Vietnam’s addiction to coal shows tough climate choices developing Asia faces on emissions pledges

- Coal already accounts for about a third of the country’s operational energy mix and its capacity is set to increase by 2030 under a new draft development plan

- Most of Vietnam’s operational coal capacity has been funded by firms from China, Japan, South Korea, and to a smaller extent, the US – all countries that are trying to decarbonise

Ahead of next week’s COP26 climate summit, aimed at extracting fresh pledges from world leaders to bring down carbon emissions, an ongoing energy crunch is driving up demand for coal globally.

Yet nowhere is this addiction to dirty fuel more visible than in the Asia-Pacific, which accounts for about three-quarters of worldwide coal consumption.

A recent report from non-profit financial think-tank Carbon Tracker showed that five Asian countries – China, India, Indonesia, Japan and Vietnam – are responsible for 80 per cent of the world’s planned coal-fired power stations.

As more of the region’s financial institutions slow down or stop their investments in coal, environmentalists are urging wealthier nations to help poorer ones build up infrastructure and know-how for renewable energy generation.

COAL FOR GROWTH

Coal-fired plants met 50 per cent of the nation’s electricity generation needs in 2019 and 2020, according to state-owned power giant Vietnam Electricity Group (EVN), and Hai Phong Thermal Power Station was in business-as-usual mode when This Week In Asia visited on a media tour late last year.

The 1,200MW plant, which cost more than US$1.2 billion to build, was alive with activity during the visit – before a major outbreak of the Delta variant of Covid-19 in Vietnam paralysed the export-driven economy for months.

It was busy helping meet the country’s soaring demand for energy, which has seen electricity consumption grow at an average of 10 per cent annually over the last decade, according to a This Week in Asia analysis of industrial data.

Only about 12 per cent of Vietnam’s electricity generation comes from renewable energy such as solar and wind, EVN’s latest figures of the nine months through September this year show. This reliance on coal has nevertheless fuelled huge growth, with the economy ballooning to US$271 billion last year – over 43 times its size in 1990.

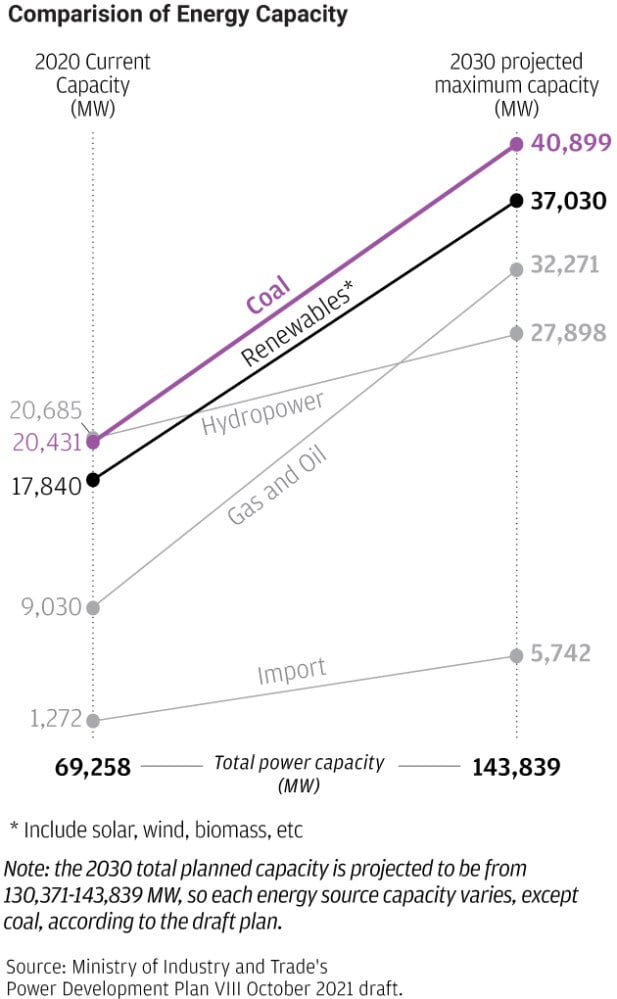

As more air conditioners are installed and online economic activities proliferate in the country of 97 million, total installed energy generation capacity has reached some 69.3 gigawatts, according to government data – almost on par with Indonesia, which has three times as many people.

