Chow Tai Fook executive denies rumours of family rift after patriarch Henry Cheng’s ‘succession interview’

- Conroy Cheng, Chow Tai Fook’s vice-chairman and nephew of Henry Cheng, said there was no discord or disputes in the family over succession plans

- The jewellery retailer reported a 36.4 per cent year-on-year increase in profit to US$577 million for the six months ended September

A top executive of jewellery retailer Chow Tai Fook and a member of Hong Kong’s affluent Cheng clan that controls the property developer New World Development denied rumours of a family rift over succession plans.

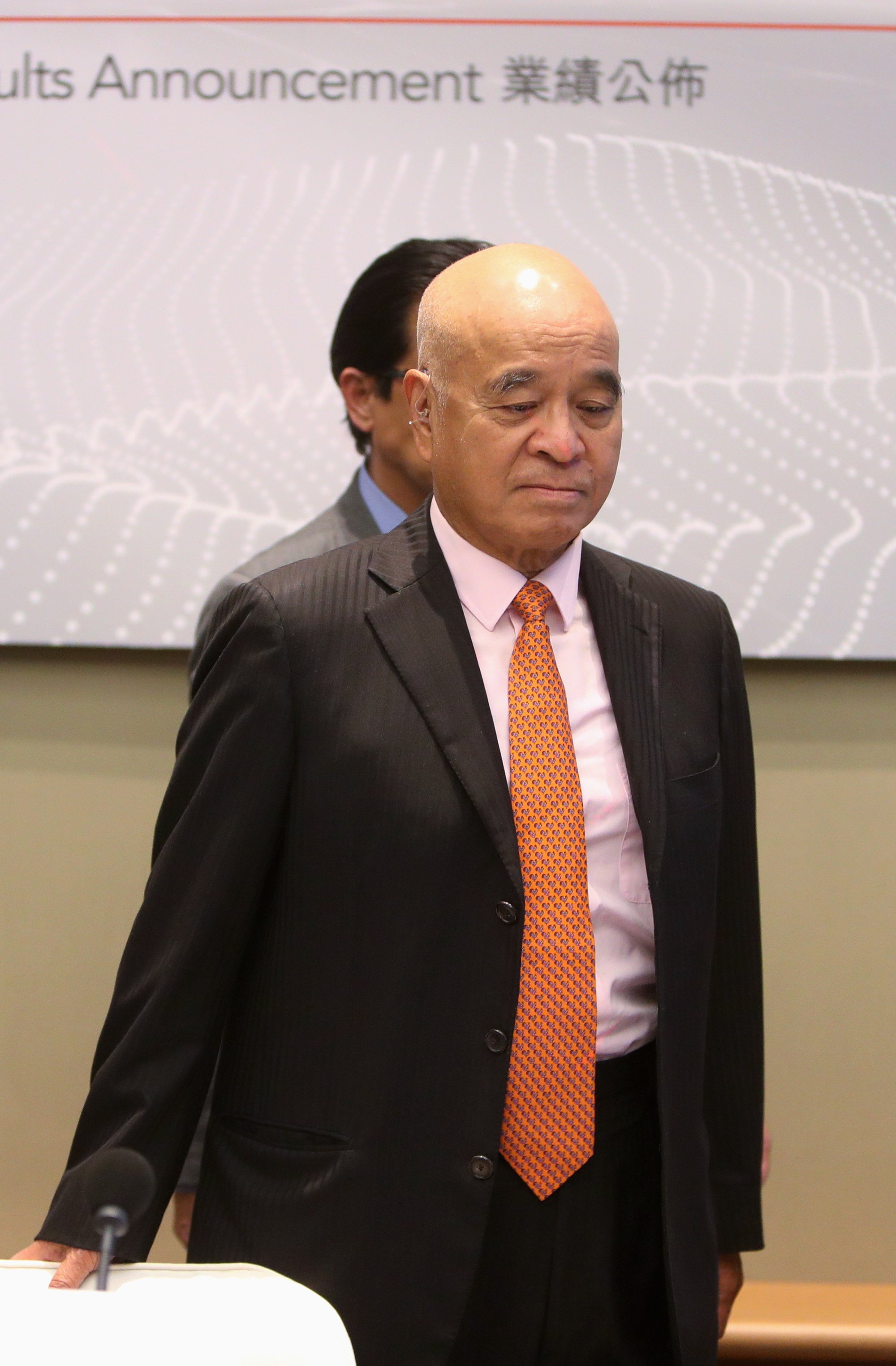

At a press conference on Thursday to announce Chow Tai Fook’s interim results, vice-chairman Conroy Cheng Chi-heng categorically denied rumours of family discord or property disputes. Conroy Cheng is also the nephew of Henry Cheng Kar-shun, the patriarch and chairman of Chow Tai Fook and New World Development.

Conroy Cheng also did not respond to questions regarding the group’s possible succession plans, after an unexpected interview with Henry Cheng ignited speculation and uncertainty over the future of the family’s extensive empire, estimated to be valued at around US$28.9 billion, according to Forbes.

During an interview with Hong Kong’s HOY TV on November 18, Henry Cheng, 76, said he may not be seeking a successor within the family. His children include Adrian Cheng Chi-kong, who is the CEO of New World Development, and Sonia Cheng Chi-man, vice-chairman of Chow Tai Fook.

The Cheng family’s empire spans numerous industries, including jewellery, property development, energy, transport and casinos, among others, and holds immense influence in Hong Kong’s business landscape.

Sonia Cheng, who attended the press conference, said her focus after taking on the role at Chow Tai Fook was to work closely with management to rebrand the business.

She too did not respond to questions related to the succession.

Earlier on Thursday, Chow Tai Fook reported a 36.4 per cent year-on-year increase in profit to HK$4.55 billion (US$577 million) for the six months ended September. Revenue rose 6.4 per cent to HK$49.5 billion from the same period last year. Adjusted gross profit increased by 12.9 per cent to HK$11.8 billion.

