Topic

Stock market action from around the world, with a focus on Hong Kong, China and the rest of Asia.

Attracting listings to the bourse from Southeast Asia, the Middle East and other regions, and introducing trading when typhoon signal No 8 is in force are at the top of his list.

Both Beijing and the West will cherry-pick and distort the numbers as their rivalry escalates, so we all need to remain mindful and alert.

- Index heavyweights Tencent and Alibaba top the turnover list with their shares rising 1.2 per cent and 4.1 per cent on Friday, respectively

- Sentiment remains upbeat after China’s top policymakers signalled further support to economic growth at the Politburo meeting on April 30

Mainland China investors will gain access to Hong Kong’s Reits via an expanded mutual market access scheme in a move which will deepen the market, enhance its liquidity and attract international issuers, analysts say.

Hong Kong kept its key interest rate unchanged for a sixth consecutive time in lockstep with the Federal Reserve’s overnight decision, with sticky US inflation forcing investors to delay rate cut bets.

Foreign investors loaded up on Chinese stocks for a third straight month in April, adding to evidence that global fund managers have become more positive about the world’s second-largest market.

Despite being touted as Hollywood’s latest miracle diet pill, Ozempic’s downsides include a gaunt-looking face … but there are ways to avoid it

Six bitcoin and ether ETFs saw US$12 million in trading on Tuesday, compared with US$4.6 billion for US bitcoin ETFs on their first day.

