Dollar weaponisation is creating a more fractured world

- Using the dollar to punish countries or keep them in line is causing geopolitical rifts and fears, as seen in the spawning of payment and settlement alternatives

- Yet what the world needs to rise to its many challenges is more engagement, dialogue and collaboration

Throughout history, currency standards have changed alongside the geopolitical order. Past international currencies have included the Chinese liang, Greek drachma, Roman denarii and Dutch guilder.

For much of the 19th century and the first half of the 20th, the British pound performed the role, and it was after the second world war that the historic Bretton Woods agreement established the US dollar as the global reserve currency through a system that, ironically, was developed so as not to disadvantage any country.

Today, an upswing in media coverage is evident in relation to the use of the dollar as a strategic tool to restrict or isolate the economies of nations that do not adhere to international law or US foreign policy.

While a majority of the world’s strongest economies have fallen in line with the policy in relation to Russia, not everyone shares the same opinion. Such geopolitical acts further deepen divides and make it even harder to engage in meaningful dialogue and overcome complex challenges.

World Bank chief economist Indermit Gill is of the view that “a lost decade could be in the making for the global economy” as a result of the economic turmoil.

According to the International Monetary Fund, dollar reserves held by central banks have fallen to 58 per cent, its lowest level in at least 25 years, raising questions about its long-term position. This is seen by some analysts as a reflection of the increasing role played by alternative currencies in international transactions.

After decades of US hegemony, shift away from dollar is now picking up speed

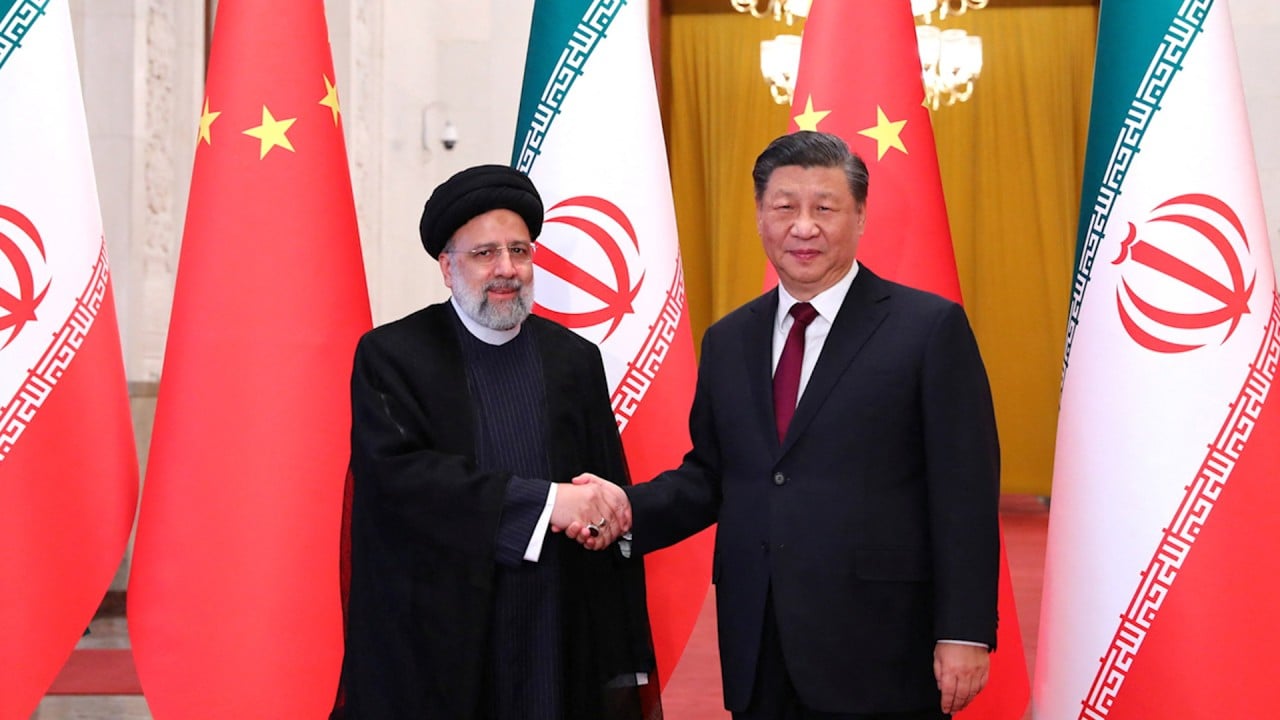

Meanwhile, the internationalisation of the yuan continues, supported by China’s growing imports and exports, investments in Belt and Road initiatives, expansion of yuan-clearing banks, improved trading and settlement systems for cross-border investment and financing, among other measures.

This is a commodity that seems to be in increasingly short supply in international relations. These negotiations also reflect China’s recent willingness to play a greater role and leverage its economic power in such situations.

It is becoming increasingly evident that the international community would benefit greatly by increasing engagement, dialogue and collaboration, so that we can work together to resolve the multitude of complex challenges that we face together and which affect us all, be it conflict or climate change.

Bernard Chan is a Hong Kong businessman and a former Executive Council convenor