TMT deals in mainland and Hong Kong total US$53.7b in the past nine months

Privatisation scheme of mobile operator China Unicom’s state-owned parent tops the 233 mergers and acquisitions recorded between January and September this year

The US$9.2 billion partial privatisation of China Unicom’s Shanghai-listed parent has emerged as the biggest deal among 233 mergers and acquisitions, worth US$53.7 billion, recorded in the technology, media and telecommunications (TMT) sectors of the mainland and Hong Kong between January and September this year.

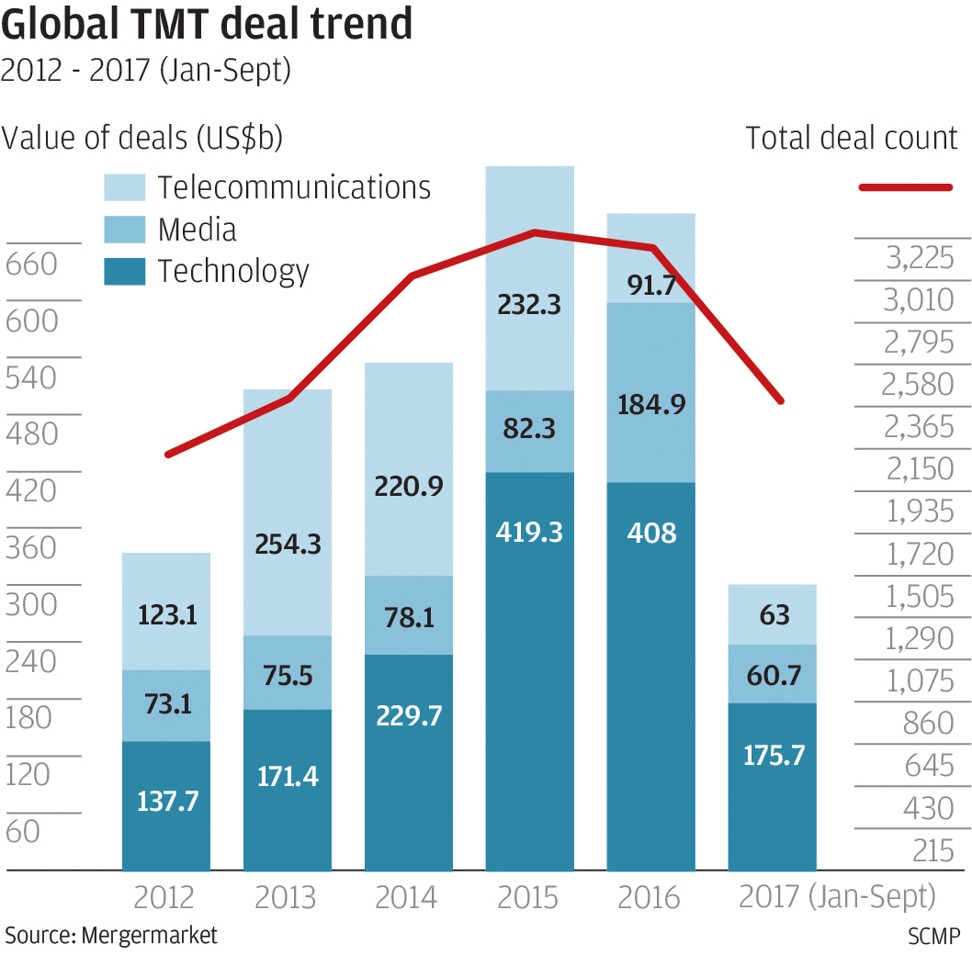

The transaction also ranked as the fourth largest among a global total of 2,370 TMT deals, worth US$299.5 billion, in the same nine-month period as mainland companies remained the world’s most active dealmakers behind those in the United States, according to the latest estimates from research firm Mergermarket.

Despite that activity, Mergermarket said the number and amount of TMT transactions the past nine months were lower than in the same period last year, when 257 deals on the mainland and in Hong Kong generated a total sum of US$71.8 billion.

That followed draconian measures imposed by Beijing to restrict outbound payments and investments after its foreign exchange reserves fell by nearly US$1 trillion over a period of 2 1/2 years from their June 2014 peak. Reserves have stopped shrinking as a result.

The strategic new investors were led by China Life Insurance, the mainland’s largest life insurer, which obtained a 10.22 per cent stake.

Edison Lee, an equity analyst at global investment bank Jefferies, said on Wednesday that it remains to be seen whether other state-owned enterprises next targeted by the government for private-sector investment could potentially raise the same amount of capital as Unicom’s parent.

“This government programme is ongoing, but the format of private-sector investment will not be the same for state-owned companies in other industries,” said Lee.

The US$5.5 billion funding round completed by Didi Chuxing in April ranked as the second-largest TMT deal on the mainland and Hong Kong in the past nine months, according to Mergermarket.

That transaction lifted the valuation of Didi, the mainland’s largest ride-hailing service provider, to more than US$50 billion, making it the world’s most valuable start-up after Uber.

The investors in this financing round for Didi included Japanese conglomerate SoftBank Group and US private equity firm Silver Lake Partners, as well as major Chinese financial services providers Bank of Communications and China Merchants Bank.

The US$1.9 billion divestment of Hutchison Telecommunications Hong Kong’s fixed-line network business ranked as the third-largest TMT deal recorded on the mainland and the city the past nine months, according to Mergermarket.

Elizabeth Lim, a senior analyst at Mergermarket, said one significant mainland TMT deal that recently passed US government scrutiny was the US$148 million sale of a 51 per cent stake in US technology company Calient Technologies, a specialist in so-called optical switching systems used in data centres, to Suzhou Chunxing Precision Mechanical.

“This deal was approved by the Federal Trade Commission in April and the [inter-agency] Committee on Foreign Investments in the US in May, so it will likely close without much issue,” said Lim.

The US government’s green light on that transaction came before US President Donald Trump’s decision last month to block the US$1.3 billion acquisition of Lattice Semiconductor, a maker of programmable logic chips, by Canyon Bridge Capital Partners, whose partners include the China Venture Capital Fund.

Chris Griner, the co-managing partner at law firm Stroock & Stroock & Lavan’s office in Washington, said the deal was vetoed for reasons of national security.

Mergermarket said the top global TMT deals recorded between January and September this year were led by the US$14.4 billion acquisition of US media company Scripps Networks Interactive by Discovery Communications.

Vodafone India and Idea Cellular’s US$12.7 billion merger announced in March ranked as the second-biggest TMT deal the past nine months. That was followed by the US$10.6 billion purchase of a 59.8 per cent stake in Japan’s Toshiba Memory by a consortium led by US private equity firm Bain Capital.