Bitcoin mining rig maker Canaan shelves Hong Kong plan for US listing

- Beijing-based Canaan, which earlier targeted raising about US$1 billion, is looking to go public in New York

Canaan Creative, China’s second biggest maker of bitcoin mining hardware, is considering listing in the United States after shelving plans for a Hong Kong initial public offering (IPO), people with knowledge of the matter said.

The Beijing-based company, which was earlier targeting to raise about US$1 billion, is discussing the possibility of selling shares in New York as soon as the first half of this year, according to the people.

Deliberations are at an early stage, and there is no certainty they will lead to a transaction, the people said, asking not to be identified because the information is private.

Canaan’s Hong Kong IPO application lapsed in November. Kong Jianping, the company’s co-chairman, declined to comment.

Bitcoin has fallen 79 per cent from its record high in December 2017, making it more difficult for cryptocurrency companies to attract stock-market investors and less profitable for miners to generate new coins.

Bitmain Technologies, the largest maker of specialised mining chips for the industry, and smaller rival Ebang International also filed for Hong Kong IPOs last year.

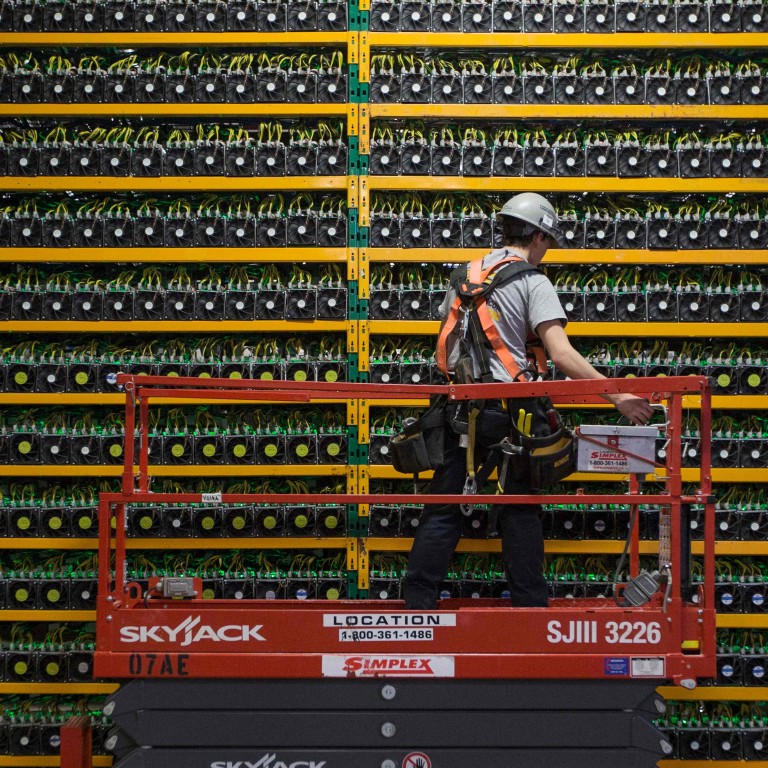

Founded in 2013, Canaan sells computer equipment under the “Avalon” brand with fast customised chips that win digital coins by solving complex maths problems. It reported 1.31 billion yuan (US$191 million) of revenue in 2017, according to a Hong Kong exchange filing in May.

Morgan Stanley, Deutsche Bank, Credit Suisse Group and CMB International Capital were joint sponsors of Canaan’s proposed Hong Kong listing, the filing shows.