China tax cut finalised but leaves many unimpressed

Modest changes allow for some growth in incomes and help with cost of living, but wage earners wanted more

China’s legislature approved on Friday a modest cut in individual taxes which has left many wage earners unimpressed.

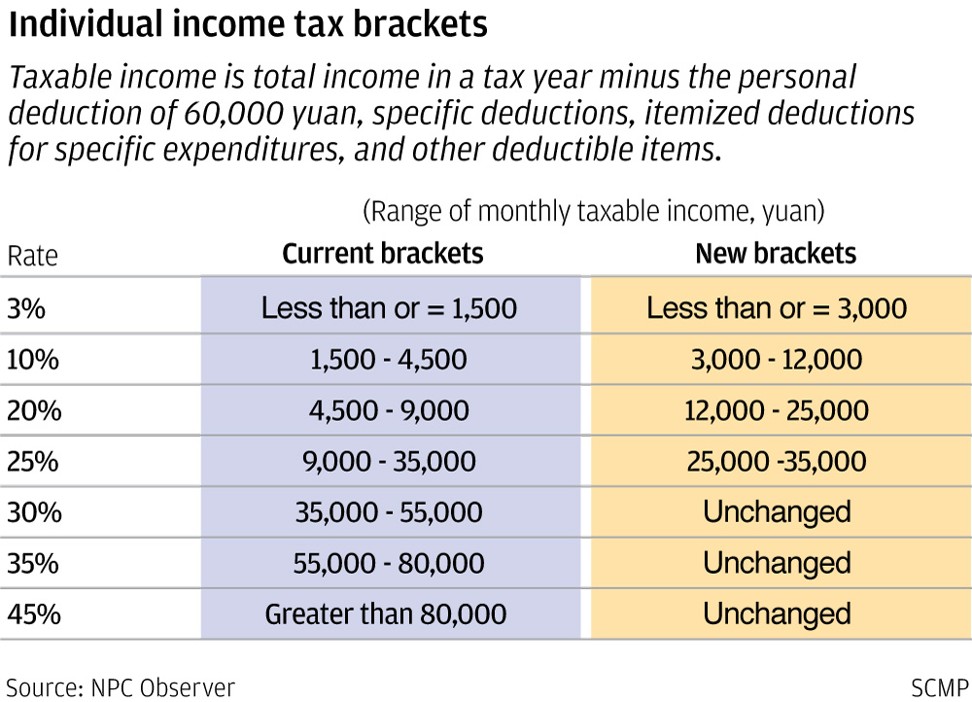

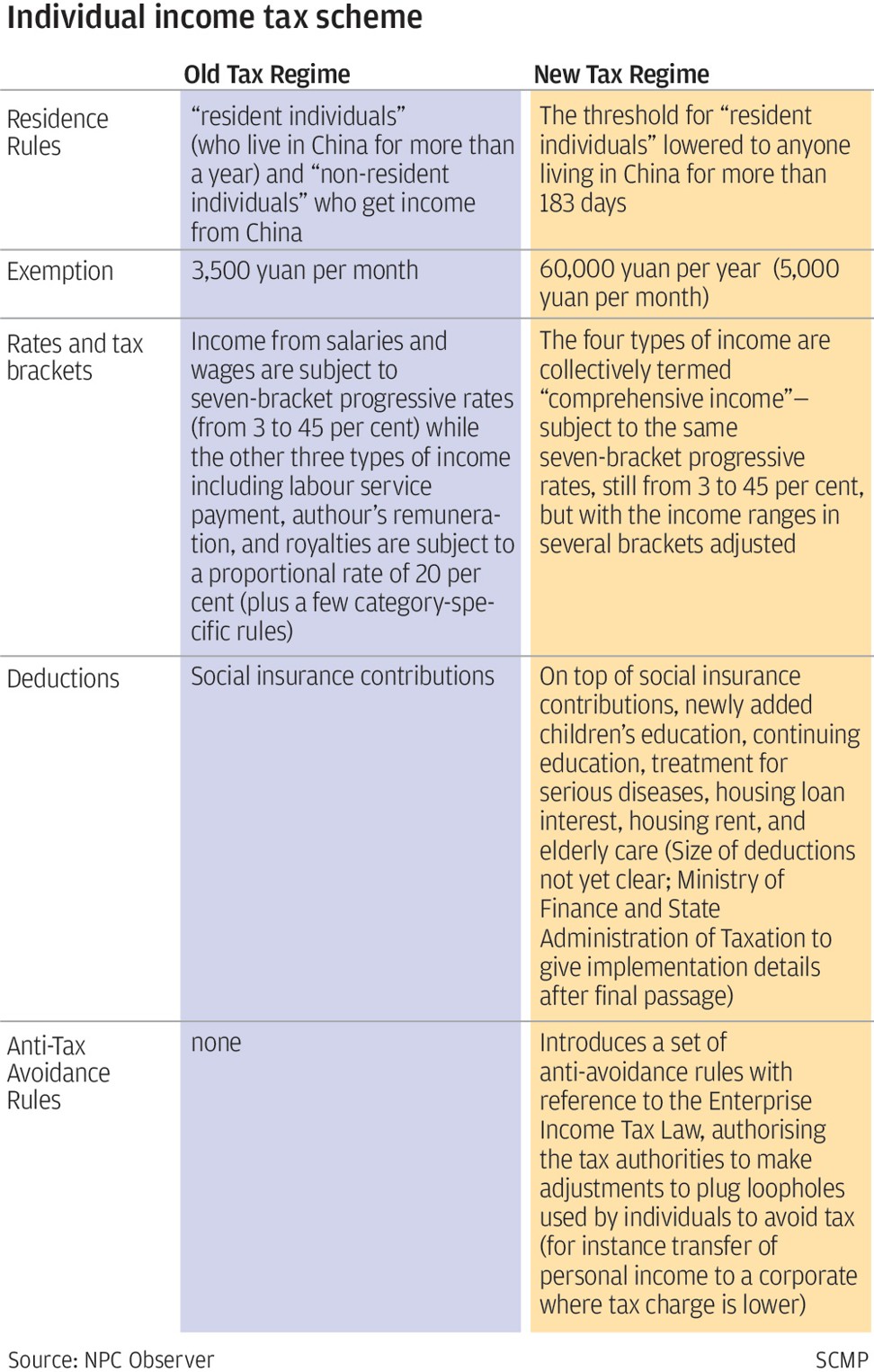

The final bill approved by the Standing Committee of the National People’s Congress increases individual taxpayers’ annual tax-free threshold to 60,000 yuan (5,000 yuan per month) from the previous 3,500 yuan per month, expands the income range for the lower tax brackets, and adds new tax deductions, including one for parental elderly care, on top of the existing deduction for social insurance payments.

The final bill is little changed from the first draft unveiled in June, with seven tax brackets and a top income tax rate of 45 per cent. The 5,000 yuan per month tax-free threshold was left in place from the first draft despite many demands for it to be raised further.

Is China’s first tax cut in 7 years too little, too late to boost consumer spending?

Cheng Lihua, vice finance minister, said the taxable income threshold was arrived at after careful calculations based on average spending and consumer prices data.

The 5,000 yuan threshold will lower the percentage of the urban labour force paying any income tax from the current 44 per cent to 15 per cent, Cheng said.

The new threshold is high enough to ensure that urban residents will be able to afford average monthly expenses before their income is subject to tax, she told a press conference in Beijing following the final vote on the bill.

The threshold also allows for some growth in average incomes before taxes kick in. The Ministry of Finance estimates that the average spending of urban residents in China is currently about 3,900 yuan per month and will grow to 4,200 yuan this year.

The higher tax threshold of 60,000 yuan per year and broadened access to lower tax brackets will take effect from October 1, according to the official document.

Details of the tax deductions, including those for education and elderly care expenses, must still be decided by the State Council, based on the advice of the Ministry of Finance and the State Administration of Taxation, and so will not become effective until January 1 next year.

Hongkongers working in mainland China face being taxed on their global income

