Topic

Stories about how technology is used to enhance the wealth management industry, including mutual funds, and exchange-traded funds

- Some bankers would likely be in line for payouts in Asia and Europe when they successfully attract new money to the lender’s private banking unit, sources said

- The referral fees would be a first for the Zurich-based lender, echoing earlier incentives that Credit Suisse had offered to its deal makers, they added

FTX said in a court filing it owes about US$11.2 billion to its creditors. The exchange estimates it has between US$14.5 billion and US$16.3 billion to distribute to them.

Charles Li, former head of the Hong Kong stock exchange, wants to bring its model of financing for a cut of daily revenue to Southeast Asia as early as the fourth quarter.

Sheikh Ali Al Maktoum, the nephew of Dubai ruler, is opening a family office in Hong Kong, one of the first high-profile global investors to respond to the city’s campaign to lure the ultra-rich.

There were early red flags over cryptocurrency platform at the centre of HK$1.5 billion fraud scandal, says YouTuber.

Prudential Hong Kong will continue to invest in AI and technology to boost its insurance business, while it expects mainlanders will continue to come to Hong Kong to buy the policies in the second half, according to its top boss.

One of Hong Kong’s first licensed cryptocurrency exchanges has officially started accepting retail users, allowing them to trade bitcoin and ether directly with fiat currencies.

Wealth adviser Endowus Group raises HK$273 million (US$35 million) aiming to deploy the proceeds in Hong Kong as the city stakes its claim to being Asia’s wealth management centre.

Asia’s wealth management firms are not up to scratch with their mobile banking services, according to a survey by consulting firm Accenture.

Mark Schobinger, who filed the lawsuit on behalf of himself and other employees, alleges they were promised 50 per cent of their 2022 bonus by executives, assurances made both before and after Elon Musk acquired the company.

Artifact Labs is planning several new partnerships with global museums after a seed funding round led by Blue Pool Capital and Animoca Ventures, despite cooling interest in NFTs.

The US$7.1 trillion asset management giant has informed the Chinese government of intentions to close its unit in Shanghai, according to sources.

The future of financial technology in Hong Kong will rely on young people with new ideas, and the city offers many advantages that will help to nurture the sector, industry leaders told the Greater Bay Area Fintech Talent Summit on Thursday.

Former employee says AAX’s troubles have been partly caused by trading strategies and risk management practices at its market maker 10kM Trading.

ZA Bank’s tie-up with UK tech firm Wise provides the Hong Kong virtual bank’s users a platform to make international money transfers, while allowing it to grab a bigger share of digital remittances from the city.

Some mainland banks and family offices are considering starting or reactivating virtual asset projects in Hong Kong, Deloitte China’s digital asset leader said.

Senior figures from JPMorgan, BlackRock, HSBC and Standard Chartered shared their thoughts on how fintech is shaking up the banking sector at a global banking summit in Hong Kong.

