European businesses look to diversify operations outside China as coronavirus hits supply chains

- The EU Chamber of Commerce warns that companies have realised ‘they can’t put all their eggs in one basket’ after suffering severe disruption

- Group’s head Joerg Wuttke also warns that the Covid-19 outbreak may disrupt high-level talks between Beijing and Brussels and delay an investment deal

China’s emergency measures to halt the spread of Covid-19 have put this year’s top-level summit with the EU at risk and risk disrupting the global supply chain, a European business group has warned.

Even though Chinese officials said they were working to resume production, foreign businesses’ operations have been seriously disrupted and may be forced to look elsewhere for supplies, the European Union Chamber of Commerce in China said.

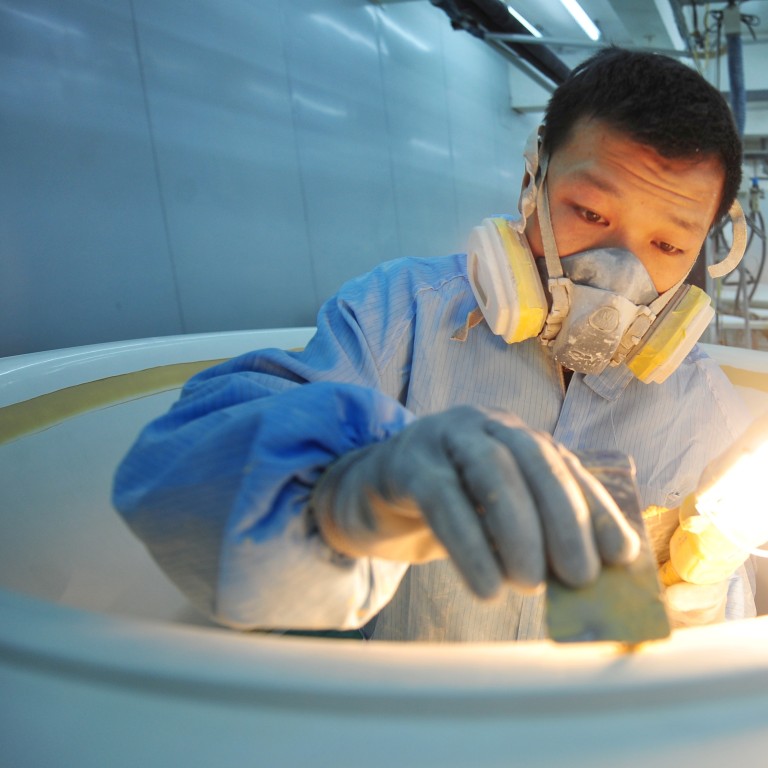

The group warned that manufacturers were not able to run at full capacity because of shortages of supplies such as masks and logistical problems caused by restrictions on movement.

Joerg Wuttke, president of the chamber, said the outbreak had made many businesses realise they had to diversify into other countries and avoid “putting all their eggs in one basket”.

.

He said that while the Chinese market was “always a lure... people have now woken up to the fact that you must have a backup plan”

He continued: “You must have a good eye on diversity. And the China story, the only story, possibly is over”.

Wuttke said the supply chain faced challenges, such as the disruption of deliveries to car makers and rising inventories, a shortage of packaging materials, and the risk that stocks of antibiotics and other drugs would start to run low.

Coronavirus up to 20 times more likely than Sars to bind to human cells, study suggests

Paul Sives, chairman of the chamber’s southwest China branch, said the rules on resuming production varied in different regions and there were was little guidance about how to get the right documentation, giving the example of a European company that spent 10 days trying to get the necessary information and documentation.

But he said a more serious problem was that some companies that have been able to resume their operations found their Chinese suppliers had not been given permission to restart their operations, warning that the knock-on effect could be “devastating”.

“District rules are different and there needs to be more centralised advice on how to get companies to go back [to work].”

Wuttke also expressed concerns over possible suspension of face-to-face talks between Beijing and Brussels as a result of quarantine requirements and the Chinese leadership’s concentration on containing the spread of Covid-19.

The two sides are trying to agree a number of measures to improve market access and Wuttke said he was worried that postponing a series of high-level talks would “basically delay” this process.

China to offer trade war tariff exemptions on 700 US products

Beijing and Brussels are negotiating a bilateral investment treaty, formally known as the Comprehensive Agreement on Investment, and aimed to conclude the talks as early as September.

Wuttke suggested both sides hold video conferences to “keep the ball rolling”, saying “things have to keep going if the regulations make travel impossible”.

“We will have a problem of high-level engagement if physical meetings are not possible”, he said.

China and the EU had been planning to start a series of high-level discussions on topics such as the economy, climate change, geopolitics and human rights in the run-up to the annual China-EU summit in Beijing late in March.

European Commission President Ursula von der Leyen and the European Council President Charles Michel had been due to attend the event but Wuttke said it “remains to be seen” whether their visit will be possible, especially since Beijing has already postponed its annual parliamentary gathering which had been due to be held earlier in the month.

Japan’s coronavirus support wins praise in China

He also said Chinese vice-premier Liu He, President Xi Jinping’s top economic adviser, had been supposed to go to Brussels in two days’ time, but “I’m guessing he will not go as he will ran risks of quarantine if he comes back”.

Brussels insists on the EU-China summit being held before a meeting between China and a group of central and eastern European countries, known as the 17+1 summit, which means that a delay to the first would see the second event, due to be held in mid-April, being put back.

Wuttke also said there may a further knock-on effect on plans for German Chancellor Angela Merkel to visit China in July and a summit for Chinese and European leaders in Germany in September.

“In short, we are worried about the fact that the stalling of the meetings will have an impact on [market access] regulations being drafted and bilateral investment talks,” he said.

The Covid-19 death toll has now passed 1,800 in mainland China and there have been more than 72,000 confirmed cases of infection.

Geng Shuang, a spokesman for the Chinese foreign ministry, said on Tuesday that preparations for meetings with European countries were “moving forward in an orderly manner according to plan”.

However, he declined to comment on Liu’s planned visit to Brussels.

Purchase the China AI Report 2020 brought to you by SCMP Research and enjoy a 20% discount (original price US$400). This 60-page all new intelligence report gives you first-hand insights and analysis into the latest industry developments and intelligence about China AI. Get exclusive access to our webinars for continuous learning, and interact with China AI executives in live Q&A. Offer valid until 31 March 2020.