Tencent Video, iQiyi in race to lead China’s online video market

The two platforms are already recognised as the most preferred combination of video streaming providers by mainland subscribers

Tencent Video and iQiyi are poised to further distance themselves from the competition this year as they intensify a two-way race to dominate mainland China’s red-hot online video market.

“It is coming down to these top two players, especially after Tencent Video doubled its paying subscribers in less than a year,” said Jefferies equity analyst Karen Chan.

Chan pointed out that Tencent Video and iQiyi already provide the most preferred combination of online video platforms watched by mainland viewers.

Youku Tudou, the former online video market leader controlled by e-commerce titan Alibaba Group Holding, has remained firmly in third place behind those two platforms, she said.

Other popular video streaming players on the mainland include Sohu Video, Mango TV, Bilibili and Funsion.

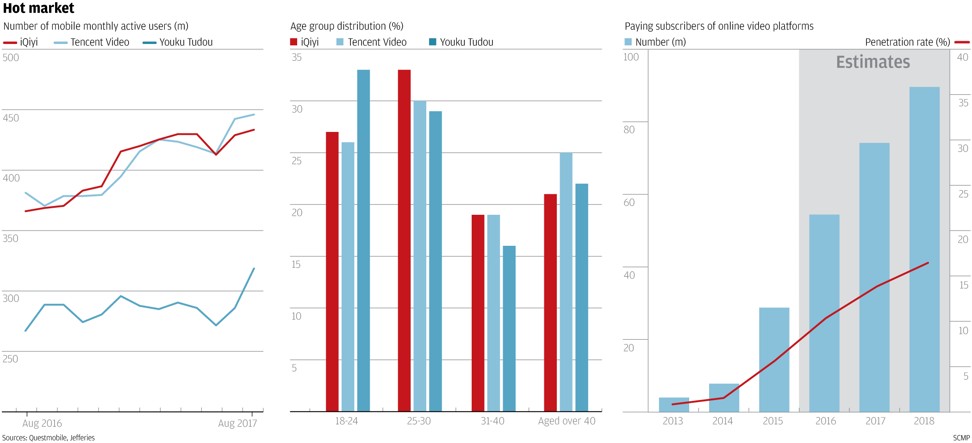

Statistics from China big data services provider QuestMobile and Jefferies showed that Tencent Video recorded 457 million mobile monthly active users as of August 17, ahead of the 442 million posted by iQiyi in the same period.

Yukou Tudou, meanwhile, had 325 million mobile monthly active users as of August 17.

In terms of viewer demographics, iQiyi showed a higher user concentration of 33 per cent in the 25-30 age group coveted by advertisers, according to Cheetah Data and Jefferies. Tencent Video and Youku Tudou had shares of 30 per cent and 29 per cent, respectively.

Tencent Video announced last week that its paying subscribers have reached a new milestone of 43 million, up from 20 million in November last year.

“This implies a paying subscriber ratio of close to 10 per cent, benefiting from strong viewership of licensed content, such as Nothing Gold Can Stay and in-house produced variety show The Tomorrow Children, Chan said.

“We currently estimate Tencent Video revenue of 18.3 billion yuan (HK$21.5 billion) at the end of this year, with paid subscription revenue contribution of roughly 30 per cent.”

In its second-quarter financial results in August, Tencent reported that its total online advertising reached 10.1 billion yuan on the back of a 48 per cent year on year media advertising revenue growth led by Tencent Video.

Chan, however, said iQiyi would be staying ahead of the pack, with its revenue this year projected to reach 19.2 billion yuan.

In June, iQiyi announced the expansion of its paid subscription model beyond premium movie, drama and in-house content to more genres, such as animation and documentaries.

With mainland Chinese internet users showing increasing willingness to pay for premium content, Jefferies has estimated the total online video paying subscriber base in the country to reach close to 140 million by 2020, up from an estimated 74 million this year.

Nomura analyst Shi Jialong said in a recent report that iQiyi appears to have “a superior content production capability”, which provides a strong edge to further grow its subscriber base.

“This is reflected by a slew of self-produced popular dramas and shows, including The Rap of China, which has gone viral on the internet,” Shi said.

Buoyed by fresh funding, iQiyi has announced plans to create original series by seasons – similar to Netflix’s House of Cards – for increased flexibility in production and better return on investment.

In February, iQiyi raised US$1.5 billion from its issue of convertible notes to a group of investors. Nasdaq-listed Baidu led the fundraising with its US$300 million investment.

Other major participants in the notes issue include Hillhouse Capital, Boyu Capital, Run Liang Tai Fund, IDG Capital, Everbright-IDG Industrial Fund and Sequoia Capital.

Chris Dong, research director at IDC China, said in a recent report that fierce rivalry in the mainland’s online video market “has led many platforms to use exclusive content as a competitive strategy”.

In April, iQiyi scored an exclusive licensing deal with Netflix that included animation, documentaries and original television programming, such as Netflix’s latest hit series Stranger Things.

Speculation has been rife that iQiyi would widen its lead in the mainland’s fast-growing online video market by raising fresh financing from an initial public offering in the United States.

Jefferies has estimated iQiyi’s current valuation at US$13 billion, higher than its US$11 billion valuation for Tencent Video.

New York-traded Alibaba owns the South China Morning Post.