Did you know investing in a Rolex could make you US$700,000 richer? Watches could give the stock market a run for its money – but only if you don’t treat it like a hobby, say experts

The Patek Philippe Grandmaster Chime – the world’s most expensive watch – sold via Christie’s for US$31 million while a US Air Force vet sold a Rolex Daytona for 2,000 times its original price this year

A United States Air Force veteran made international headlines earlier this year after learning that the watch he originally bought for scuba diving nearly 50 years ago for less than a month’s wages (around US$350) is now worth over US$700,000 in today’s market.

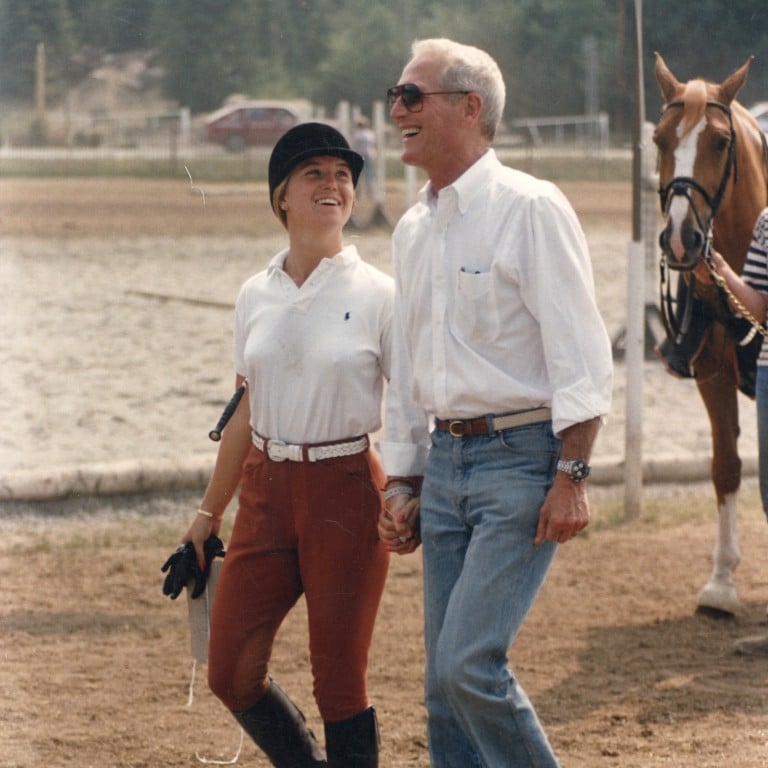

Half a century later, that 1971 Rolex Cosmograph Daytona Oyster – along with its original case, packaging, warranty papers and receipts – has been appraised at 2,000 times its original sticker price, easily beating any equivalent stock market investment, thanks in part to its pristine condition and to the Daytona’s notorious association with the late actor Paul Newman.

While replicating such results today is not nearly as widely accessible as it was 50 years ago – a new Rolex Daytona runs to around US$17,000 – luxury watch investments have seen an undeniable peak in popularity, something that is both intriguing for timepiece hobbyists and profitable for the right investors … but only if you’re willing to accept that your base-level knowledge will need to be built upon and finessed before making that first investment.

“Based on what I have observed with some of the top collectors/scholars, the pursuit of knowledge and the desire to know more helped them to build their dream collection,” explains Ho Zi-yong, head of sales, watches, at Phillips Asia. “They learn and refine their knowledge as they progress, allowing them to articulate [build foresight] and hopefully accurately acquire important timepieces.”

“We make a big distinction between investors and collectors,” explains professional watch expert and founder of The Watch Fund, Dominic Khoo. “Investors in a commodities fund don’t really care for barrels of oil or coffee beans – and hardcore watch lovers don’t really care for 20 per cent returns.”

According to Khoo, the most important thing to take into account when dipping your toes into investing in the high-end watch market is to know who you are and be truthful with your intentions. The key is having an honest conversation with yourself: do you really want to build your timepiece portfolio, or do you just want to invest in a personal accessory that you might consider selling down the road?