Beijing set to pledge billions more for Africa despite concerns over Chinese lending

President to address African nations in Beijing on Monday at the Forum on China-Africa Cooperation, with financing and his ‘Belt and Road Initiative’ on agenda

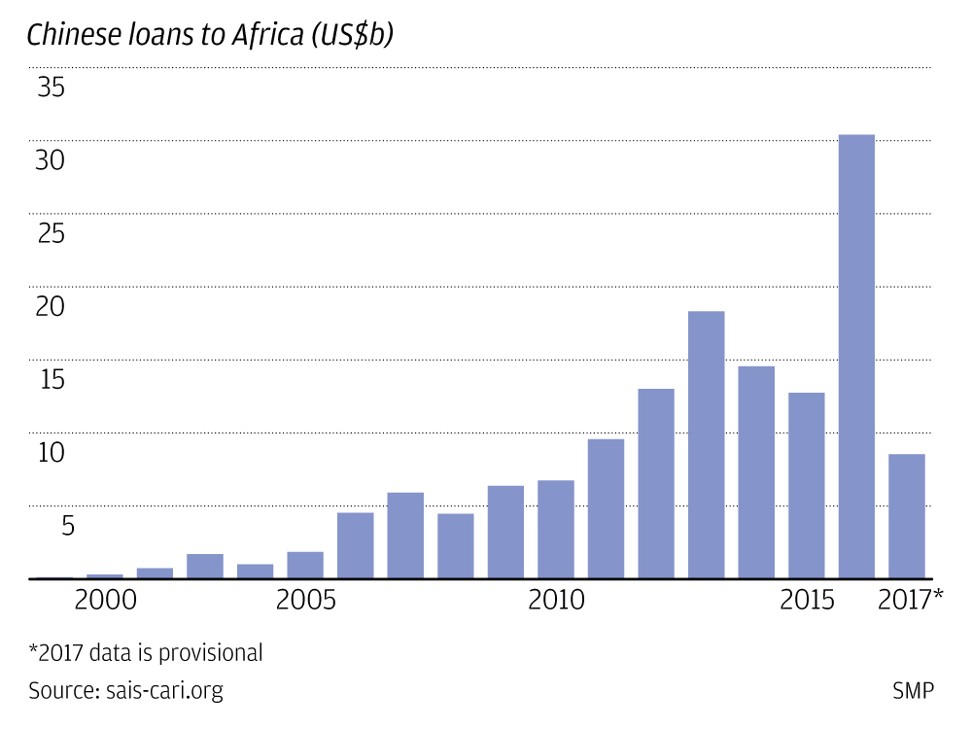

China is slated to pledge billions of dollars more in aid and loans to African nations at a key conference in Beijing on Monday, even as rising debt risks and lower-than-expected returns have slowed Chinese investment in the continent, analysts say.

In all, leaders from 53 African nations are expected to take part in next week’s Forum on China-Africa Cooperation.

In his talks with Guinea President Alpha Conde on Saturday, Chinese President Xi Jinping said relations between China and Africa were developing fast. He also urged Guinea to participate more in the “Belt and Road Initiative”, Xi’s flagship programme of infrastructure projects that span the globe.

Despite growing concerns over Chinese lending, Xi is expected to announce even more financing to Africa in his keynote address at the forum, after pledging US$60 billion in loans and grants at the last conference in 2015.

One stated goal is to “synergise” the belt and road programme, even as the initiative’s loan structure has increasingly come under fire for its potential to result in “debt-trap diplomacy”.

As Africa’s largest trading partner, China has become increasingly significant to the resource-rich continent, as it expands from trade and investment to security engagements – from its military base in Djibouti to conflict mediation in South Sudan – as well as more peacekeeping and humanitarian aid.

But China’s direct investments to Africa have slowed slightly in recent years, from a peak of US$3.4 billion in 2013 to US$3.1 billion last year, according to data from the Chinese Ministry of Commerce.

Analysts say that Beijing’s policies towards the continent have not changed significantly, but have seen less-than-expected returns on projects they have financed, even as African governments, growing more aware of the risks of taking on debt, have pushed for more favourable deals.

“‘Debt-trap diplomacy’ is a real challenge not only for the debtor nations in Africa but also for China, the creditor nation, since a heavy debt burden will inevitably complicate diplomacy both at the bilateral and multilateral levels,” Seifudein Adem, a specialist in Africa’s interactions with Asia at Doshisha University in Japan, said. “The major challenges for Chinese investments in Africa in the long run include the tension among the objectives of Chinese economic actors in Africa.”

Scholars from the China-Africa Research Initiative at Johns Hopkins University found that while Chinese loans were not a major contributor to debt distress in Africa, a number of countries were heavy borrowers from Beijing. Among the most at risk were Djibouti, with Chinese financiers holding 77 per cent of total debt at the end of 2016, as well as Zambia, which had borrowed at least US$6.4 billion from Chinese lenders, and the Republic of the Congo.

“The risk is obviously real,” Ilaria Carrozza, a researcher of China-Africa relations in London, said. “I don’t think that Chinese investments or anyone else’s investments are bad per se. The challenge is to make this debt sustainable … for recipient countries – so African countries – to use its infrastructure projects to attract more investments, and capture the return on these investments.”

While there are risks that other countries would need to seek funding from the World Bank or the International Monetary Fund if unable to pay back Chinese or other credit, many governments would balk at the strict conditions attached to those loans, observers say.

“Chinese financing being available as an option for African economies is a welcome relief, especially looking at how the IMF has tried to dictate areas of potential development for African governments,” said Michael Omouyi, executive director of the Centre for Nigerian Studies at Zhejiang Normal University. “To accept China’s offer is more sustainable and manageable than IMF loans.

“However, African economies need to change their perspective from passive recipients of Chinese loans – viewing China as a benefactor – to really engage with China as a lender.”

Omouyi said African nations must also better leverage the belt and road for infrastructure, including negotiating as a bloc to ensure that Chinese firms did not attach strings that prevented open competitive bidding in their projects – “the single biggest downside of Chinese financing”.

Carrozza noted that China’s reduced investments in Africa might push it to diversify how it engaged with the continent, including a stronger aid agenda and a focus on security interests, while African governments sought out a wider variety of lenders.

“We’re seeing that China is losing interest a little bit … they haven’t seen the returns that they’re hoping for,” she said. “China now has way more options in terms of where to invest because of the links created through the belt and road, so African governments have to fight a little harder for Chinese investments. There is a greater awareness of diversifying their partners, and not just looking at China.”

While China may have slowed its investments on the continent, its growing presence and expanded scope of engagement in Africa have come as the United States has pulled back on the global stage, analysts say.

“The African continent is just at the periphery of China foreign policy,” Thompson Ayodele, director of the Initiative for Public Policy Analysis in Nigeria, said. “China should make use of the fact that the US is pulling back in the sense of trade, or free trade, as the cornerstone of US foreign policy … now it is America first.”

Adem, of Doshisha University, agreed that China would continue to pursue strategic investments on the continent. “Europe today lacks the capacity and the US lacks the will to check or counter in Africa,” he said.