While no actual names have been uttered around town identifying the HK$30 million Tierce bunglers, it is impossible to escape the notion that it must have been one of the huge multinational syndicates.

Jockey Club officials were tightlipped on Sunday, on or off the record, about any details that might have helped identify those involved. In itself that suggests a single major customer, even if the amounts weren't already a bit of a giveaway.

Jockey Club officials were tightlipped on Sunday, on or off the record, about any details that might have helped identify those involved. In itself that suggests a single major customer, even if the amounts weren't already a bit of a giveaway.

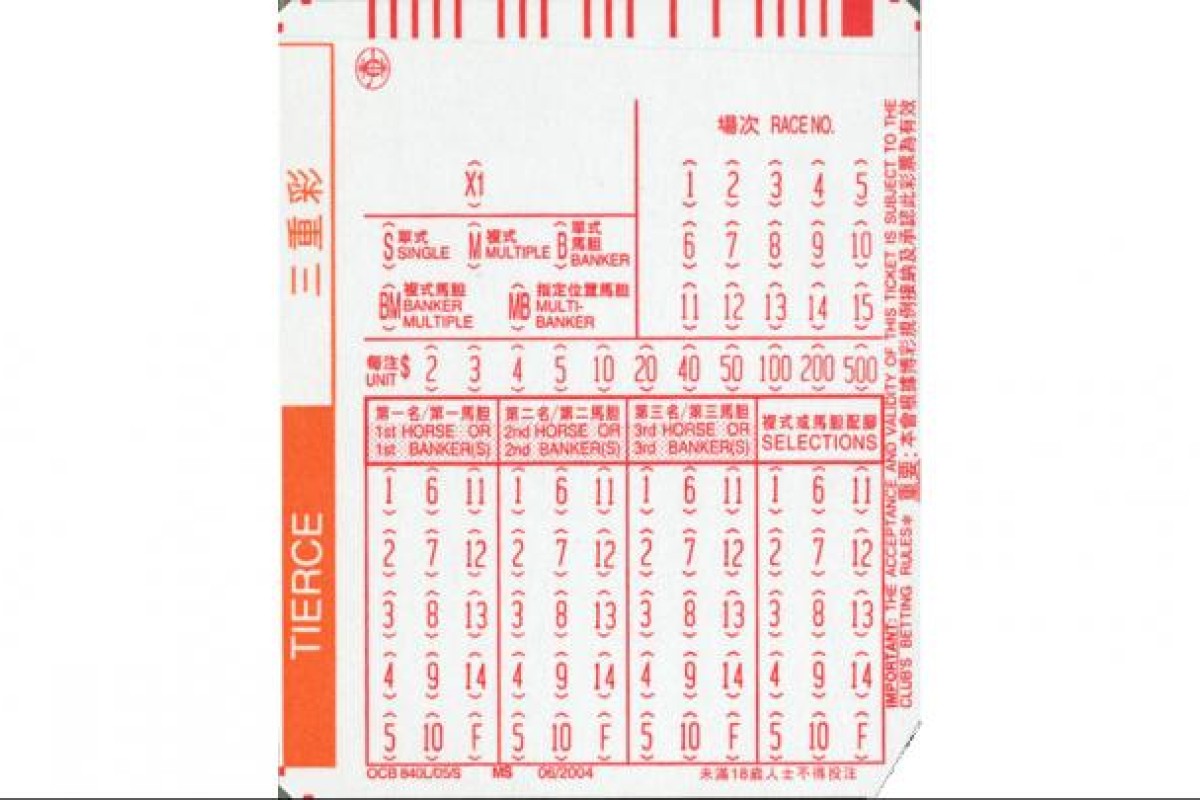

Even allowing for the possibility that the bets were placed from multiple accounts, that's a heck of a lot of bets. At $3,000 a ticket on the 10-9-8 Tierce, you're talking 10,000 bets placed on the one combination.

The fact that there were multiple accounts involved, which could muddy the idea of these bets being ultimately for the same entity, changes nothing - placing bets through multiple accounts is in line with modus operandi of the largest computer syndicates, which also write their own software.

And there were tell-tale signs that the 10-9-8 combination would have been among the Tierce bets for one of the major players. The 10 horse, Masquerader, was very heavily bet very late in the win pool, going from 20 to 11, and firming sharply in the quinellas as well. That kind of behaviour across multiple pools doesn't suggest illegal money coming back to the legitimate tote, unlike many of the late win price stompers.

The 9, Rumba King, remained very well bet regardless of what firmed or eased around him, basically starting the same odds as he was three or four minutes before the race. Even the 8, Ka Ying Kid, was a supported horse late at longer odds, trimming by several points, but the level of that support was not made obvious to all by the flashing lights as those fireworks were on the eventual winner, Bundle Of Love, Masquerader and Amigo.

Some of our counterparts in the Chinese language media seemed keen to look at the sensation as something like the late price stomping in win pools, or even a Macau-style manipulation of the pool in order to get the resulting juicy odds on the winning Tierce.

The latter idea might be a great thought - force one 2,000-1 Tierce down to nothing at all so the prices of all the well-fancied Tierce combinations go to ridiculously big dividends and then bet on them.

How else do you make a dividend that should be paying not much more than 200-1 pay 2,178-1? Super thought, and people would not be averse to it, except that there probably aren't many places to get the $14,000-odd on the winning combination required to get back their $30 million, let alone turn a profit. Illegal operators might smell a rat, one suspects.

That a professional syndicate hit a software snag that cost it $30 million might seem a surprise, but we occasionally see similar mistakes with investment robots in derivatives markets, simply a different form of gambling, that cost companies hundreds of millions.

The syndicate might have failsafes built in to its programs, where something like, say, the total volume of bets being placed might set off an alarm, but their very sophistication probably leaves the way open for an expensive accident - placing literally hundreds of bets across different pools in the 10 or 20 seconds before a race jumps doesn't leave much room for human intervention.

Don't shed too many tears for the 'victim' - the $30 million might make some dent in the season's profits, but they won't be lining up outside the soup kitchens just yet.

Still, it's more interesting, going forward, to consider an event like Sunday's Tierce debacle in the light of the brave new world of commingling and other great technological leaps.

The concept of single pool wagering comes to mind. The idea is not in operation in any racing jurisdiction yet but, as we understood it, Sunday's extremely heavy, if accidental, support for the 10-9-8 Tierce that drove the dividend down to 1.1 would have had a serious impact on dividends for any bet placed on the race, of any type.

And consider it in terms of commingling. The possibility exists that a large professional outfit based somewhere else in the world could hit the same problem while betting into Hong Kong's pools via their local betting operator (though probably a syndicate that significant is already betting here through Jockey Club conduits).

Or the bets could be heading the other way, from Hong Kong to a lesser operator overseas, and rewriting the entire market on a race. Again on Saturday, Hong Kong betting on the final six races from Rosehill's Golden Slipper meeting was as much or more, depending on your parameters, than was being wagered on the home side of the totalisator equation in Australia.