China trade: imports help Japan’s exports post largest monthly gain since late 2017

- However, the pace of recovery in Japanese firms’ exports to the United States remains relatively slow

- Japan’s shipments to Asia as a whole gained 22.4 per cent, while those to the European Union advanced 12.8 per cent in March

A surge in China-bound shipments saw Japan post its strongest export growth in more than three years last month, in a sign that the economic recovery from last year’s deep coronavirus slump remains intact.

However, the trade data is unlikely to completely ease worries about the fragile state of the world’s third-largest economy, which took an enormous hit from a collapse in global trade due to the pandemic in the first quarter of 2020.

Japanese Ministry of Finance data showed on Monday that overall exports surged 16.1 per cent in March from a year earlier, marking the steepest rise since November 2017. That was better than an 11.6 per cent jump expected by economists in a Reuters poll, and followed a 4.5 per cent contraction in February.

“The rebound in exports slowed significantly across Q1, and external demand is unlikely to provide much of a tailwind to growth this year,” said Tom Learmouth, Japan economist at Capital Economics. “The impressive annual figure was down to base effects from the weakness in exports in March 2020.”

Most exports to China aren’t very hi-tech, and there’s the possibility there will be restrictions amid rising US-China tensions

The exports surge was marked by especially strong shipments to Japan’s largest trading partner, China, while the pace of recovery in firms’ exports to the United States remained relatively slow, said analysts.

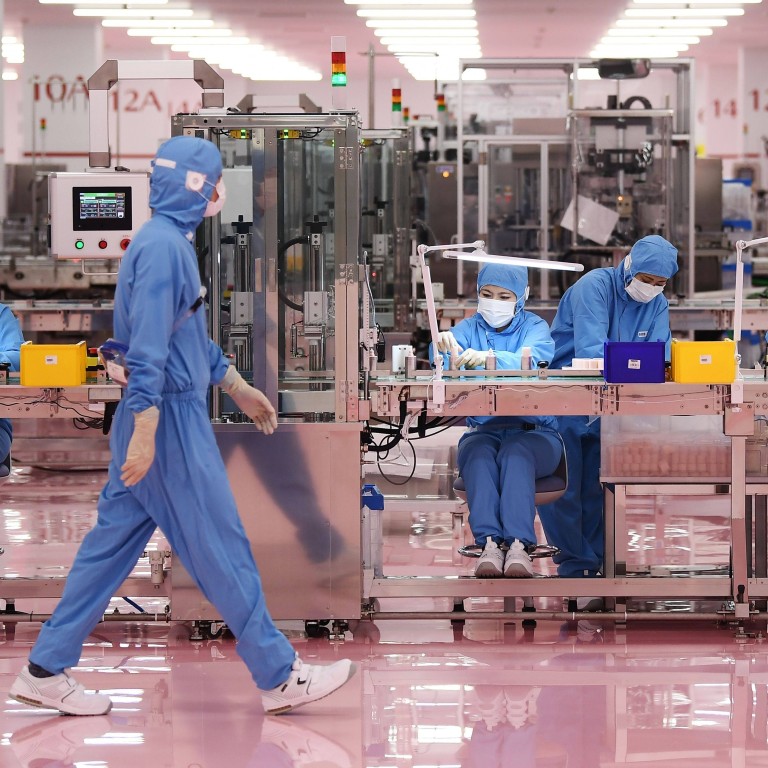

By country, exports to China stood at 1.63 trillion yen (US$15 billion) in March, hitting the highest level since comparable data became available in January 1979, underpinned by strong demand for plastics, semiconductor machinery and raw materials such as copper.

“Most exports to China aren’t very hi-tech, and there’s the possibility there will be restrictions amid rising US-China tensions,” said Takeshi Minami, chief economist at Norinchukin Research Institute.

However, Japan’s economy was likely to face headwinds from a slower recovery in US-bound shipments, which tend to add more value than those exported to China and elsewhere in Asia, for at least another couple of months, he added.

Japan, South Korea exports boosted by China demand

Exports to the United States, the world’s top economy, rose 4.9 per cent to post their first year-on-year gain in five months, as strong demand for cars and construction machinery such as bulldozers offset lower shipments of aircraft.

Shipments to Asia as a whole gained 22.4 per cent, while those to the European Union advanced 12.8 per cent in March.

Imports rose 5.7 per cent in March compared with the same month a year earlier, versus the median estimate for a 4.7 per cent increase, bringing a trade surplus of 663.7 billion yen (US$6.11 billion) versus the median estimate for a 490.0 billion yen surplus.

The trade data follows the Reuters Tankan poll on Friday that found confidence among Japanese manufacturers rose to a more than two-year high in April as strong demand in the electronics market boosted prospects for exporters.

Additional reporting by Kyodo