A collective approach to dealing with complexity

Andrew Sheng advocates an approach of trial and error to deal with the 'unknown unknowns'

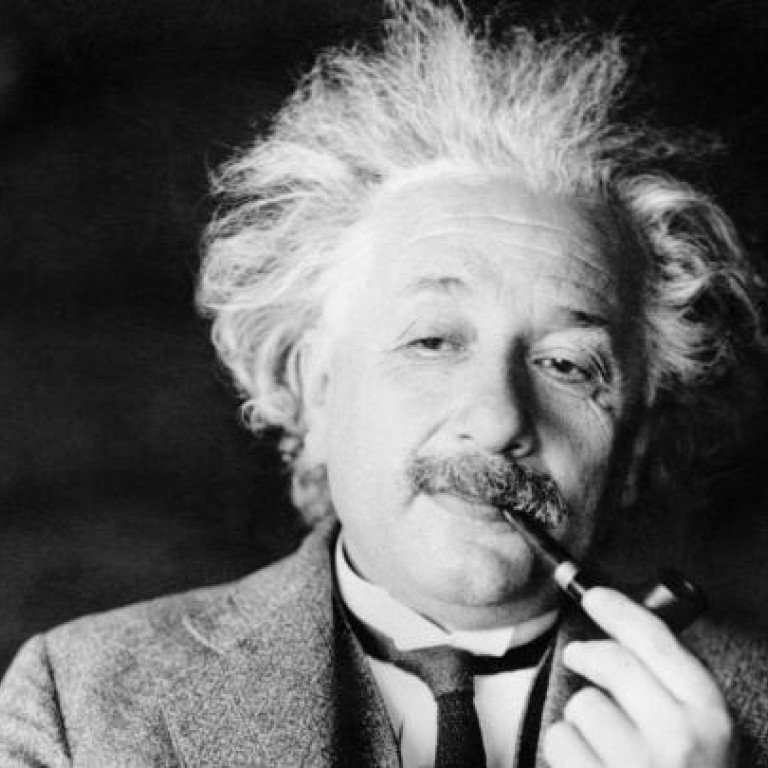

A big puzzle that has remained with the current unfolding crisis is why didn't the brightest minds see it coming? As Albert Einstein famously said: "The problems that exist in the world today cannot be solved by the level of thinking that created them."

After agonising over this problem myself, I concluded that the key lay in the way we thought about global issues. Most economists, including myself, were taught the neoclassical general equilibrium model. This assumed perfect information, a frictionless world and an ideal model (like Humpty Dumpty) that would revert back to stable equilibrium when it is slightly out of kilter.

We now know that this simple model was the foundation of most of the current econometric and asset valuation models in use today for policy formulation, risk management and asset pricing. It also blunted innovative thinking about a world full of unknown unknowns. The result was disaster myopia.

Indeed, mainstream economics training led us to go always for "first best" and therefore most economic advice sought ideal policies that were impractical to implement or nigh impossible in political terms. In this world of specialist knowledge, common sense is not very common.

What we lack are moral and intellectual compasses in dealing with multi-dimensional, complex, simultaneous transformations, such as rising population, disruptive technology, industrial transformation, climate change, terrorism and human conflict, and natural disasters.

How do we deal with unknown unknowns?

The older economists like John Maynard Keynes, Friedrich Hayek, Herbert Simon and Milton Friedman all understood that we must work with imperfections in information and knowledge.

Hayek's 1974 Nobel address, "The Pretence of Knowledge", laid bare perils of overactive policies assuming omniscience, when we don't know enough. He was against big government because, by his definition, no bureaucracy knew better than the self-order of markets. The physicist Richard Feynman argued that "it is not what we know, but what we do not know that we must always address to avoid major failures, catastrophes and panics".

Sociologists, anthropologists and political scientists have always known that people deal with uncertainty in groups. The limited liability company was invented in Holland and Britain to reduce uncertainty for investors. Survival under complex, non-linear conditions requires social organisation, leadership and adaptation.

The massive confusion we are witnessing is the result of megatrends - the increase in population with more than half now living in cities, profound technological and industrial change, and rising natural disasters, social conflict and climate warming.

Our minds and training cannot cope with simultaneous changes that are really systems interacting within systems in an ever-changing, multipolar, multi-dimensional global system. We have to rethink economic and political theory to address growing inequality, rising unemployment, financial disarray and climate change. But we tend to examine our markets in isolation.

The American systems thinker Fritjof Capra suggests that the "development process is not purely an economic process. It is also a social, ecological, and ethical process, a multidimensional and systemic process".

The trouble is that bureaucracies tend to fight complexity with more complexity. The US Glass-Steagall Act that separated banks from capital markets worked for more than 60 years and was only 37 pages long. Proposals for the Volcker Rule under the Dodd-Frank Wall Street Reform and Consumer Protection Act already run to some 300 pages, while Dodd-Frank is 848 pages, with possibly thousands more after all the subsidiary rules are put in place.

In the area of bank regulation, the first set of Basel I rules in 1988 was 30 pages, with Basel II in 2004 rising to 347 pages, and the latest draft of Basel III being 616 pages. Much of the latest proposals are based on complex models to estimate risks. If these rules are so complex that only specialist risk managers and lawyers understand their meaning, how would boards of directors, many of whom are independent and part-time, fully grasp their significance?

In simple terms, when we are dealing with unknown unknowns, is it better to have very complicated systems with complicated rules, or relatively simple systems that are easy to understand and use?

It's apparent that we simply do not have good enough theories to guide us in such complex times. But crossing the river by feeling the stones is not a random process. It is a practical skill that can be learned, by companies, institutions and even countries. One begins by strategising within uncertainty, then prioritising within limited resources and identified risks.

In the face of uncertainty, you experiment by searching for new options and alternatives. Your team must share the experience of discovery, for they will "seed" the new teams that are able to adapt and innovate through co-creation with other teams. If you succeed, you exploit and expand the model. If you fail, you review, regroup and try again .

With systems thinking and action, we learn collectively to deal with the complexity and unpredictability of the world.