Vietnam’s largest energy consumers are also its biggest money spinners. Manufacturing and construction, the sectors that have attracted most of the country’s US$403 billion in accumulated foreign direct investment, accounted for more than half of all energy consumption between 2010 and 2018, a report by state-owned Vietinbank said.

FINANCED FROM ABROAD

Most of Vietnam’s operational coal capacity has been funded by firms from China, Japan, South Korea, and to a smaller extent, the US: all countries that are trying to decarbonise.

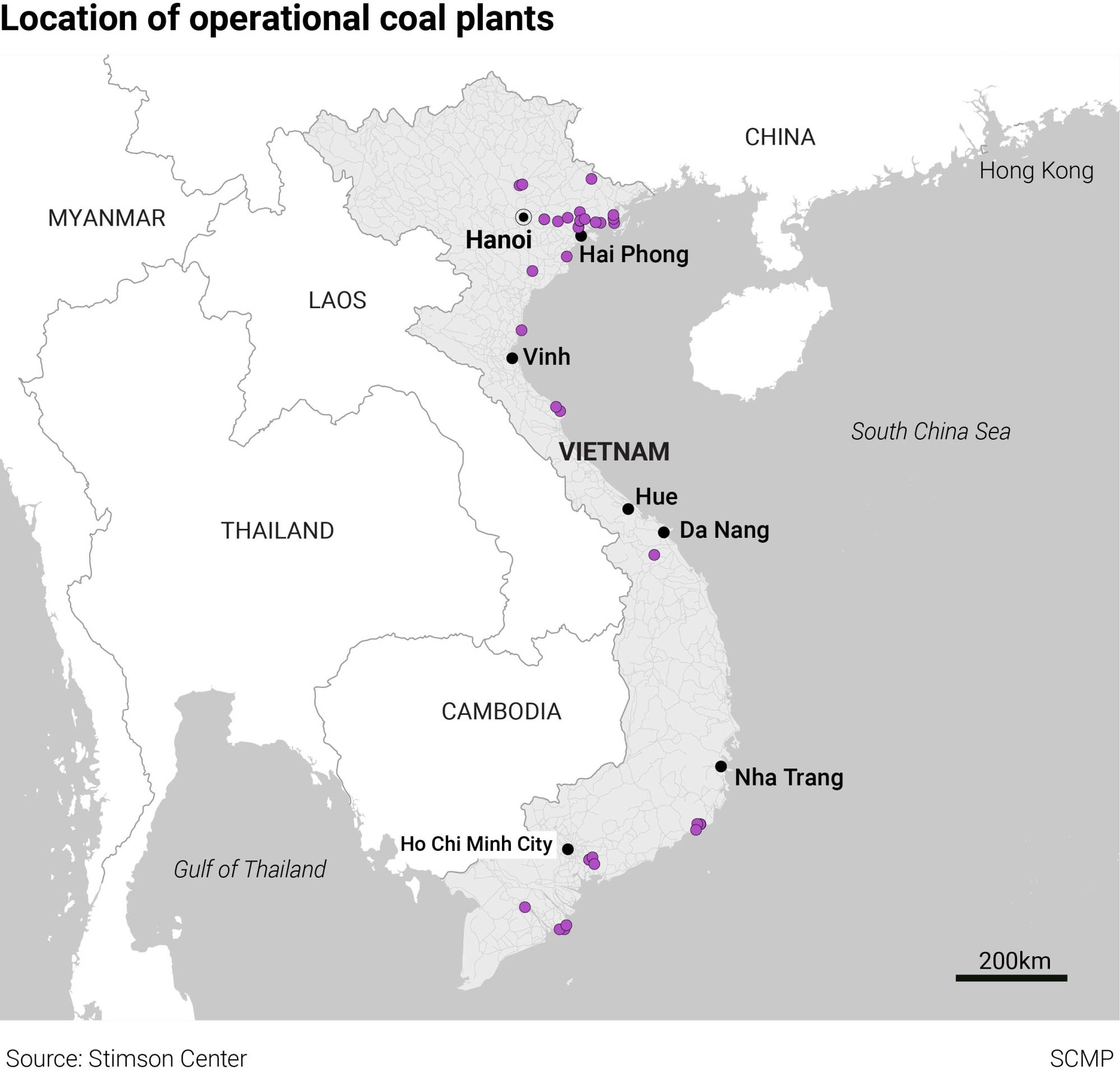

Chinese, Japanese and South Korean financiers are also involved in future coal projects that are in the construction or planning phase, data from the Washington-based Stimson Centre non-profit think tank shows.

Private firms from wealthier countries have been deeply involved in supporting the coal buildout in many developing nations, which was partly driven by “clear returns on investment in countries with rapidly rising electricity demand” like Vietnam with its growth of energy-intensive industry, according to Courtney Weatherby, a research analyst with the Stimson Center’s Southeast Asia and energy, water, and sustainability programmes.

“This is a clear opportunity to directly support a push away from coal by individual companies which choose to set company-wide renewable energy targets, invest in rooftop dollars, and engage with the government to support higher integration of renewables into the national power grid,” she said.

TRANSITION NEEDED

Vietnam’s coal-fired power plants were responsible for 4,359 premature deaths in 2017, according to a 2020 study into air quality and health by Hanoi-based sustainable development NGO GreenID – a number it projects could increase if more coal capacity is added to the energy pipeline.

Environmentalists have been urging the government to continue its pivot towards renewable energy seen in the recent surge in solar panel installations, but a new draft development plan that suggests Vietnam might double its coal-fired generation capacity to about 41 GW by 2030 - or about a third of the total - has them worried.

The draft lays out an eventual decrease in coal-fired power generation to one-fifth of total capacity, but not until 2045 when gas-fired plants are expected to account for another third.

