Tech war: China to revamp chip strategy under US pressure, but US$143 billion support package is not on the cards

- An official at the China Semiconductor Industry Association says Beijing is likely to shift its focus away from filling in technological gaps

- He says he has not heard of any plans by China to provide 1 trillion yuan (US$144 million) to subsidise its semiconductor industry

China is set to overhaul its semiconductor strategy under US pressure, focusing on enhancing strengths instead of fixing weaknesses, in an admission that Beijing’s current plan is not working, according to a Chinese chip industry veteran.

Wei Shaojun, an official at the China Semiconductor Industry Association, said in a live-streamed speech on Thursday that the country’s current efforts to shore up the domestic chip industry by focusing on shortcomings is a strategic error.

He expects Beijing to revamp its approach in overcoming US restrictions by putting more resources in areas where China has an advantage, such as mature process technologies.

“It’s a strategic mistake to only fill in the gaps,” Wei, a professor at Beijing’s Tsinghua University, said at the Chinese IC Summit in Shenzhen. “In the past few years, the more we tried to make up for our deficiencies, the more passive we have become.”

“We should focus not on overcoming weaknesses, but on enhancing our strengths,” Wei said.

Regarding a recent news report by Reuters that said China would provide 1 trillion yuan (US$144 million) over the next five years to subsidise its semiconductor industry, Wei said he had checked with his contacts but “no one has spoken about such a plan”.

Instead, Wei said China will carry out a complete redesign of its strategy to better leverage resources and use a variety of ways to boost the industry. The new gameplan will be robust enough to last until 2035 at least, he said.

Wei said the industry should shift its focus to mature process nodes and other areas that are less sensitive to export curbs by Washington, which currently encompass advanced chips and electronic design automation. He expects the US to further tighten its efforts in restraining China’s chip development.

“Will there be a turnaround [in the US strategy]? I personally don’t have high hopes,” he said.

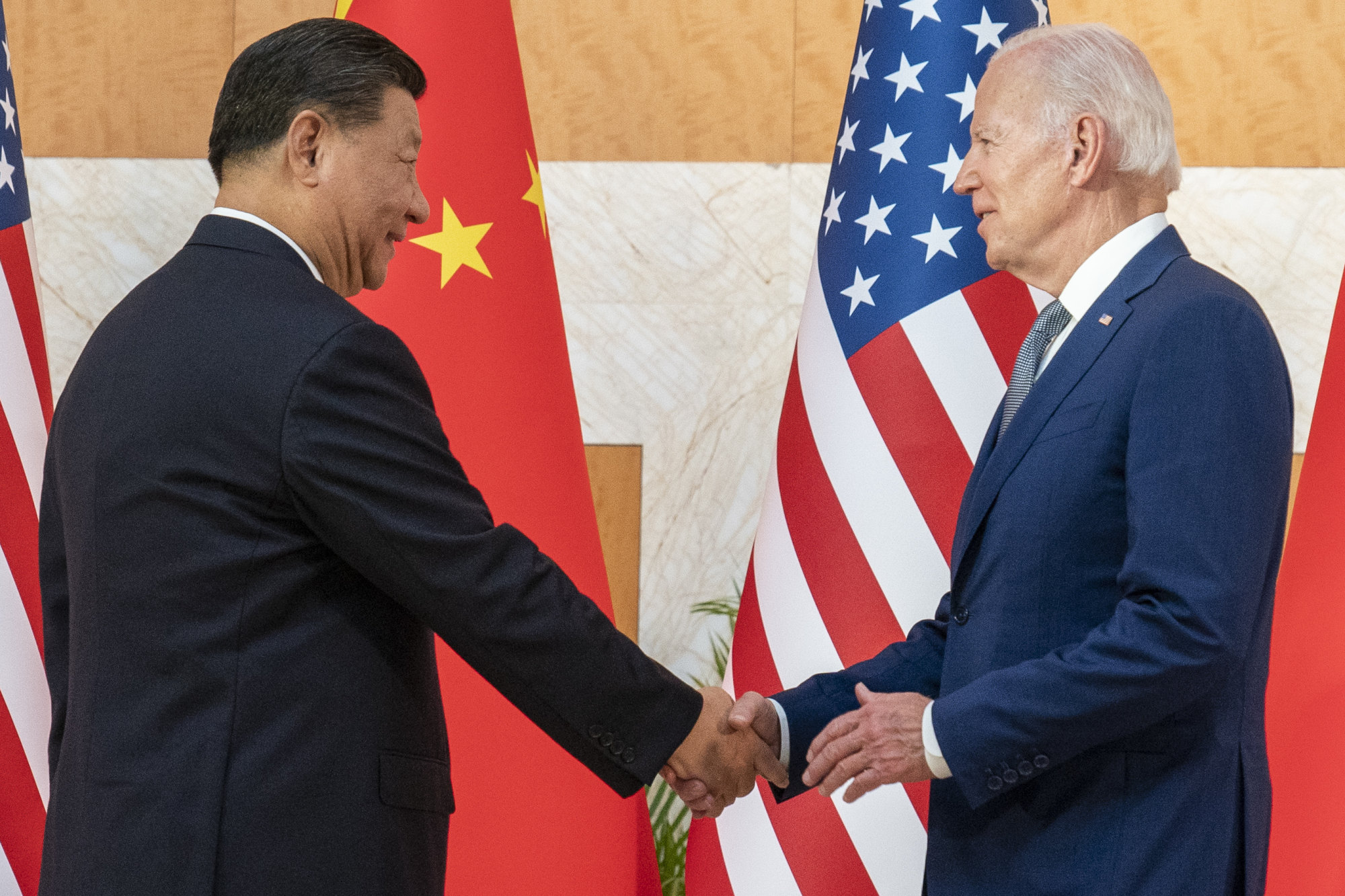

The series of US moves has put semiconductors at the centre of a full-fledged tech war between the world’s two biggest economies.

China has long taken a top-down approach to support domestic chip companies with hefty subsidies and other forms of assistance. In 2014, it set up the China Integrated Circuit Industry Investment Fund, known locally as the Big Fund, as the primary financing vehicle to support the semiconductor industry. The first round of investments reached over 138 billion yuan.

By 2019, total government-backed chip investment funding in China reached almost 500 billion yuan, according to an estimate by the China Semiconductor Industry Association.