Stock markets, in the United States especially, have become

bubbles that refuse to burst or liquidity lakes that refuse to drain even as vitality leaks from the global economy. What is with this death-defying quality that many equity (and bond) markets appear to have taken on?

Analysts are generally agreed that equity valuations are “stretched”. Some stocks in the S&P 500 index are trading at near double their historic price-to-earnings multiple while

corporate earnings in the US and elsewhere are declining at an accelerating pace.

“Equity markets appear to be overvalued in Japan and the United States,” the International Monetary Fund (IMF) noted last week in its latest Global Financial Stability Report. This is based on fair value, which represents the estimated worth of assets and liabilities on a company’s books rather than on market value.

The IMF also noted that while US equity prices have increased, “fundamentals-based valuations have declined”. Germany is also among the “overvalued” equity markets while emerging markets are generally closer to fair value. The most inflated stock indices continue to cling to near-historic highs.

Can it be that they perceive something on the horizon that most of us are unable to see – an early end to the US-China

trade war perhaps, or a smooth and relatively painless

Brexit?

Neither of these felicitous outcomes is possible. Even if trade wars end tomorrow, the hit to business confidence and investment will be slow to heal. And even if Brexit requires no more than a polite handshake to accomplish, the parting will do lasting damage to the United Kingdom and European Union economies.

Stock prices remain high despite glaring evidence too, that crisis is brewing in areas of the global financial system.

Corporate debt has reached alarming levels around the world (not least in

China) while many nonbank lending institutions could be on the verge of collapse, as the IMF noted.

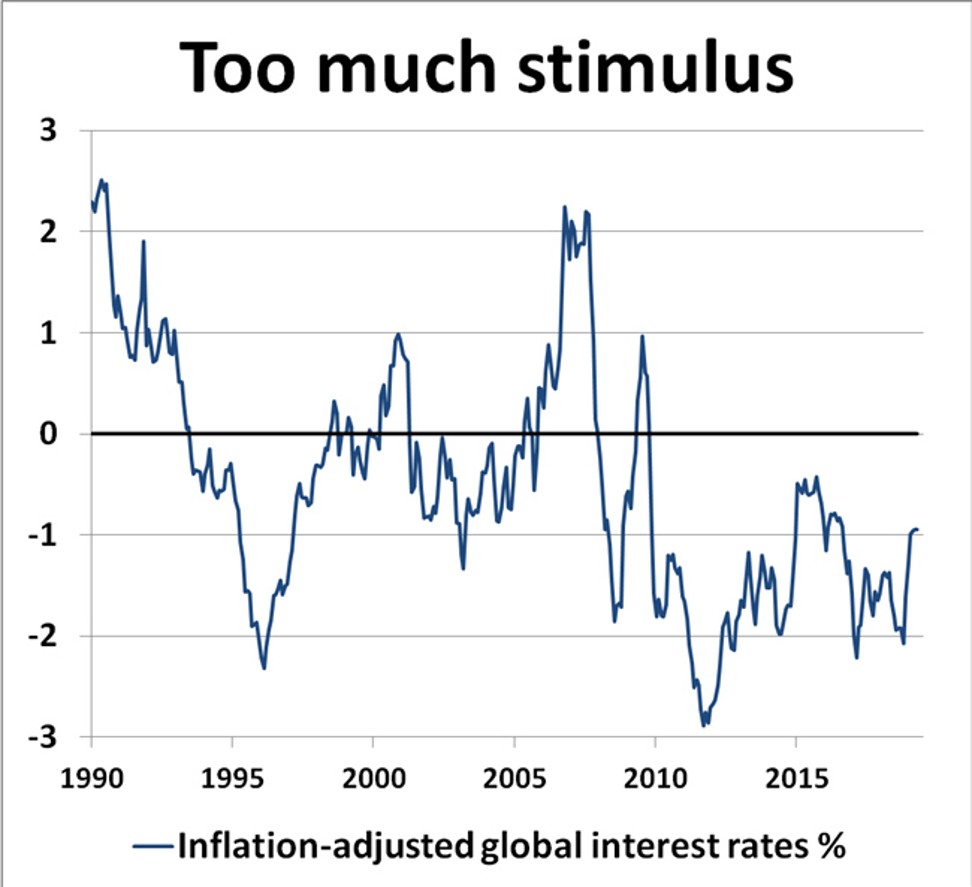

There is an obvious explanation for why markets continue to soar like balloons above the troubled economic landscape. Most of the central bank liquidity that was supposed to be pumped into the economy in recent times has been diverted from real economic activity into fuelling

asset bubbles.

Central banks are caught in a dilemma. They

eased monetary policy to support economic expansion but in the process created an environment of increased downside risk by making borrowing cheap and encouraging an orgy of lending among lightly-regulated nonbank lending institutions.

What makes this even scarier is that, as the IMF observed, markets are assuming “an additional 45 basis points of policy easing in the US by the end of 2020 and that policy rates could remain negative in the euro area, Japan, and Switzerland for many years”. Interest rates will stay “lower for longer”.

Money cannot drain from stocks into bonds because that vessel is already full with average yields falling to

near 1 per cent as bond prices rise in line with demand for “safe” assets. Property or real estate prices also remain generally high on the back of liquidity-driven demand.

We are in a situation now where no one (least of all populist politicians like

Donald Trump) dares to let markets sag for more than a day or two at a time, for fear that the financial bubble or facade of economic prosperity will be exposed for the fantasy that it is.

Bloomberg reported recently that “new academic research finds that the [stock] market has a measurable influence on how people who own shares vote – potentially a big one”. In theory then, we can expect Wall Street to be supported

at least until the next US presidential election in 2020.

If such ambitions were being promoted only by a US president who is anxious to retain his hold on power through the Roman imperial device of “bread and circuses”, the bull market’s days would have been numbered from a while back. But central banks have been complicit in maintaining the bubble.

This dangerous state of affairs whereby the stock market becomes the only sun at the centre of the economic universe surely cannot continue, or as the IMF

said in its latest World Economic Outlook report, also published last week, “monetary policy cannot be the only game in town”.

Fiscal stimulus (especially infrastructure building) will need to take over from monetary easing, and that will further boost the price of bonds rather than stocks. Those stocks linked to fiscally-stimulated “real” economic activity are likely to be the only survivors of an equity market downturn.

If market liquidity switches smoothly from the inflated tech and consumer sectors to seemingly less glamorous construction, industrial and logistics sectors, the price bubble may not burst – or at least, may implode less violently. But equally, the transition could be very painful for bloated stock prices.

Anthony Rowley is a veteran journalist specialising in Asian economic and financial affairs