Huawei blasts US ‘fearmongering’ as security concerns sharpen following arrest of Meng Wanzhou

- Huawei’s massive push to gain a prominent say in the future of mobile communications has raised hackles in the US

- It has now become a focal point for American attempts to contain China’s ascendancy

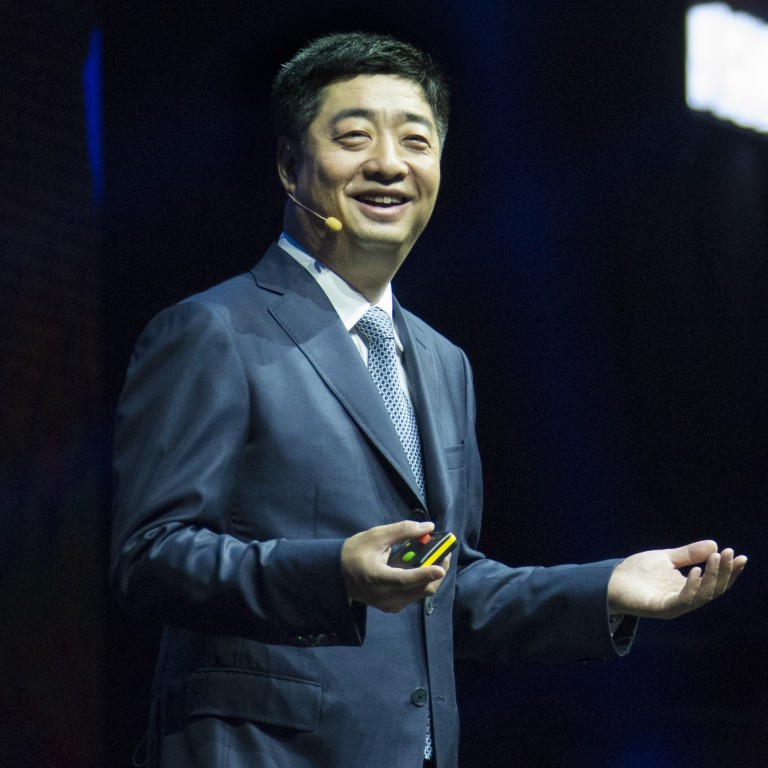

Huawei Technologies rotating chairman Ken Hu Houkun, speaking publicly for the first time since the shock arrest of the company’s chief financial officer, warned that blacklisting the Chinese firm without proof will only hurt the industry and snarl the advent of future wireless technologies worldwide.

The Shenzhen-based company took swipes at the US and its allies on Tuesday during its first press event since CFO Sabrina Meng Wanzhou was detained in Canada on allegations she defrauded banks to violate Iranian sanctions. The daughter of billionaire founder Ren Zhengfei, she now faces extradition in a case that has sparked a diplomatic row, chilled travel to China and exacerbated fears Beijing could employ its networks for espionage, something Huawei has always denied.

Huawei, China’s largest technology company by sales, has rapidly become a lightning rod for America’s fears about the country, as tensions between the world’s two richest nations escalate.

In Europe, carriers and major customers from Orange to BT Group and Deutsche Telekom have voiced their concerns about Huawei’s gear, on top of existing bans in Australia, New Zealand and the US.

That unprecedented backlash comes at a critical juncture for a company with ambitions of leading the roll-out of 5G, the next-generation wireless technology expected to power-up a plethora of devices from smartphones to cars.

While Huawei would not address Meng’s case directly, the company reiterated that it abides by international law and is confident the judiciary will come to a fair conclusion. More broadly, it challenged its accusers to produce actual evidence of their claims about security or – at the very least – to share them with Huawei’s customers.

“Some countries in rare cases take an abnormal approach,” Hu, one of several rotating chairmen, told reporters at its manufacturing base in Dongguan, the company’s largest campus worldwide.

“They take the 5G technology concerns, a technical issue for the industry, and turn it into groundless speculation targeting a specific company.

“Despite the efforts to create fear about Huawei and to use politics to interfere with industry growth, we’re proud to say that our customers continue to trust us,” he said.

Meng’s arrest was regarded as an attack on one of China’s foremost corporate champions. While Alibaba Group Holding and Tencent Holdings dominate headlines thanks to flashy growth and high-profile billionaire founders, Ren’s company is by far China’s most global technology company, with operations spanning Africa, Europe and Asia.

Huawei’s ambitions include artificial intelligence, chip manufacturing and 5G mobile technology. That last effort – a massive push to gain a prominent say in the future of mobile communications – has raised hackles in the US and become a focal point for American attempts to contain China’s ascendancy.

Hu said he has seen no immediate impact on Huawei’s business stemming from the allegations against Meng, reaffirming that the company’s revenue will surpass US$100 billion this year.

Still, the US has been pushing governments for months to block Huawei from supplying new 5G telecommunications network projects. That strategy is now taking hold in Europe, where the Chinese technology giant is bleeding allies.

“This is not putting the focus on how to improve and perfect the technology, but is speculation targeting specific companies out of political considerations,” Hu said.

The heightened scrutiny comes at a critical moment for Huawei’s ambitions in Europe, its second-biggest market outside Asia. European telecommunications network operators are getting ready to order tens of billions of euros worth of equipment for 5G systems, and Huawei has spent more than a decade positioning itself to win much of that work.

Yet the outlook may be dimming for Huawei there. European officials and companies, initially slow to act on the US warnings, have increasingly distanced themselves publicly from the Chinese telecoms equipment supplier.

Even before Meng’s arrest, Huawei had expressed frustration with the way it is perceived by governments, most recently in the UK, where it is regarded as less than fully secure.

On Tuesday, Hu warned that barring Huawei would only raise overall costs and hold up much-needed infrastructure.

“From a deployment cost point of view, it will be significantly higher and will delay time-to-market of new technologies,” he said.

In response, Huawei is planning an overhaul of its global software systems. It is offering to spend at least US$2 billion to transform the way it engineers software, instead of merely applying one-time changes and workarounds in response to specific demands from companies and governments.

That work will continue until all security concerns are assuaged, people familiar with the matter have said.

“We know there are concerns so we’re willing to take the extra steps needed or go the extra mile versus our peers,” Hu said.

The question now is whether the US, which is preparing its case against Meng, will also accuse Huawei of seeking to sidestep sanctions – a move that may eventually trigger the same sort of moratorium on purchases of American technology that nearly killed off smaller rival ZTE Corp.

Hu said he would not comment on something that has not yet happened, but stressed that Huawei has spent years diversifying a supply chain that today spans 13,000 partners and involves more than US$70 billion of procurement annually.

“The more global your supply chain, the more vulnerable it might be,” Hu conceded. But he added: “All the countries involved are inter-dependent – if any link of this global industry chain is obstructed, that hurts the development of the global economy and the industry supply chain as a whole.”