Hong Kong-listed old economy stocks are coronavirus roadkill. Will they come back to life?

- Airlines, retail, cinemas are among sectors beaten down by the virus

- Is there pent-up demand for the old world ready to explode? Or are virus-driven changes in consumer habits permanent?

As the coronavirus drags into its seventh month, old economy stocks face a high-stakes reckoning: do their battered share prices signal they are roadkill, unlikely to ever fully revive? Or, will these stocks rebound, becoming the miracle comeback stories of tomorrow?

The answer is hotly debated among professionals looking ahead to where they expect share prices of these Hong Kong-listed stocks to be a year from now.

“The virus is the great known ‘unknown’ for the markets,” said Bruce Pang, head of macro and strategy research at China Renaissance Securities Hong Kong. “The unknown features of Covid-19 – such as its incubation period and contagious channels – bring more uncertainty,” making it difficult to predict which beaten-down stock sectors can roar back, he added.

By some long-established yardsticks – such as share price to earnings – many virus roadkill stocks look cheap, at least theoretically making them good buys. Yet detractors urge investors to instead look at the sentiment that has already picked winners from the virus era. They argue that the sentiment strongly supports the notion that important changes in consumer habits will be quite long lasting, perhaps even permanent.

“Airlines are gone, and hotels are gone,” said Alex Wong, founder of Ample Capital, as he started to tick off stocks he now shuns in favour of tech stocks. “This pandemic not only hurts their business, it also hurts the perception of their business model that requires heavy-asset investment.”

His general advice about old economy stocks is simple: “Skip them.”

“At the current level, Sa Sa is still a ‘buy’ based on a 12-month horizon,” she now says. “The company has diligently worked on cost reductions, fine-tuning its product mix and managing inventories. Given a more nimble cost structure nowadays, the company should likely deliver a good comeback once the impact from the epidemic improves.”

Quite a few stocks crushed by the pandemic seem like promising choices for investors when their current target prices – 12-month forecasts made by professional analysts – are compared with those of new economy stocks that have been skyrocketing.

As investors piled into new economy stocks, share prices soared, often past their target prices. While some analysts have responded by upping their target prices, one question hovers: can these new economy companies keep expanding and innovating enough to enable their share prices to continue to defy gravity?

As of Friday, according to the consensus target price of analysts tracked by Bloomberg, Tencent is likely to grow just 5 per cent in the next 12 months.

Alibaba would rise 15 per cent and Ping An Good Doctor would gain a mere 6 per cent, as of Friday’s consensus target prices.

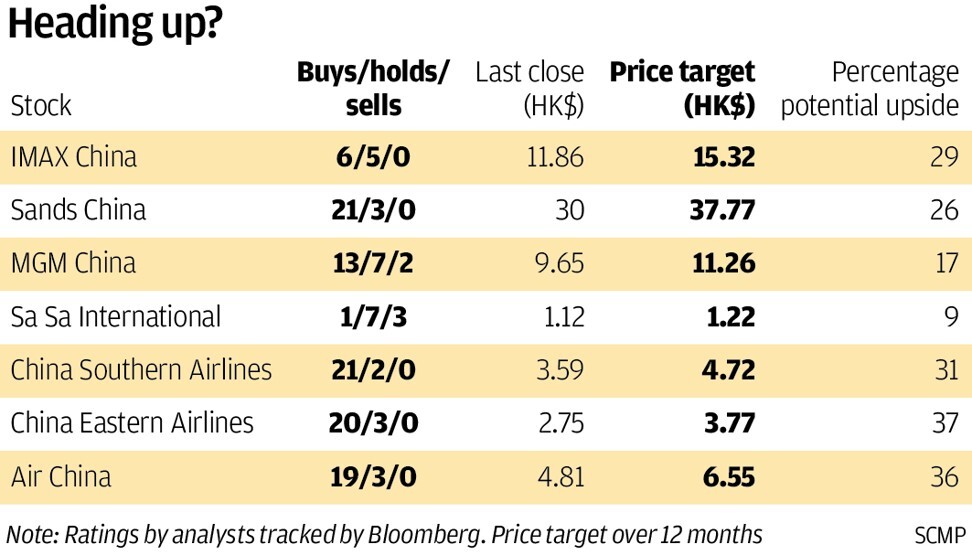

In comparison, Macau casino operator Sands China is expected to hit the jackpot, zooming up 26 per cent from Friday’s close. Likewise, China Southern Airlines is forecast to climb 31 per cent and cinema operator IMAX China to grow 29 per cent.

