Explainer | China’s yuan vs renminbi: what’s the difference?

- China’s currency is officially the renminbi, which literally means ‘the people’s currency’, while the yuan is technically the unit of measurment of the renminbi

- Despite Beijing’s best efforts, the currency still has a long way to go before it can challenge the US dollar because of rigid capital controls

When did China first start using the renminbi?

The history of Chinese money spans more than 3,000 years, but the official renminbi was first issued during the Chinese civil war in December 1948, after the establishment of the People’s Bank of China (PBOC) in Shijiazhuang city, Hebei province.

In 1949, the Communist Party defeated the Kuomintang and Mao Zedong proclaimed the People’s Republic of China, making the renminbi the sole legal currency across the country.

What’s the difference between the renminbi and the yuan?

Chinese money has two names that are often used interchangeably: the renminbi and the yuan.

Officially, China’s currency is the renminbi, which literally means “the people’s currency” in Mandarin.

The renminbi is sometimes called the “redback” by Western media, a play on “greenback”, which is used informally to describe the US dollar.

Why are there different yuan exchange rates?

China’s currency system is complicated because the PBOC imposes strict capital controls to limit the flow of foreign capital in and out of the country, fearing an exodus of outflows in a crisis could spark a stampede out of the yuan.

03:05

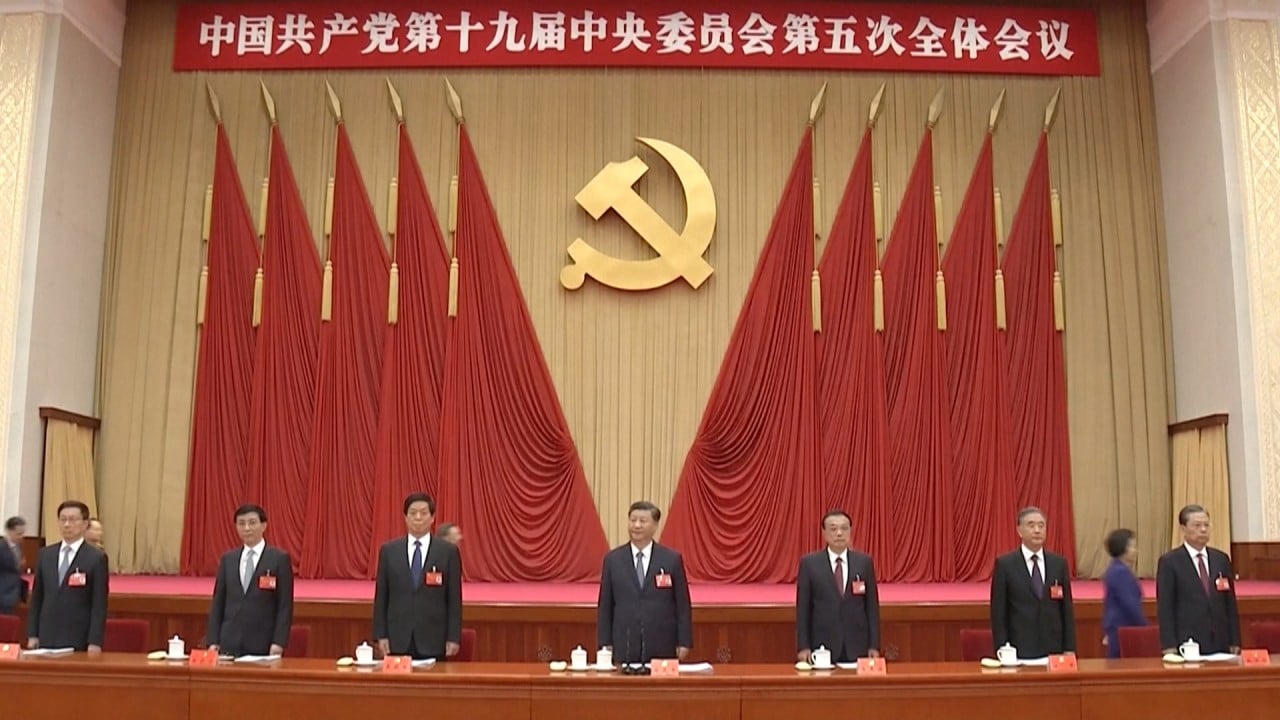

What happened at the Chinese Communist Party’s major policy meeting, the fifth plenum?

However, the yuan is not fully convertible in the capital account – which records the net flows of transactions between China and the rest of the world – as Beijing continues to maintain strict currency controls on portfolios, as well as plant and equipment investments.

This arrangement has resulted in two market prices for the yuan’s value against foreign currencies, albeit with only a slight difference. The onshore yuan, with its abbreviation CNY, is used within China and its value is “managed” by the PBOC; while the offshore yuan CNH rate is traded more freely outside mainland China.

How the US uses the dollar payments system to impose sanctions on a global scale

Can the yuan replace the US dollar?

As a result, China is urgently trying to crack the hegemony of the US dollar and promote use of the yuan beyond its borders to minimise disruptions to its trade and investment activities.

After plunging abruptly in 2015, international use of the yuan started to recover last year as major steps were taken to open up China’s financial markets to foreign investors and entities.

Far more must be done for the yuan to really displace the dollar. A fully open capital account remains a key prerequisite

The latest data from the International Monetary Fund showed the yuan’s share of global currency reserves was 2 per cent in the second quarter of 2020, well below the US dollar’s 61.3 per cent.

Similarly the yuan’s share of global payments was 1.97 per cent in September, the fifth most active currency, while the US dollar was in first position, commanding 38.45 per cent of payments.

“Far more must be done for the yuan to really displace the dollar. A fully open capital account remains a key prerequisite,” said Alicia Garcia-Herrero, chief economist for Asia-Pacific at Natixis.

“These days, 2030 seems to be China’s new target for achieving that, with the previous goal of 2020 fading from memory.”

Want to know more?