The company declared an interim dividend of HK$0.25 per share for the first half, representing a payout ratio of about 54.9 per cent.

The jewellery retailer had a network of 7,838 retail outlets as of September 30. A total of 189 stores were opened in mainland China during the period under review. In Hong Kong and Macau, the group added one new store, taking the total to 67 in these two cities.

The company said it expects to open between 300 and 400 new stores in the financial year ending March.

“We continue to expect the 2024 financial year to be a year of gradual recovery and normality driven by a steady improvement in retail sales value and overall profitability,” Conroy Cheng said.

During his interview with HOY TV, Henry Cheng said the most important question that he would ask a potential successor is whether the person was interested in business.

Dedication towards the family, leadership skills and moral righteousness are also important qualities that he was looking for in a candidate.

“It doesn’t matter how qualified he is [in other aspects], he will not excel in the world of business if he’s not passionate about it,” Henry Cheng said. “With all these prerequisites and limitations, it’s definitely not easy to find a successor.”

Henry Cheng also revealed that a family succession might not be his only plan, as New World Development’s business spans “a variety of fields” and requires “many talents to manage”.

Henry Cheng also said he could consider spin-offs and initial public offerings “under the right time and environment”.

The development comes as Henry Cheng and his family, on November 3, announced that they would take full control of NWS Holdings, an infrastructure unit under New World Development to help reduce the developer’s debt burden.

One of the most indebted developers in Hong Kong, New World Development said in a previous filing that it expected its net gearing ratio to fall from 47 per cent to around 42 per cent following the sale. Its peers average about 20 per cent.

Gearing refers to the ratio of a company’s debt to equity and shows the extent to which its operations are funded by lenders as opposed to shareholders.

New World Development’s net profit slumped 28 per cent to HK$900.9 million in the last financial year, according to the company’s annual report filed in September.