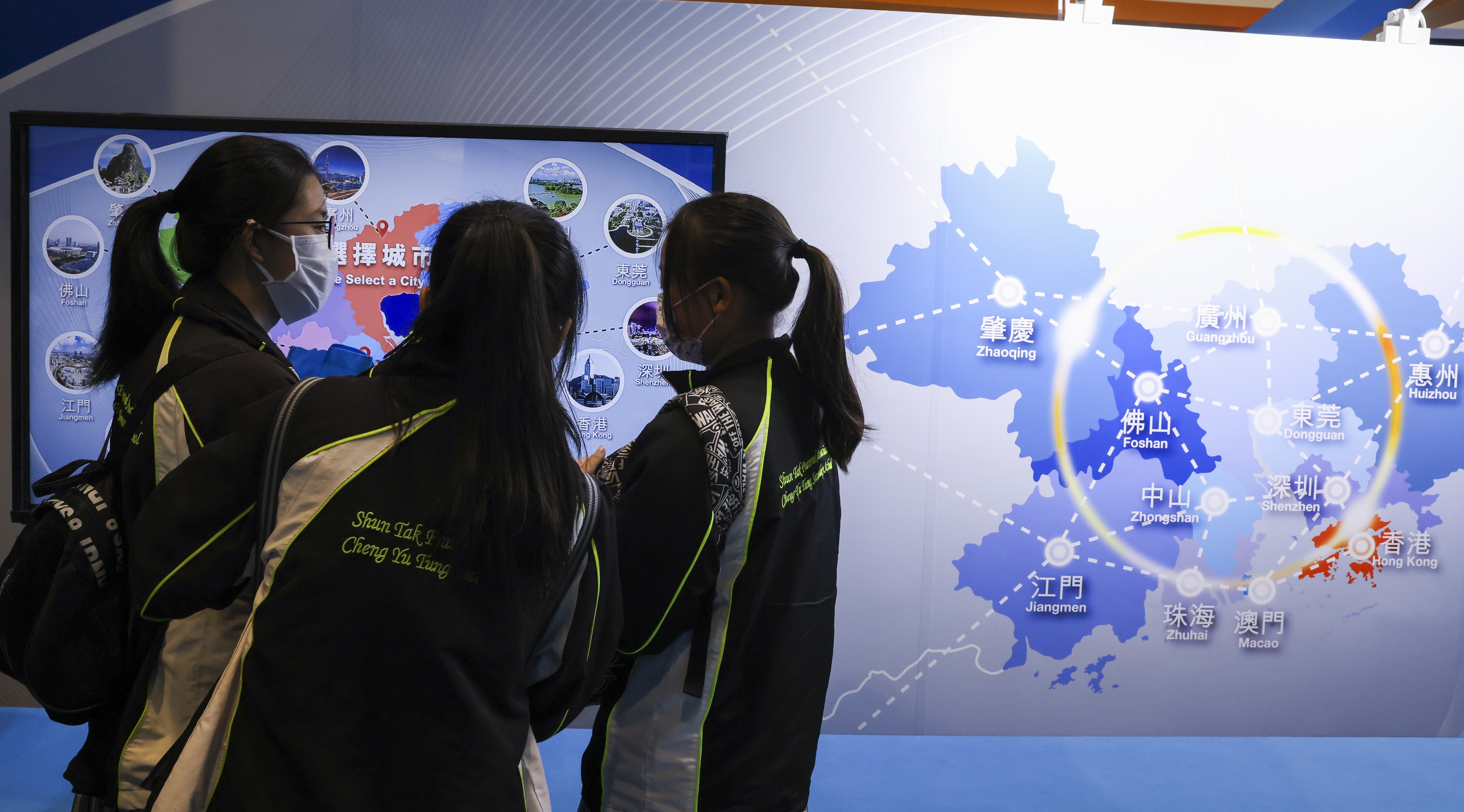

Hong Kong is the key to success in the Greater Bay Area (GBA), the place to do business, expand and invest in mainland China’s markets, industry leaders have said in the lead up to a major summit of senior bankers in the city.

‘Almost 90 per cent of those with a general interest in cryptocurrencies created all their own wealth’, says Wealth-X report.

From faster payments to Wealth Management Connect, Hong Kong has adopted a number of measures in recent years to bolster its bona fides as a fintech hub.

HKMA allows 16 banks to sell products in Hong Kong and the mainland, while three can only sell to Greater Bay Area residents via the southbound route.

Greater Bay Area, which is home to four top 10 richest people in China, will have a new cross-border trading scheme for investment products, a core project by Beijing to promote capital flows and investment among the 11 cities in the plan.

