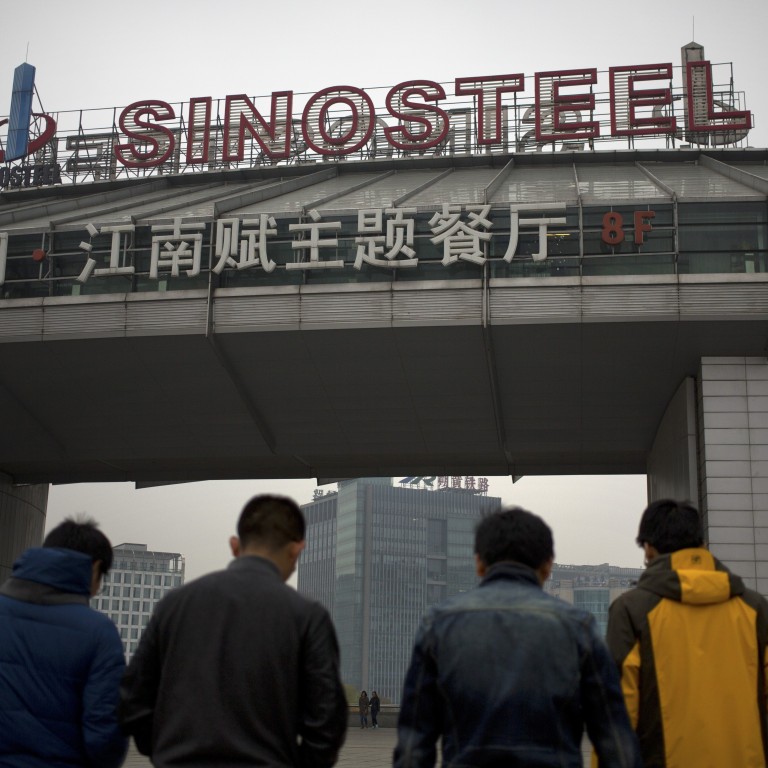

China steelmaker Sinosteel increases Australian iron ore stake after merging with Baowu Steel

- Sinosteel’s purchase of half the future output of new Fenix Resources mine comes amid controversy over China halting imports of Australian coal

- New commitment to Fenix mine follows troubles at Sinosteel’s other Australian iron ore mines that sapped its financial resources in recent years

Chinese steel producer Sinosteel is doubling down on the Australian iron ore market with a deal to buy half of Australian-listed explorer Fenix Resources’ production just days after being taken under the wing of mega Chinese steelmaker China Baowu Steel Group.

Fenix agreed on Wednesday to sell 50 per cent of the production at its new Iron Ridge mine in Western Australia to the Chinese group. The other half will go to Hancock Prospecting’s Atlas Iron, which is owned by Australia’s richest woman, Gina Rinehart.

Fenix’s Iron Ridge, which was approved for development in September, is expected to produce about 1.25 million tonnes of iron ore a year. Production at the mine is scheduled to start later this year, with the first shipment scheduled for early 2021.

While there was speculation that the suspension was the latest retaliation in a series of trade moves against Canberra for its support of an international investigation into the origins of the coronavirus, Australian officials have so far played down the issue and sought clarification from Beijing.

Sinosteel’s move to boost its access to iron ore comes as Australian iron ore exports to China have soared this year amid an infrastructure and property boom following the end of Covid-19 lockdowns, and as Sinosteel comes under the control of one of the biggest steel producers in the world, another state-owned company, China Baowu Steel.

The decision to merge Sinosteel – which has struggled with financial difficulties over the past decade – into Baowu was made at the weekend by China’s State-owned Assets Supervision and Administration Commission (SASAC), which manages the companies owned by Beijing.

China steel mills begin ‘diverting’ Australian coking coal after import ban

There will be no changes to operations at Sinosteel, nor to its asset structure. Details of the arrangement were still being discussed.

Sinosteel and Baowu did not offer reasons for the new tie-up, but the move is in line with China’s plans to speed up the consolidation of its large and fragmented industries such as steel and coal to increase production efficiencies and reduce oversupply by smaller producers, according to analysts.

S&P Global Platts said in an outlook report that most of the steel production industry was anticipating further consolidations to better realise China’s ambitions for more urbanisation and increased infrastructure development.

03:24

Are Australians really unsafe in Hong Kong?

“More mid-sized enterprises are likely to close after merging with larger mills. This will be another form of reducing capacity, and it means the ‘giants’ will have more pricing power and a larger voice in the industry,” S&P Global Platts said, citing a Chinese steel mill source.

Pang Ming, chief economist at Huaxing Securities, also said the State Council’s commitment to improving the quality of listed state-owned companies will result in more mergers and consolidations.

Pang said such consolidations will help to better “preserve” the quality of state-owned companies, which Beijing considers to be the backbone of China’s economy.

China ban on Australian coal stirs suspicion of fresh political retaliation

Meanwhile, the SASAC also held a policy briefing at the weekend to introduce a three-year plan to promote the reform and development of state-owned enterprises.

The plan aligns with the central government’s consolidation strategy to combine small and large companies – a move that will stabilise supply chains and shore up China’s domestic economy, according to Weng Jieming, deputy director of the SASAC.

Last year, Beijing said it wanted China’s top 10 steel producers to control 60 per cent of the nation’s overall steel production capacity by the end of this year.

And the steel industry is not the only sector that is consolidating.

The new holding company will absorb assets from the Datong Coal Mine Group, the Shanxi Jincheng Anthracite Mining Group, a new company founded by the Yangquan Coal Industry Group and the Shanxi Lu’an Mining Industry Group. Three firms – Datong, Yangquan and Lu’an – are on this year’s Fortune 500 list of the world’s largest enterprises, in terms of sales revenue.

Like with steel, the move was aimed at increasing efficiency in China’s fragmented coal industry.

Sinosteel was part of China’s first major overseas investment in 1987, when it signed a joint venture agreement with Rio Tinto to develop the Channar iron ore mine in Western Australia.

But Sinosteel ran into trouble with its own A$2 billion (US$1.4 billion) Weld Range iron ore mining project in Australia in 2011 due to setbacks in the development of a key rail line to bring the ore to the nearest port. The delays of the line in Oakajee drained Sinosteel’s resources over the next few years.

And in 2014, the miner ran into financial difficulties in the face of mounting debt during a steel industry downturn.

Last year, however, the company sought to jump-start the Oakajee port and rail line after buying the interests of Japan’s Mitsubishi in the project.