China’s second-half car sales defy global slump with 8 per cent gain, as buyers return to showrooms in world’s largest vehicle market

- Premium marques, or vehicles that sell for at least 400,000 yuan (US$61,700), were the biggest winners of 2020 in China

- Electric vehicles also made huge leaps in sales, increasing by 12 per cent in 2020 to 1.17 million units

China’s car sales increased during the six months ended in December, as customers returned to showrooms amid a tentative recovery in consumer sentiment in the first major economy to emerge from the coronavirus lockdown.

Sales of passenger vehicles – cars, sports-utility vehicles (SUVs) and minivans, excluding commercial trucks and buses – rose 8 per cent to 11.75 million units in the six-month period, compared with the interim a year earlier. Annual sales volume fell for the third straight year in 2020, shrinking by 6.8 per cent to 19.6 million units, according to data by the China Passenger Car Association (CPCA), as factories and businesses across the country were locked down during the first half to contain the Covid-19 disease.

“Given the huge impact from the coronavirus outbreak, the full-year sales result can be interpreted as a rare achievement, because a recovery has taken shape with customers’ confidence restored,” said Cui Dongshu, secretary general of the CPCA, the industry guild. “The strong growth momentum in [electric] vehicles during the second half proved to be a major growth driver.”

The slump-defying second half explains why global carmakers and start-ups are doubling down on their investments, sales and marketing in China, betting on the spending power in the world’s second-largest economy to make up for declines elsewhere.

Premium marques, or vehicles that sell for at least 400,000 yuan (US$61,700), were the biggest winners of 2020 in China. One in six new cars sold in China now belongs in the premium category, compared with the 2017 ratio of 10 per cent, according to IHS Markit.

Daimler said sales of its Mercedes-Benz marque rose 11.7 per cent in China. Audi, the premium brand in the Volkswagen portfolio and the standard issue for ministerial vehicles, reported a 4.4 per cent increase in sales in the first nine months, while BMW posted a 6.4 per cent gain in the same period.

China’s central government and local authorities handed out cash subsidies tax exemptions and distributed free number plates to encourage car owners to ditch their petroleum guzzlers for cars that ran on battery packs, hydrogen fuel cells or hybrid petrol-electric motors.

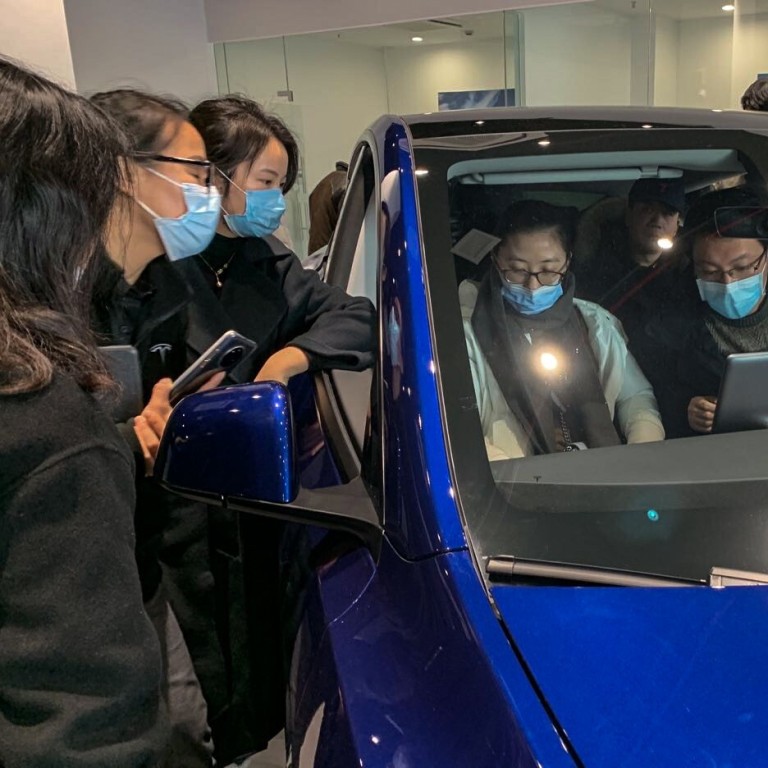

“Tesla’s locally built Model 3 inspired young customers to own electric vehicles,” said Tian Maowei, a sales manager at Yiyou Auto Service in Shanghai. “Fast growth in NEVs will certainly be achievable this year.”

What will it take for global battery makers to catch up with China’s lead?

Some new buyers said they had to wait until the second quarter for their Model Ys to be delivered.