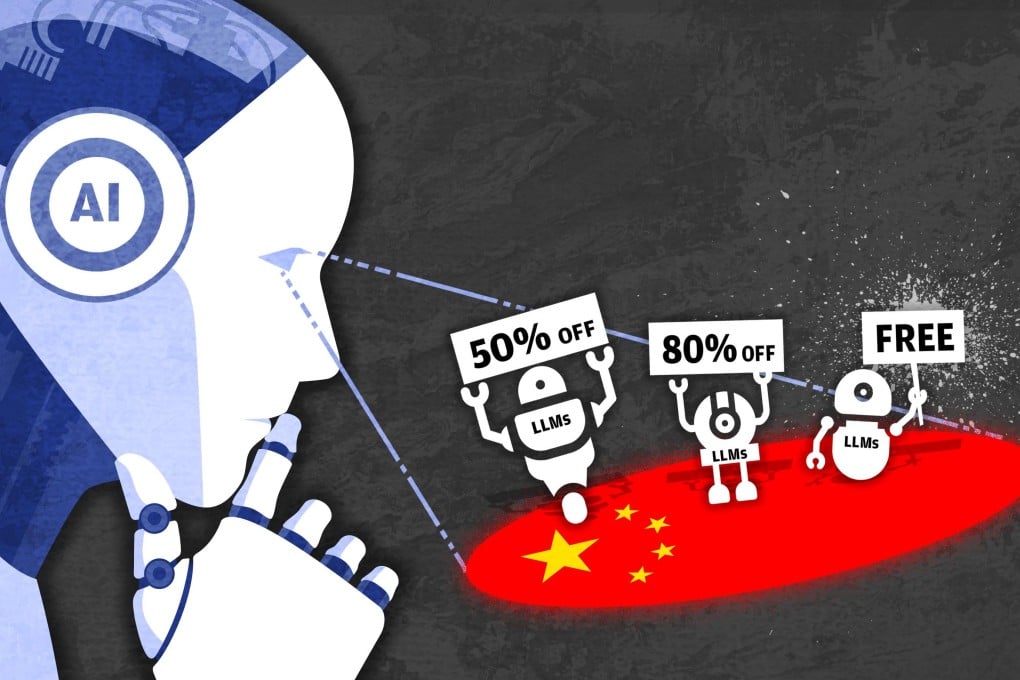

New AI battle adopts old price war strategy as Chinese tech giants keep start-ups at bay behind the Great Firewall

- The price of AI services in China plummeted in May after ByteDance kicked off a price war by pricing access to its LLMs at 99.8 per cent below GPT-4

- Industry insiders fear the harm could be fatal for many start-ups, but app developers are enjoying cheaper access to the tech powering their services

In the 18 months since Microsoft-backed OpenAI launched ChatGPT, Chinese tech firms large and small have rallied around a singular goal – besting the San Francisco-based start-up with their own Chinese-language chatbots.

The results have been mixed, with some tech giants claiming to have better results than GPT-4, OpenAI’s most advanced model, with Chinese queries. But with a deluge of more than 200 Chinese large language models (LLMs) – the tech powering these chatbots – from a slew of companies all jostling for market share, China’s AI firms can claim at least one other clear, albeit less boastworthy, advantage over their US counterparts: price.

“It’s like the bad money is driving out good money,” said You Yang, a computer science professor at the National University of Singapore (NUS).

The price war indicates a lack of competitiveness based on the merits of the models themselves, according to You, making them incapable of attracting customers at previous market prices.