Before that, the plan envisages more than half of Vietnam’s energy needs being met by fossil fuel power plants by 2030, with an article on the trade ministry’s website published last Wednesday acknowledging that renewables’ share of the country’s energy mix will not “increase sharply” between now and then.

In 2017, those worst affected by coal-fired power plants’ pollution mostly lived in the north of the country – including capital Hanoi – the GreenID study found, though southern economic hub Ho Chi Minh City was also among its list of 10 future hardest-hit provinces and cities.

Tran Dinh Sinh, deputy director of GreenID, said there was huge potential for renewable energy in Vietnam, as either wind or solar power could meet the country’s current energy needs several times over, given a greater focus on building out capacity.

Vietnam’s draft power development plan, which GreenID has urged the trade ministry to revise, is at odds with the global shift towards phasing out coal and reaching net-zero carbon, Sinh said, adding: “The name of the plan clearly shows that it is meant for the 10-year period from 2021 to 2030, while [what it says] for the 2030-2045 period is only a vision.”

Since 2017, when Vietnam’s coal-fired power generation capacity was 16.8 GW, the government has achieved notable results in pushing solar energy development.

In the two years to 2020, Vietnam’s installed solar capacity almost quadrupled to a peak of 19.4 GWp, said Sinh of GreenID, citing EVN statistics. But the surge in solar development, supported by short-term government directives, threatened to overwhelm the national power grid – forcing some developers to pare back capacity.

No new solar energy capacity was installed in Vietnam this year, said Sinh, whose NGO is calling for long-term legislation or a renewable energy master plan to encourage more investors to enter the market.

“We have to keep to our [international] commitment to reduce carbon emissions by 9 per cent on our own and 27 per cent through external support [such as foreign aid],” Sinh said, referring to climate pledges Vietnam has submitted to the UN.

“We hope our suggestions will be taken into account for Vietnam to produce clean, green energy.”

This story was produced with support from the Mekong Data Journalism Fellowship jointly organised by Internews’ Earth Journalism Network and the East West Center.