Yet how such battle-scarred stocks actually perform in the coming year may largely depend on virus-related catalysts, analysts say.

07:54

Six months after WHO declared Covid-19 a public health emergency, what more do we know now?

For example, Macau’s glittering – but currently nearly empty – Cotai strip is just waiting for the Chinese government to resume the Individual Visit Scheme that allows mainland tourists to travel to the only spot in China where casino gambling is legal. About 90 per cent of Macau’s gross gaming revenue comes from mainland visitors.

Over recent weeks, Chinese authorities have begun loosening restrictions on Macau’s business travellers, who tend to be high-rolling gamblers. These are “magic steps” toward IVS resumption, MGM China’s hospitality president and CFO Hubert Wang said in an optimistic earnings call last week. He predicted IVS could restart by mid-September “or even a bit earlier” for residents of neighbouring Guangdong province. Others predict a gradual resumption by the Golden Week holiday beginning October 1. That resumption is the rocket fuel casino stocks like Sands China and MGM China need, analysts say.

MGM China, which is losing about US$2 million a day due to the virus and as of Friday was down 24 per cent for 2020, is well liked by analysts. It has 13 buys, seven holds and two sells, and a target price nearly 17 per cent above Friday’s close.

Meanwhile, China’s airlines are slowly seeing a return of domestic flights, which account for more than half of each of the big three’s revenue. But they need the catalyst of international travel resuming, which remains about 95 per cent down.

Jefferies analyst Andrew Lee, who says Chinese airlines are in the “first stage of the domestic recovery”, has “buy” ratings on China Southern Airlines, Air China and China Eastern Airlines.

As of Friday, all three were still down more than 30 per cent for the year, but analysts expect their share prices to really take off once the virus stops thwarting them. China Southern is expected to rise by 31 per cent, Air China by 36 per cent and China Eastern by 35 per cent in the next 12 months, according to the average forecast of analysts tracked by Bloomberg.

Meanwhile, IMAX China, which has 700 IMAX theatres in the mainland, sees itself ready to star in a comeback story. The virus forced theatres to close, and IMAX China swung to a US$35.2 million loss in the first six months of the year, compared with a US$24 million profit for the first half of 2019, while its revenue plunged 89 per cent in the period.

But in an earnings call last week, IMAX China noted the gradual reopening in mainland China that started on July 20 puts the company on track to have 600 mainland theatres operating by mid-August, though with distancing measures that limit seating to one-third of capacity.

Board chairman Richard Gelfond said: “We believe the prolonged period of theatre closures and the global travel restrictions currently in place should lead to a release of pent-up demand for out-of-home domestic entertainment as theatres reopen in mainland China and when new content returns to the big screen, similar to what happened after the 2003 Sars epidemic in Hong Kong.”

Analysts are mixed on IMAX China, with six rating it a “buy”, five a “hold” but none a “sell.” Yet their average target price is a whopping 29 per cent above its Friday close.

To be sure, not all old world sectors are suffering, and some are big tech innovators themselves. Chinese electric vehicle maker BYD, for example, has seen its shares soar 90 per cent this year, compared with Tencent’s 42 per cent gain, as it dominates development of cheap, long-distance batteries in the world’s largest car market.

But run-ups in some battered stocks have petered out, as investors chose to take short-term profits rather that make a long-term bet. For example, Hong Kong real estate stocks, such as Sun Hung Kai Properties, New World Development and Kerry Properties, have seen several rallies since the March market bust, but they ended in sell-offs.

The uncertainties around the virus, coinciding with jaw-dropping gains in new economy stocks, make it difficult for investors to bet on comeback stories, said Alan Li, portfolio manager at Atta Capital.

“If you are a super long-term investor, like Warren Buffett, it’s a good time to start accumulating those sectors at their multi-year lows.” But following that roadkill strategy means passing up the quicker profits in favoured sectors, so “most investors can’t afford the opportunity cost,” Li said.