Star Market, Xi Jinping’s US$376 billion baby, is poised for Ant Group boost as it turns one

- The tech stock-heavy Star Market has become Asia’s largest such market by value

- More than 130 companies have raised 205 billion yuan in capital over the past year, 34 per cent more than originally targeted

As far as first birthdays go, few would compare with the progress China’s version of Nasdaq has made in its first 12 months.

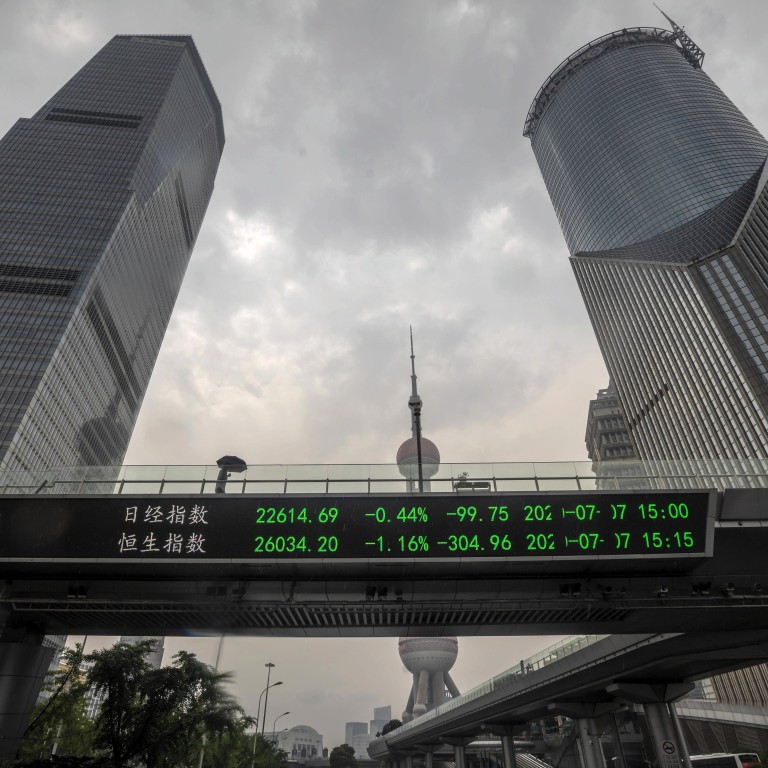

Ordered into existence by Chinese President Xi Jinping in November 2018, and launched less than eight months later, the technology stock-heavy Star Market has become Asia’s largest such market by value – as of Tuesday, it was capitalised at 2.62 trillion yuan (US$375.9 billion).

More than 130 companies have raised 205 billion yuan in capital over the past year, 34 per cent more than originally targeted. The first batch of 25 companies that made their trading debuts on July 22, 2019, are currently trading at 133 times their earnings.

SMIC plans to raise US$2.8 billion on Star Market as US stifles China tech ambitions

Beijing launched the Star Market at a time when US-China relations had worsened, with the Trump administration trying again and again to curb China’s ascendancy in the field of technology. The threat of mainland Chinese companies being cut off from American components and networks loomed large. This prompted China to develop its own key technology sector and launch the Star Market to ease funding for such companies.

“We feel that after accessing the Star Market our development prospects have broadened. It urges us to improve company earnings to support our lofty valuation and to meet our investors’ expectations,” said Yin Zhiyao, the founder and chief executive of chip maker Amec, which was among the first batch of 25 companies to list on the technology board.

Why Ant Group chose a dual IPO in Hong Kong and Shanghai and not New York

The big fundraising sizes and high market value reflect the important role and growing popularity of the market, said Wang Feng, chairman of Shanghai-based financial services company Ye Lang Capital. “Over the next three to five years, investors hope to see the rise of China’s own Intel and Apple through the funding support of the Star Market,” he added.

The Star Market – officially the Shanghai Stock Exchange Science and Technology Innovation Board – is poised to receive quite the birthday present. Jack Ma’s Ant Group, which operates the Alipay online payments platform for Alibaba Group Holding, the world’s largest e-commerce company and South China Morning Post parent, will split its massive initial public offering between Star Market and the Hong Kong stock exchange. The listing is widely expected to be among the largest in history.

The Shanghai exchange is also launching a Star Market index, which will track the top 50 companies on the board, on Thursday. Some of the companies listed on the Star Market were on Wednesday included in the benchmark Shanghai Composite Index for the first time, to better reflect the A-share market movement.

01:02

China uses 'predatory' tactics against US companies, says US Attorney General Bill Barr

The technology stock-laden market has triggered a buying craze over the past year, which has contributed to hugely inflated valuations. As of Monday, the 132 companies trading on the Star Market were valued at an average of 97.7 times their earnings, according to Shanghai Stock Exchange data.

And while the valuation has retreated from a record high of 110.7 times seen in February, it was still much more expensive than China’s biggest technology companies trading in Hong Kong. The multiples for Alibaba, Tencent Holdings, JD.com and NetEase have been capped at no more than 50 times.

The elevated stock prices have triggered concern about a boom-and-bust cycle, and analysts have questioned the fundamentals and growth prospects of the companies involved.

Star Market second only to Nasdaq, leads Hong Kong in terms of funds raised

“A hefty rise in prices upon listing is a special characteristic of China’s stock market and, normally, a reasonable valuation can be found one year after the trading debut, when locked-up shares [held by founding shareholders] become free floating,” said JP Gan, founding partner of venture capital group Ince Capital. “Prices, liquidity and market cap should be watched at this juncture.”

Normally, a massive equity influx dilutes existing holdings and leads to the exit of some funds. Starting on Wednesday, the Star Market faces the influx of as much as 3.1 billion additional shares, which were formerly non-tradeable but will now become free floating. This tranche of shares, held by founding shareholders, venture capital funds and institutional investors such as mutual funds, is estimated to be worth about 187.7 billion yuan, Shanghai-based data provider Wind Information said.

Chip maker Amec declined 0.7 per cent to 215.42 yuan in morning trade on Wednesday. A total of 194 million of the company’s formerly non-tradeable shares worth 42 billion yuan became free-floating on Wednesday. Electronics components maker Montage Technology Group fell 2.3 per cent to 95.58 yuan. It must deal with the unlocking of 341 million shares valued at 32.6 billion yuan.

China’s new Star Market turns dozens of founders into overnight billionaires

Chen Ping, a fund manager at HSBC Jintrust Fund Management, said it was important to gauge the overall market sentiment before forecasting the impact of these shares. “The average daily turnover on the market is valued at more than 1 trillion yuan, and there remains fresh demand from lots of exchange-traded funds for shares of Star Market firms,” he said. “Any negative impact on share prices will be limited.”