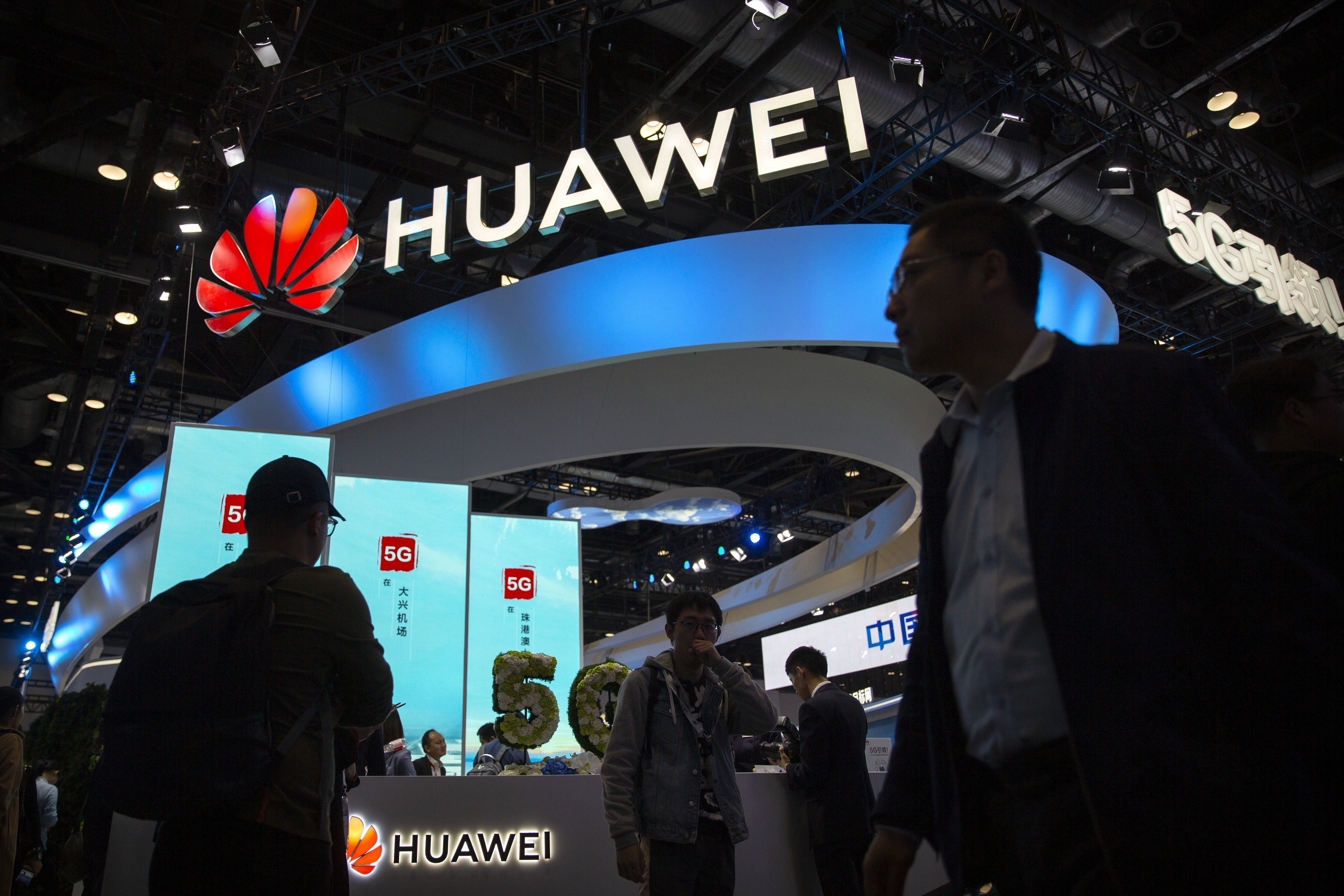

The Chinese telecoms giant aims to diversify by tapping the rapid pace of digitalisation in the global financial services industry after its network gear and smartphone businesses were dragged down by US sanctions.

HSBC has maintained about 50 per cent capacity in its Hong Kong offices for much of the pandemic.

Regulators say there have been beaches of consumer rights with some platforms operating outside permitted business areas.

The bill would give holders of cryptocurrencies up to six months to liquidate their digital assets, after which penalties would be levied. Even China, which has banned mining and trading, does not penalise possession.

Wealth growth has surged in Asia in recent years and the number of people with more than US$30 million is forecast to outpace the rest of the world through 2025, according to a Knight Frank report last month. The richest Asia Pacific billionaires are worth a combined US$2.5 trillion, almost triple the amount at the end of 2016, data compiled by Bloomberg show.

Bitcoin volatility is likely to continue rising in the near term and remain elevated until it settles in around its next plateau, says commodity strategist.

The shroud over peer-to-peer lending firms has fallen, and China’s banking regulator says all such platforms across the country have ceased operations – but countless billions are already feared lost.

CSRC approval of Ant Group’s IPO in Hong Kong shows Beijing’s commitment to the city’s role as an international financial centre, according to analysts.