Advertisement

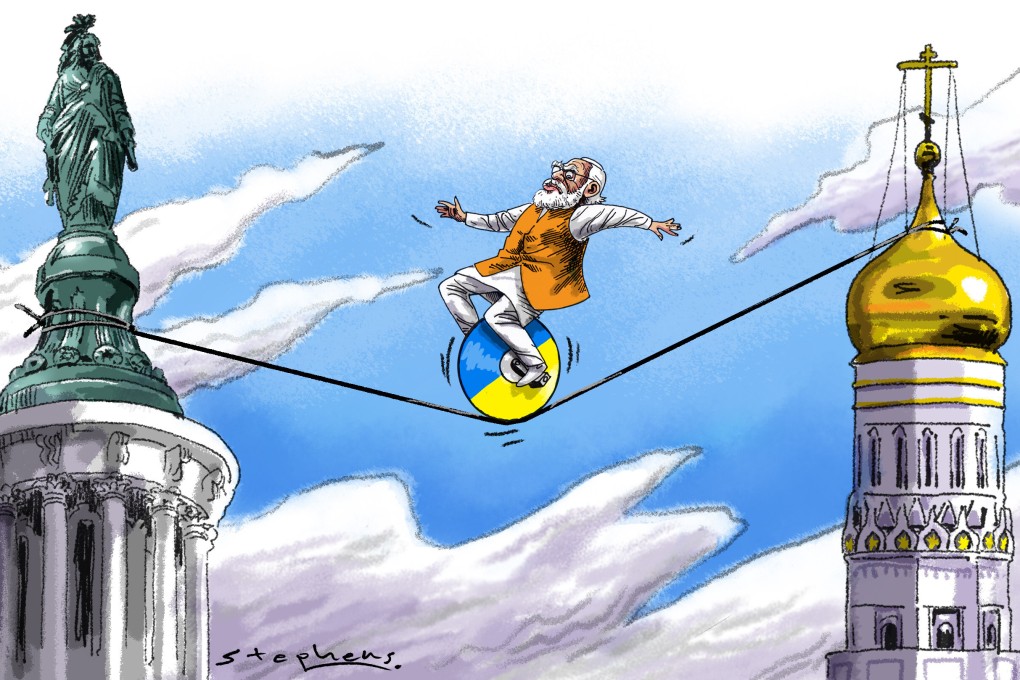

Opinion | Ukraine crisis leaves India’s Modi walking a fine line between the US and Russia

- India has been slow to join the US and other democracies in denouncing and sanctioning Russia over its actions against Ukraine

- Delhi must act wisely as it relies heavily on Moscow not only for its arms purchases but also for fertilisers that keep its agriculture sector growing

Reading Time:4 minutes

Why you can trust SCMP

8

Since the onset of its military action against Ukraine, Russia has found itself in an awkward diplomatic position in which it has been almost completely alienated internationally, with just a handful of states expressing support or, at best, neutrality. India’s neutrality might have come as a surprise to the United States and Europe, which have tried to push New Delhi to take a harder line against Russia.

India’s stance can be attributed to its heavy reliance on importing Russian arms, which constituted almost half of its weapons imports from 2016 to 2022, with about 85 per cent of all Indian military equipment originating in Russia or the Soviet Union.

However, other reasons are also at play: India has long been noted for its independent foreign policy and non-aligned status, which arose in the 1960s in opposition to Cold War bipolarity.

New Delhi has adeptly navigated the roiling waters of regional and global politics in recent years. While participating in the US-led Quadrilateral security grouping and forging closer ties with Washington to balance against China, it has also improved relations other major nations by embracing the Russia-India-China grouping, the BRICS bloc and the Shanghai Cooperation Organisation.

This diversified cooperation was highlighted by Indian Prime Minister Narendra Modi, who said “India has a connection with countries involved in the war … India’s needs are connected to these countries”. Unlike its American and European partners, India is not willing to risk its economic ties with Russia by siding with sanctions aimed at the Russian economy.

India has deepened cooperation with Russia in the energy and banking sectors, with sanctioned Russian banks VTB, Sberbank, Promsvazbank and Gazprombank operating offices there. Russian state-owned energy giant Rosneft has pledged to supply India Oil with up to 2 million tonnes of crude by the end of this year.

Advertisement