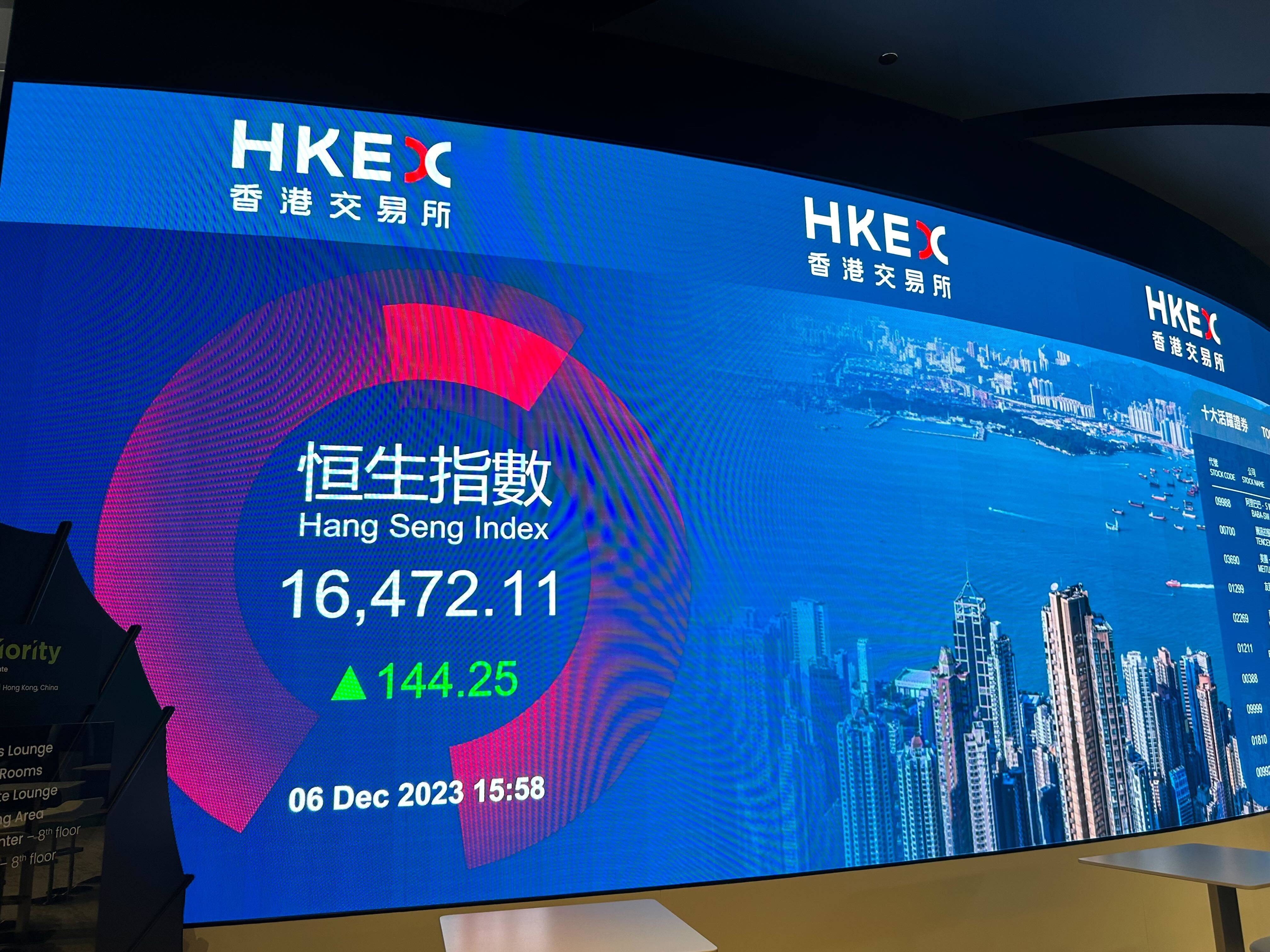

Hong Kong stocks emerged as the best-performing key market globally in April, after funds sought bargains by shifting out of expensive US and Japanese equities and as China’s growth shows more signs of stabilising.

Hong Kong’s market is the best performer among major peers globally this month, and better-than-expected manufacturing activity in mainland China is expected to add further impetus.

The Warren Buffett-backed carmaker posted first-quarter net profit of 4.57 billion yuan (US$631 million), 47.3 per cent lower than the quarter ended December 2023.

Hong Kong stocks closed near bull market territory after corporate earnings continued to surprise on the upside with property sector support measures on mainland China adding to the momentum.

Reinhold Geiger is considering making an offer for the L’Occitane shares he does not already own at HK$33 to HK$34 apiece as early as Monday.

CICC cuts pay amid brutal business environment as a sluggish economy and dismal IPO volumes hurt the financial services sector.

This was the smallest batch of video games approved so far this year by regulator the National Press and Publication Administration.

Chinese local government entities have carried the mantle of cornerstone investors in first-time stock offerings in Hong Kong in the past two years as foreign investors shun deals. Their outsize role could work against the city’s capital market, market experts say.

Investigation into Yao Qian, who serves as the director of the department of technology supervision at the China Securities Regulatory Commission, comes amid an uptick in market reforms.

Guolian Securities plans to buy a 95.48 per cent stake in unlisted Minsheng Securities, in an acquisition that is expected to make it a top-20 brokerage.

Hong Kong stocks rose and completed its best weekly performance since October 2011 as positive earnings from top-tier Chinese companies and supportive policy measures boosted investor confidence

Global investors turn constructive on Chinese stocks after a series of stock market reforms aimed at strengthening scrutiny and boosting returns to shareholders.

Hong Kong stocks rise on optimism that the appetite for Chinese assets is returning as Beijing pledges support to markets and signs of an earnings recovery emerges.

SenseTime’s shares gained as much as 36 per cent after the company launched the latest iteration of its SenseNova large language model.

Hong Kong stocks rose for a third day after earnings optimism drove the benchmark Hang Seng Index to a five-month high.

Goldman says Chinese stocks may rise 40 per cent amid ‘more conducive trading environment’ in near term, while UBS raises ratings on Chinese and Hong Kong stocks to overweight.

Chabaidao’s stock ended the day 27 per cent lower after slumping as much as 38 per cent. It raised about HK$2.6 billion (US$331.7 million) from the sale of 147.8 million shares at HK$17.50 each.

Hong Kong stocks climbed most in three weeks as investors ramped up their buying on expectations that a slew of supportive measures from the Chinese securities watchdog will aid sentiment.

Many Chinese firms are expected to shift their fundraising plans to Hong Kong following measures by the mainland’s market regulator to support initial public offerings in the city, analysts say.

CAP shares rose up to 3.1 per cent on Monday morning on the Santiago Stock Exchange. Move imposes anti-dumping fees of up to 34 per cent on imports. CAP decided to suspend planned closure of steel plant.

Hong Kong stocks extended gains amid expectations the latest measures announced by Chinese authorities will broaden the investor base

China Securities Regulatory Commission on Friday announce five measures to further enhance connectivity between mainland and Hong Kong capital markets.