoria Harbour,” said Thomas Lam, executive director at Knight Frank. “The price will set a benchmark for home and land prices in the area.”

As recently as a year ago, Kai Tak was the epicentre of Hong Kong’s property bull run, with developers outbidding each other by as much as 50 per cent to get their hands on scarce land to add to their order books. A vacancy tax proposed last July pried developers into releasing more homes for sale, while rising mortgage rates gave first-time buyers cause for pause.

The 117,900 sq ft plot, located on land jutting out into Victoria Harbour on what was the former airport runway, fetched six bids at the closure of tender at Friday last week, falling short of Knight Frank’s expectation of seven to 10 bids.

Scenic site at Kai Tak draws fewer than expected bids from property developers

Sun Hung Kai’s outbid CK Asset Holdings, Kerry Properties, Kingboard Investments and a venture between K Wah International and Sino Land. A consortium comprising Wheelock Properties, China Overseas Land & Investment, Chinachem Group, Empire Group, Henderson Land Development and New World Development also submitted a joint bid.

“The group is very pleased to win Kai Tak’s land again,” said the developer’s deputy managing director Victor Lui. “The land is the best residential plot on the runway. The government will invest heavily on infrastructure to develop the Kai Tak area. The prospects are very good.”

At a plot ratio of about 5.5 times, the land parcel can be developed into a project with 648,000 sq ft of gross floor area. Sun Hung Kai will invest about HK$20 billion on the project to build what it calls an “iconic, luxury harbourfront development”, where every flat can enjoy an ocean view.

Completed apartments on the site can sell at more than HK$30,000 per square foot, according to estimates by Knight Frank.

Hannah Jeong, head of valuation and advisory services at Colliers International, said Sun Hung Kai’s success in winning the latest tender may reflect dwindling market sentiment.

“Sun Hung Kai Properties has taken part in the previous Kai Tak land sales continuously and they finally got one site, probably because other developers have put out lower bidding prices due to lacking confidence in the market,” she said.