Coronavirus: China under pressure to detail debt relief before G20 talks

- Beijing creditors would account for the bulk of the burden if loan payments to dozens of low-income countries were rescheduled again

- The World Bank president says the terms of the lending need to be disclosed

Wealthy nations under the Group of 7, led by the United States, have accused China of being secretive about its debt arrangements, with US Secretary of State Mike Pompeo saying China’s lending would create an unsustainable debt burden and hide corruption.

But observers said the negotiations about terms for relief during the pandemic could simply be taking time and the same rule should apply to all creditors.

The initiative offers relief for payment due between May and December this year to 73 low-income countries, mostly in Africa and some in Asia, hit by the coronavirus pandemic.

The Chinese government has said it is committed to the initiative, but in remarks seen as aimed at China, Malpass said the terms of the debts needed to be disclosed.

“This will avoid the secretive reschedulings that are under way in some countries, such as Angola and Laos, often with undisclosed grace periods and terms,” Malpass said.

02:28

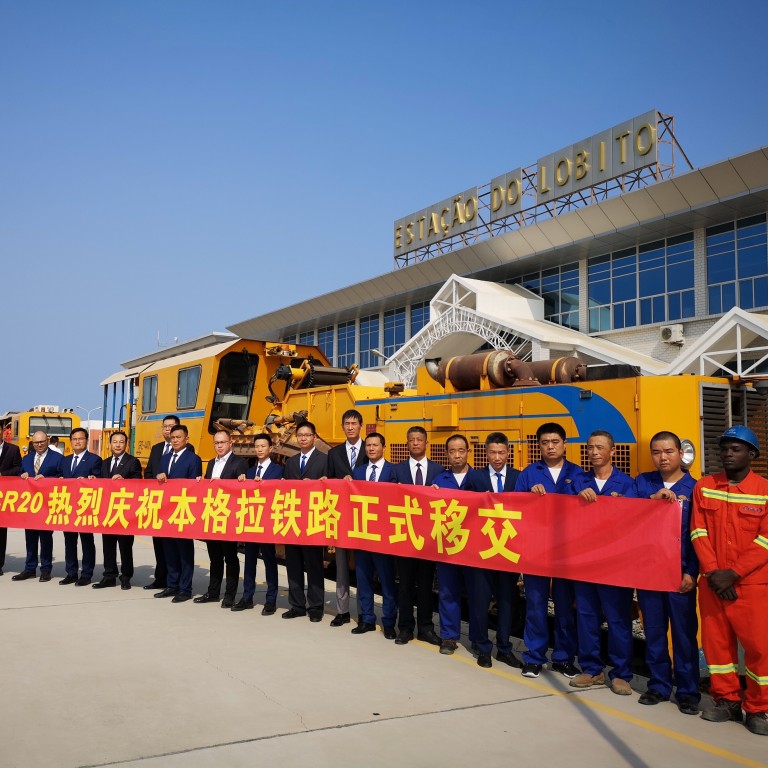

China invests billions in Africa

Observers said that at its November meeting the G20 would discuss whether to extend the initiative to cover payments due next year, and pressure would continue to mount on China to agree to the extension and improve transparency.

If the DSSI is extended into 2021, China would carry most of the burden in forgoing debt payments this year and next year.

And if China did take a public, international commitment, it would be extremely unusual for it to renege on it, observers said.

Hannah Ryder, the head of international development consultancy Development Reimagined which also studies China-Africa relations, said China had been open to debt cancellation and restructuring in the past.

“The official Chinese government position is that China will always respond and support countries that ask for assistance with loan management,” Ryder said.

“But deliberations could be taking time.”

Scott Morris, a senior fellow at the Centre for Global Development think tank in Washington, said the G7 countries had done a good job coordinating on debt suspensions through the informal group of creditor nations called the Paris Club, including reporting their actions publicly.

“[But] China has not been well coordinated and has not felt the need to report its actions publicly,” Morris said.

“Ongoing questions about the degree to which China is participating in the initiative will remain an obstacle to deeper debt relief from the G7 or the G20.”

Pandemic takes the shine off China’s Belt and Road Initiative as African partners struggle with coronavirus

Twenty-seven countries have so far been approved for DSSI participation, according to a communique from the Paris Club. But neither the Chinese nor the recipient countries have so far made public the details of this debt-service relief.

Much of the criticism of the lack of transparency centres on ongoing the China-Laos and China-Angola negotiations. Angola is the biggest recipient of Chinese loans in Africa, receiving about 29 per cent, or US$43.2 billion, of the US$148 billion Beijing loaned to the continent between 2000 and 2018, according to figures from the China Africa Research Initiative (CARI) at the Johns Hopkins School of Advanced International Studies in Washington.

In Laos, debt from China accounts for about 45 per cent of the country’s gross domestic product – and the East Asian country has recently gone back to China for help to restructure its loans.

Responding to the criticism, Chinese Finance Minister Liu Kun said the World Bank “should lead by example in suspending debt service”, or its role as a global leader in multilateral development will be weakened.

China’s promise of loan write-offs for distressed African nations barely dents a much bigger debt crisis

Mark Bohlund, a senior credit research analyst for REDD Intelligence, a New York-based platform that provides intelligence and data on emerging markets, said an extension would be easy for the G7 countries because the G7 accounted for only a small part of the total debt service relief on offer.

“Most of the cost of such an extension would fall on China as it is the biggest bilateral creditor by far for most DSSI-eligible countries,” Bohlund said.

Of the amount due from poor nations taking part in the G20 debt plan between May and December this year, 70 per cent, or US$7.17 billion, was to China. The amount is expected to rise to US$10.51 billion, or 74 per cent of the total, next year.

01:58

Coronavirus: South Africa becomes continent’s clear leader in Covid-19 infections

Gyude Moore, Liberia’s former public works minister and a senior policy fellow at the Washington-based Centre for Global Development, said China’s hesitation was understandable since neither the World Bank nor private creditors were a part of the DSSI.

“If China is participating, the transparency question applies to all the DSSI-participating creditors, not just China. The initiative is incomplete without the private creditors and the international financial institutions. China will, understandably, refuse to bear all the burden,” Moore said.

CARI director Deborah Brautigam said that because of the Chinese principle of non-interference, Beijing normally waited for the host country to make announcements about things like debt terms.

Brautigam said the same standard should be applied on all creditors since none of the details of debt negotiations with G20 creditors had been made public. She said the Paris Club has only published a list of countries that had approached it, but not any details about how it all worked or how much debt relief they have provided so far.

For example, the United States was the main bilateral creditor in Somalia, “but I haven't found any public information about our DSSI negotiations there”, Brautigam said.