Despite the sharp drop in the number of urban residents subject to income tax, many expressed disappointment after details of the new tax law were disclosed, especially residents of the biggest cities, who pay the vast majority of national income tax given their generally higher income levels.

“Only the deduction for parental elderly care was added [to the first draft]. It’s much less than we expected,” the SIFL Institute, a private, non-profit institution, wrote on Weibo, China’s version of Twitter.

“The amendment should make clear the scope and standards for the itemised deductions, rather than authorise the Ministry of Finance to decide,” it added.

To a large extent, the legislature ignored suggestions to reduce the tax burden further. More than 100,000 netizens made suggestions during a month-long comment period.

In one suggestion sent to the legislature, the SIFL Institute suggested lifting the tax threshold to 8,000 yuan, reducing the seven-bracket tax regime and capping the top tax rate at 30 per cent.

“It looks like the vast majority will enjoy lower tax payments under the new bill – but it really depends on your income structure,” said Charles Sun, a human resources specialist working with a state bank in eastern Jiangsu province.

For instance, the new law effectively raises taxation on annual bonuses, which could discourage their use, Sun noted. Previously, bonuses were given special treatment but they will now be treated the same as other income.

If a person earns 1 million yuan a year and 40 per cent of that comes from a performance bonus, the new law would mean a tax increase of more than 10,000 yuan, Sun said.

“But if his income structure is adjusted to a bigger monthly salary of about 80,000 yuan and a smaller bonus, he would see his tax payment reduced by more than 25,000 yuan compared to the old rules,” Sun said.

Vice finance minister Cheng said the income threshold could be adjusted in future to take account of rising income levels.

“The threshold is not fixed, but will be adjusted dynamically according to the need for personal income tax reform and consumer prices,” she said.

It is unclear how often the threshold might be adjusted. The personal income tax law has been amended seven times, but the tax threshold has been raised only three times, the last time in 2011.

“The authorities have to take regional imbalances and income polarisation into consideration – the threshold is already high in the vast western and remote regions,” said Cai Chang, a professor of taxation at the Central University of Finance and Economics.

“They seem to want to avoid losing too much [income tax] revenue at once.”