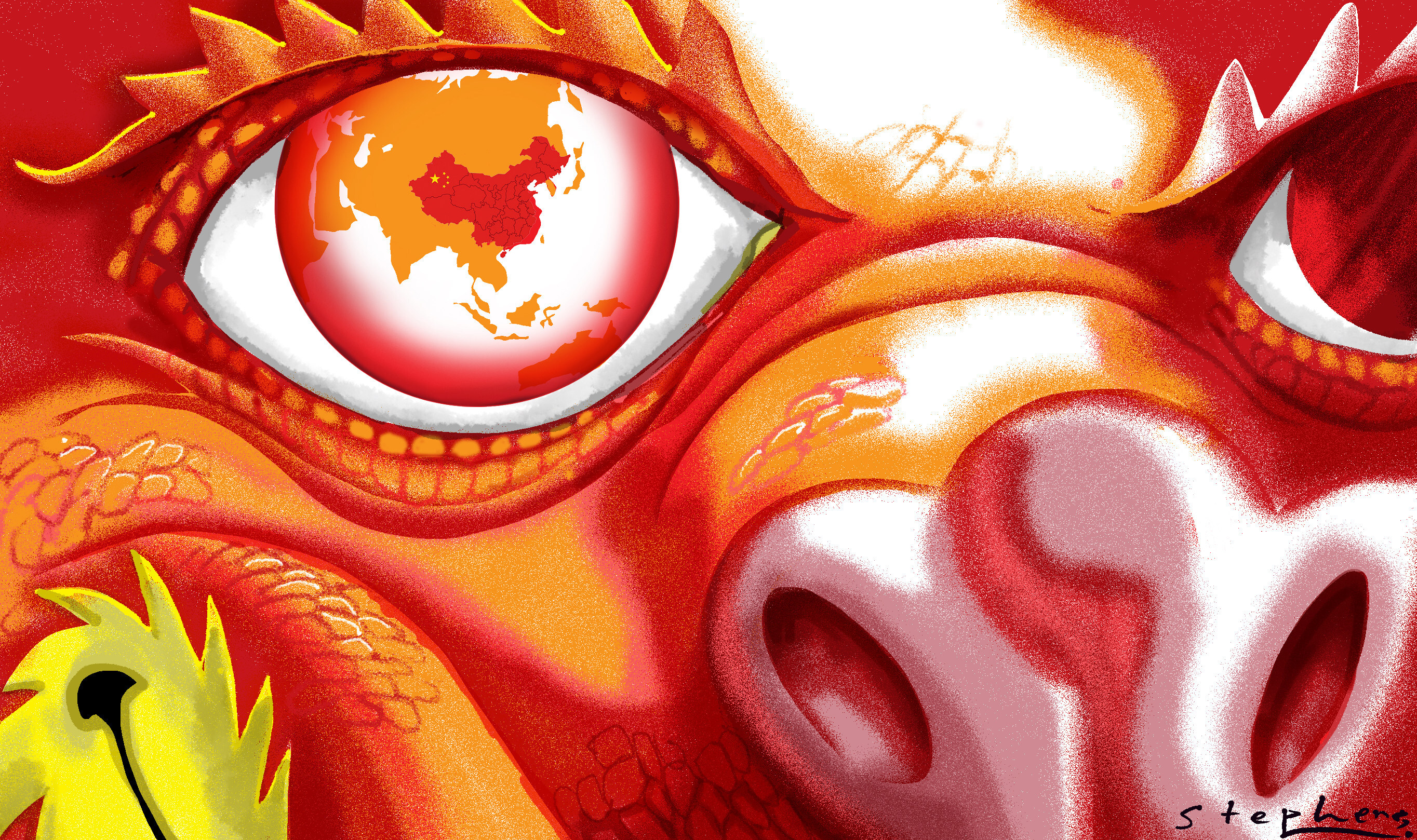

It’s the successor to the grossly underestimated “Made in China 2025” strategy, which spawned China’s dominance in electric cars, green tech and other high-end industries.

From talent to tech, markets may be partially decoupled or fully severed. But in a civilised contest, acts of violence – particularly war – would be out of the question

The rivals blame each other for changing the Asia-Pacific security order and upsetting the status quo, and disagree over the true aim of US sanctions and path to peace in Taiwan. For peace to endure, they must focus on clearing the causes of their strategic mistrust.

Xi Jinping’s references to revolutionary spirit underlines his resolve to barter China’s vast capital and market for tech cooperation to break the US chip ban, and attract talent, including for military modernisation.

However hard the Biden administration tries to counter Chinese chip manufacturing, there is a key factor it fails to take into account: talent flow. The US can ban the sale of technology to China. But it cannot stem the flow of global, including US-trained, tech talent to China.

The key to a sustainable consumer economy is higher incomes for the bottom tiers in society and a stronger middle class. If China can deliver on these, the newly minted middle class will be a driver for greater consumption as well as improved industrialisation.

Despite its vaccine donations and firm commitments to reduce carbon emissions, China still struggles to win the world’s trust. As it takes on more global responsibilities, it must overcome the scepticism and show it is a responsible partner.

Beijing’s pursuit of global infrastructure expansion, economic primacy and a compelling China narrative are all part of the same mission. If China reclaims the title of the world’s top economy, Chinese civilisation will spread once again – the dawn of an era as golden as the Han dynasty.

Far from frantic, the boycott movement is reasoned, controlled and firmly aligned with China’s vision of its tech-empowered economic ascendancy. Nike is protected from wrath for now because it fills a gap in wearable tech in China’s value chain, especially ahead of the Olympics – unlike H&M.

China’s economy is surging while the rest of the world struggles with the pandemic. Even so, China’s demographic time bomb, an only partially liberal financial market and systemic weakness in frontier science and technologies threaten its rise.

The world is moving beyond the order the Biden administration is cultivating, and no normalisation can bring back the old status quo. While America searches for a renewed role in the region, China already has an established position.

There are two ways the US can win an economic war against China – coax its economy to grow faster than China’s or stifle the rise of the Chinese economy. The fastest way to victory is to derail liberal market reforms in China and turn its economy away from greater liberalisation.

A street vendor economy will only create the illusion of job security for millions of urban unemployed, migrant workers and fresh graduates. Only by doubling down on technological empowerment can China’s race to global economic superpower status truly succeed.

The backlash against the popular Wuhan Diary shows that the Chinese government struggles to allow people the freedom to express basic human emotions. On a global scale, how China deals with Africa’s debt could determine how it is viewed.

Xi Jinping staying away from the signing of the deal suggests China is leaving open how far it will abide by it. At present, the deal fosters China’s larger goal of stability and does not challenge its economic model, which is veering back towards state control.

China’s biggest economic risk in 2020 comes from its efforts to deflate the real estate bubble, which is closer to collapse than any point since 2003. Failure to find a soft landing would may the end of China’s economic dream.

Beijing might be looking to replace Hong Kong as a offshore financial centre with London. In China’s long history, the unrest in Hong Kong will only be a minor blip in the country’s progress.

The US wants to rewrite the rules of the global trading game it helped create, and may well succeed. But the challenge of China’s economic model, a combination of authoritarian and libertarian capitalism, won’t be so easily dismissed.