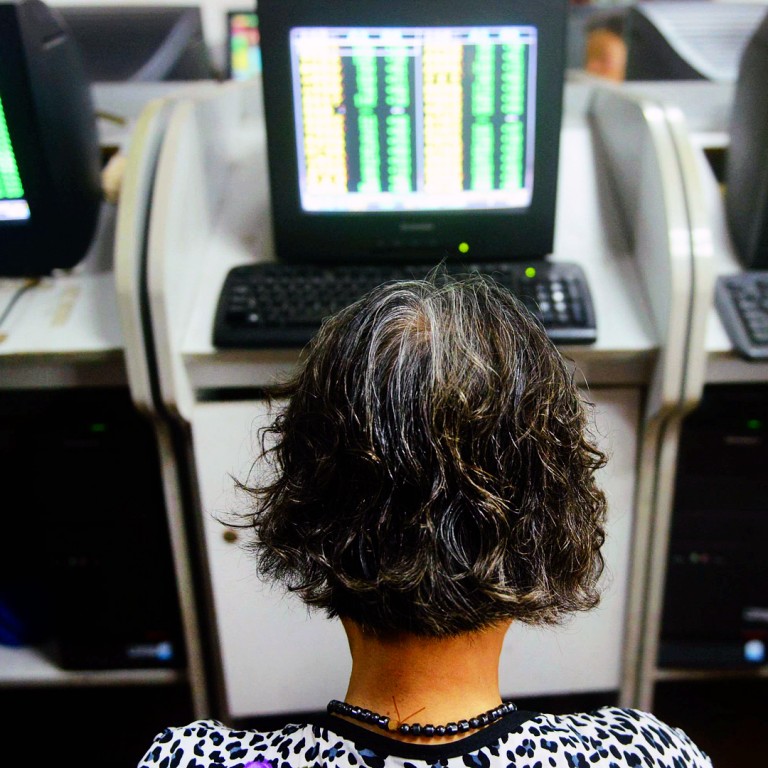

Update | Chinese stocks settle lower but recover from worst of beating; Hong Kong ekes out gain

Shanghai and Shenzhen close down but uncertain mood persists in markets despite modest recovery. Hong Kong up at close but tone quiet and steady for most of session

Mainland Chinese stocks settled lower on Tuesday but the markets had sharply pruned its losses as bargain-hunting and buying of large-cap financial companies offset pressure in small-cap names, with Hong Kong defying the weak tone to end the day fractionally higher.

The Shanghai Composite Index closed 1.68 per cent lower at 3,663 after recovering from a 5 per cent slump in morning trade. The CSI 300 Index of large-cap stocks finished 0.2 per cent down at 3,811.09.

Shenzhen's Composite Index fell 2.24 per cent to finish at 2,111.70, while the ChiNext Board was 3.78 per cent lower at 2,581.96.

The Hang Seng index closed up 0.62 per cent at 24,503.94. The H share index dropped 0.51 per cent to 11,173.04.

Chinese equity markets had been battered on Monday by the worst single-day decline since 2007 and follow-through pressure dragged shares down at the start.

Han Fei, an analyst at Guotai Junan Securities, said Monday’s market rout was due to talk about the state-owned provider of margin financing reportedly backing off from stabilising China’s stock markets, triggering a drastic sell-off.

“The confidence among stock investors remains fragile, reflecting a growing risk-averse appetite and a slowing return from equity investing,” Han said.

Almost all 31 shares in banks, insurance companies, and brokerages finished higher in morning dealings, with DongWu Securities, Minsheng Bank, and China Life leading the gainers.

Despite solid gains in the financial sector, about 900 companies in Shanghai and Shenzhen suspended trading on Tuesday after reaching the daily downside limit of 10 per cent, highlighting the market-wide weakness as punters shifted their focus towards save-haven companies.

“Banks had a solid performance in the morning session as it is expected that they will be among the first stock to receive some additional support by the authorities,” said Gerry Alfonso, a director of Shenwan Hongyuan Securities in Shanghai.

He added: “Brokerage houses are also performing relatively well as the sudden increase in volatility could help pushing up trading volumes in the short term.”

China’s two oil majors – PetroChina and Sinopec – gave up 1.62 and 1.43 per cent, respectively, by midsession in contrast to their Hong Kong-traded counterparts, which rose by 3 and 1.7 per cent.

Watch: China markets can't shake volatility