IMF official urges China to take urgent action to address ‘rising vulnerabilities’

David Lipton wants China to slow credit growth substantially to lower debt burden and calls for greater flexibility in yuan’s exchange rate

China should take “imperative actions” to address increasing vulnerabilities such as the rapid rise of debt, overcapacity and defects in financial markets, a senior official with the International Monetary Fund said Tuesday.

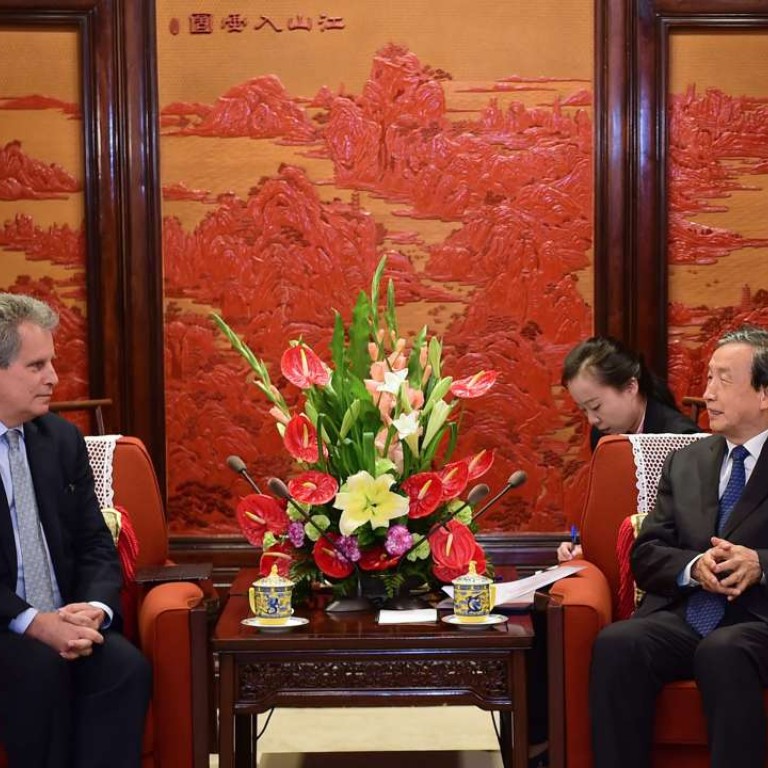

David Lipton, the IMF’s first deputy managing director, urged the central government to allow the yuan to move more freely and warned that the upcoming Brexit vote in the UK would bring broader uncertainty to the already weak global economy.

He made the comments at a press briefing after meeting with senior Chinese officials in an annual review by the fund of the country’s economy.

The discussions this week in Beijing with senior Chinese officials centred on policies needed for rebalancing China’s economy and the urgent need to carry out the reforms, Lipton said.

“We see significant advances on switching from industry to services, but less on tackling credit growth,” he said. “There has been substantial liberalisation of financial markets, but less improvement in governance and hardening state-owned enterprise budget constraints.

“As a result, vulnerabilities are still rising and the buffers to deal with shocks are eroding. This calls for more urgency in the implementation of reforms,” he said.

Lipton said last weekend that overall debt in China was equal to 225 per cent of GDP. Of that, corporate debt amounted to about 145 per cent of GDP “which is very high by any measure”, he added.

We see significant advances on switching from industry to services, but less on tackling credit growth

Specific estimates on China’s debt burden vary among different institutions, but there is consensus that the piling-up of liabilities has become a bigger threat to the nation’s financial and economic stability. The concern also prompted two rating agencies, Standard and Poor’s and Moody’s, to downgrade their outlook for China’s sovereign debt earlier this year.

Lipton expected growth in China to slow to 6 per cent in 2017 and urged the government to tighten budget constraints, especially on state firms. He also said the government should slow credit growth, raise taxes greatly to reduce pollution and to help prevent premature death.

“Given the wide-ranging challenges involved in addressing these issues, we see merit in establishing a well staffed group with a clear mandate to promote and implement practical restructuring of SOEs and to address the associated banking consequences, building on the plans for the coal and steel sectors already underway,” he was quoted as saying in a statement.

Lipton told reporters that the yuan’s exchange rate was becoming “more flexible and market-based” and encouraged China to achieve “an effective float” of the yuan in the next couple of years.

“The process of introducing greater flexibility will take time to put in place [and] to take hold and can only be judged over time. We’ve seen greater flexibility in the yuan in recent months. It has been more or less stable in effective terms for some time now and the policy to introduce greater flexibility will bring benefits to China,” he said.

Lipton also said if the British vote for an exit from the European Union on June 23, it will lead to a period of uncertainty in trading and other arrangement between the UK and EU, which will have a broader impact, including in Asia.

“It is hard to anticipate exactly what those effects would be. But the uncertainty would be a negative factor and comes at the time when the global recovery is slow and somewhat weak,” he said.